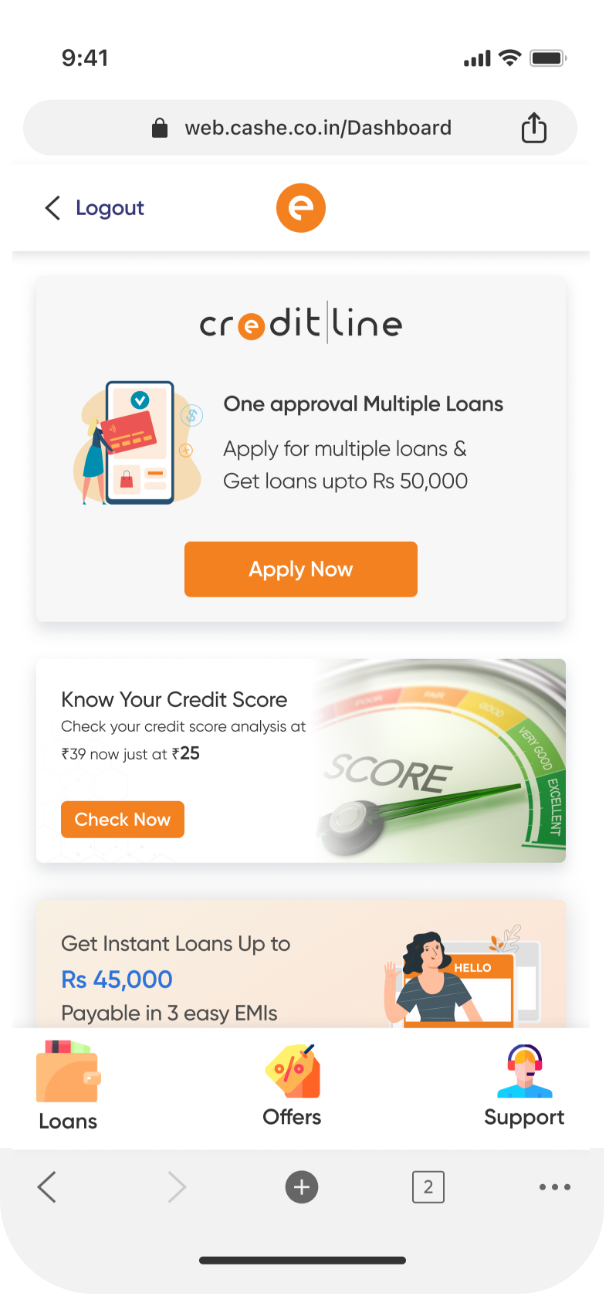

Cash Loan App

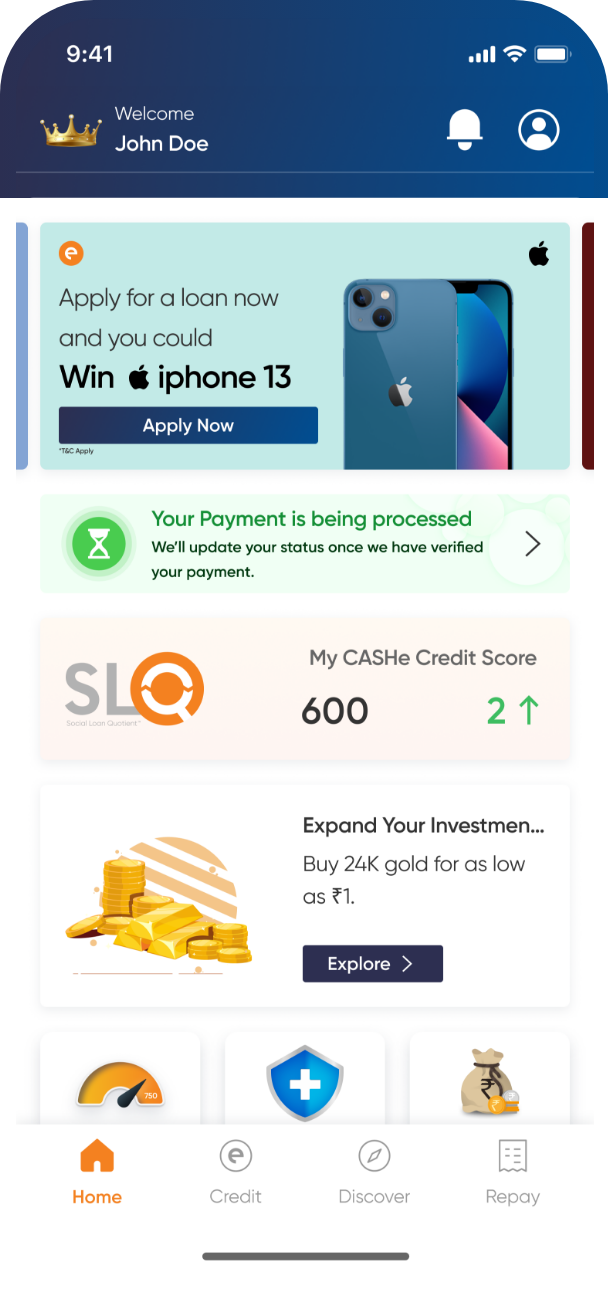

We live in times where we need instant personal loans for our desired purchases, EMIs or an unexpected bill payment. Where the bank procedures can be time-consuming, cash loan app will save your time as well as your efforts.

India is getting digitalized, from a pen to a smartphone, everything can be bought online. Why not a personal loan?

