Money Loan

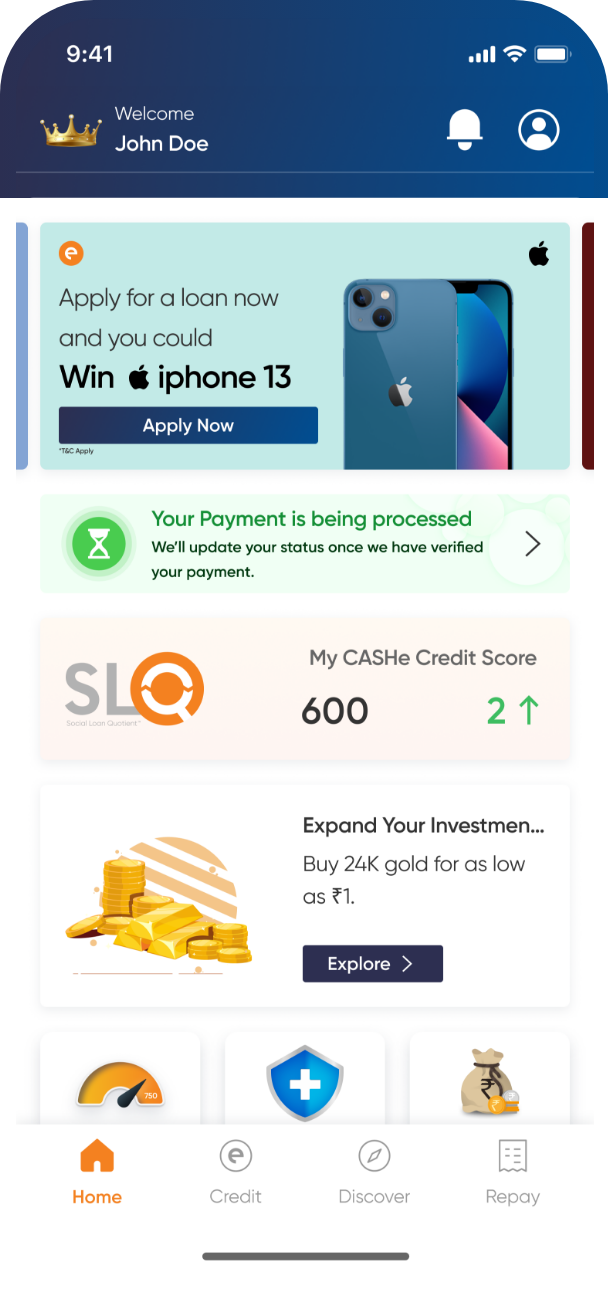

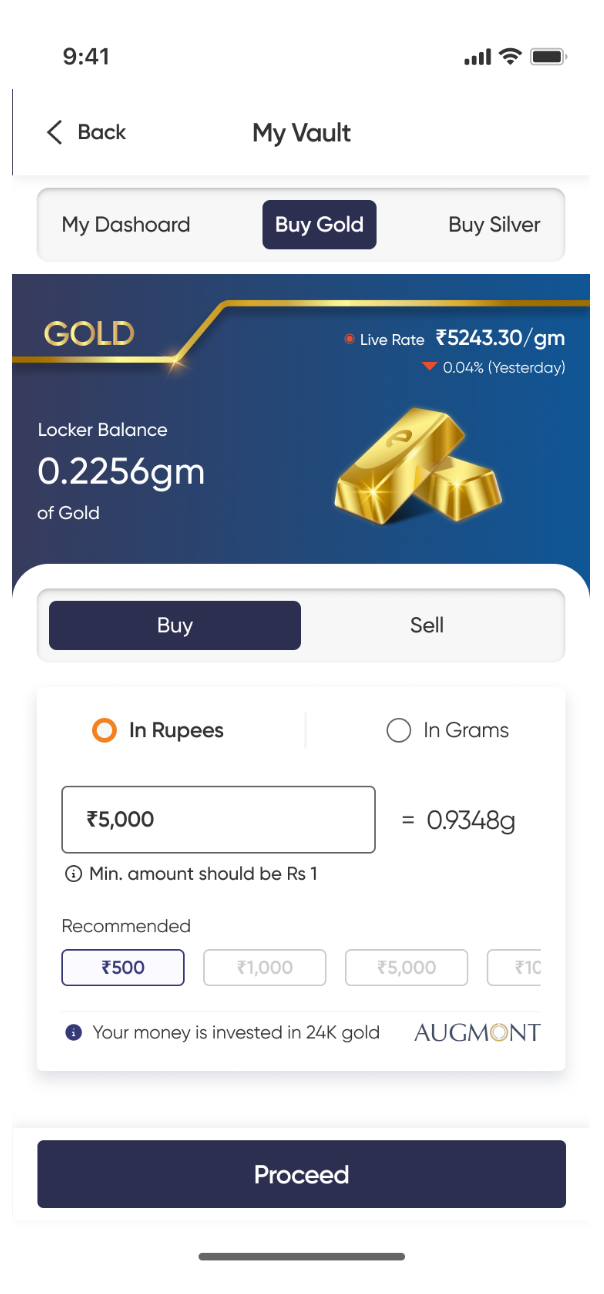

A money loan is when you borrow a short-term loan from a lender and pay it back later with interest. It often comes with an agreement wherein you commit to paying the loan amount over a pre-decided loan tenure. Money loans are extremely helpful in case of emergencies or unexpected expenses. Whether it is making big purchases or paying your due bills, CASHe instant money loans can help you out when you don’t have enough money upfront. However, you should ensure that you pay back the loan according to the agreement terms to avoid penalty charges or damage to your credit score.

Features And Benefits of Money Loan

-

-