What is a cash loan app?

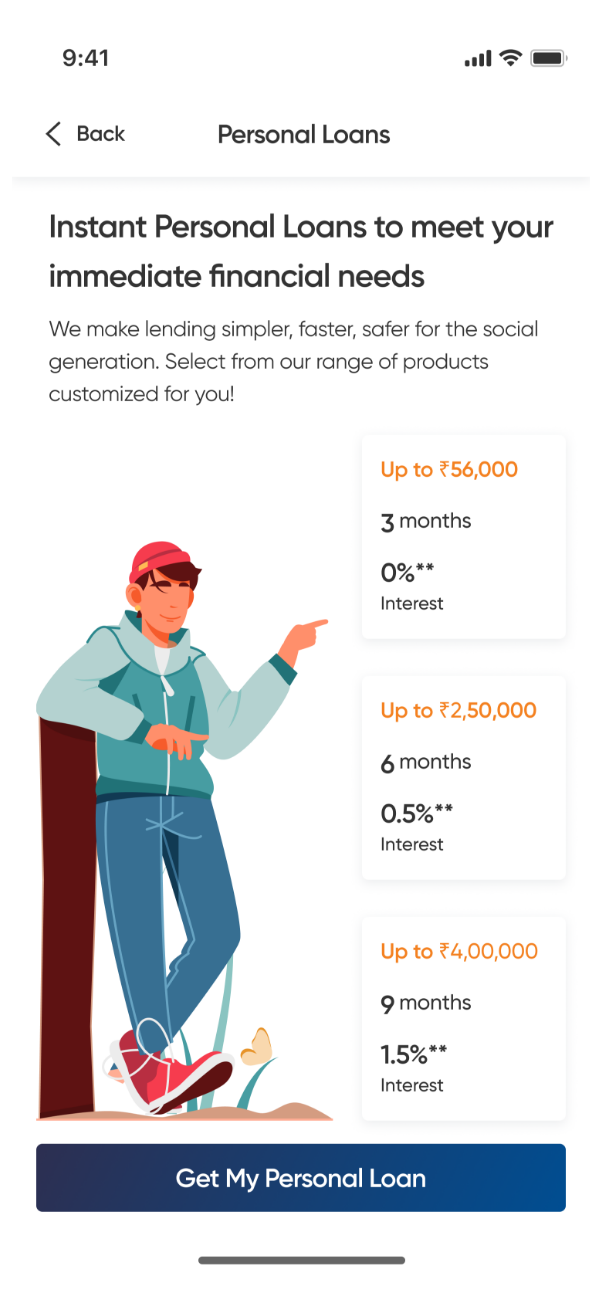

There are online apps which are specifically designed for young professionals to meet their instant personal loan needs. These loans are majorly given as cash to fund a short-term financial requirement. Terms like payday loan or advance loan are also used to refer the same. You can lend an amount from Rs. 9,000 up to Rs. 4 lakhs from such online lenders.