Online Application

-

The process of applying for a money loan with CASHe, the top instant cash loan app, is completely online. So, with this convenience of online application, you can easily complete the entire loan process from the comfort of your home. You do not need to visit any physical branch regarding your money loan application. This will help you save your time and effort to a large extent.

-

-

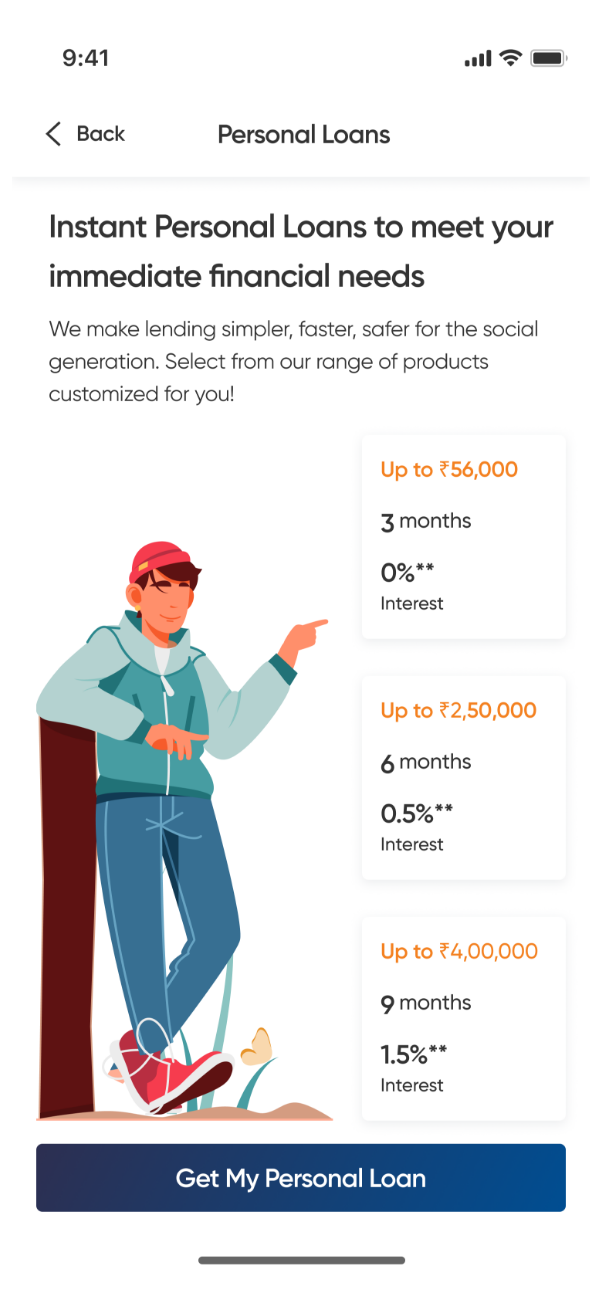

Competitive Interest Rates

-

CASHe offers best-in-the-market interest rates and hence, you do not need to worry about the accumulation of interest during your loan tenure. We at CASHe always ensure that you receive favourable terms and lower overall borrowing costs.

-

-

Customised Loan Tenure and Amount

-

If you meet the eligibility criteria, you can choose a loan amount of up to ₹4 lakhs and a loan tenure of up to 540 days according to your financial requirements. This way you will be able to manage your loan repayment period that best suits your budget and goals.

-

-

No Collateral Needed

-

You do not need to provide any collateral to avail a money loan. With CASHe, get your urgent cash loan without any physical documents.

-

-

Quick Approval

-

Get your money loan approved within 20 minutes of the loan application, provided you submit the latest documents with the right information.

-

-

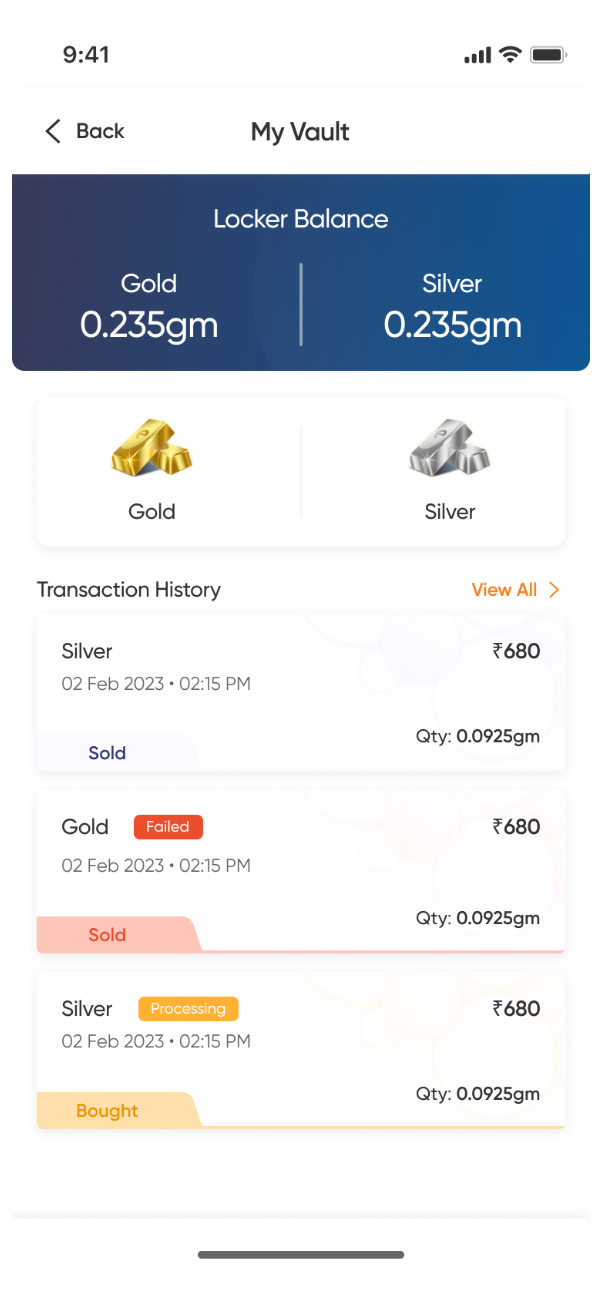

Easy Repayments

-

Enjoy hassle-free repayment options that are designed to make it simple and convenient for you. Fulfil your repayment obligations without any stress or inconvenience.

Eligibility For Money Loans

To be eligible for an instant money loan, you need to meet specific criteria established by CASHe. These criteria ensure that you have the financial capability to repay the loan. So, you are eligible for CASHe money loans if:

- You are an Indian citizen

- Are of age between 23 years and 58 years

- You have an active bank account for the transfer of the loan amount

- Possess valid identification documents such as Aadhar Card, Voter ID, PAN card, etc.

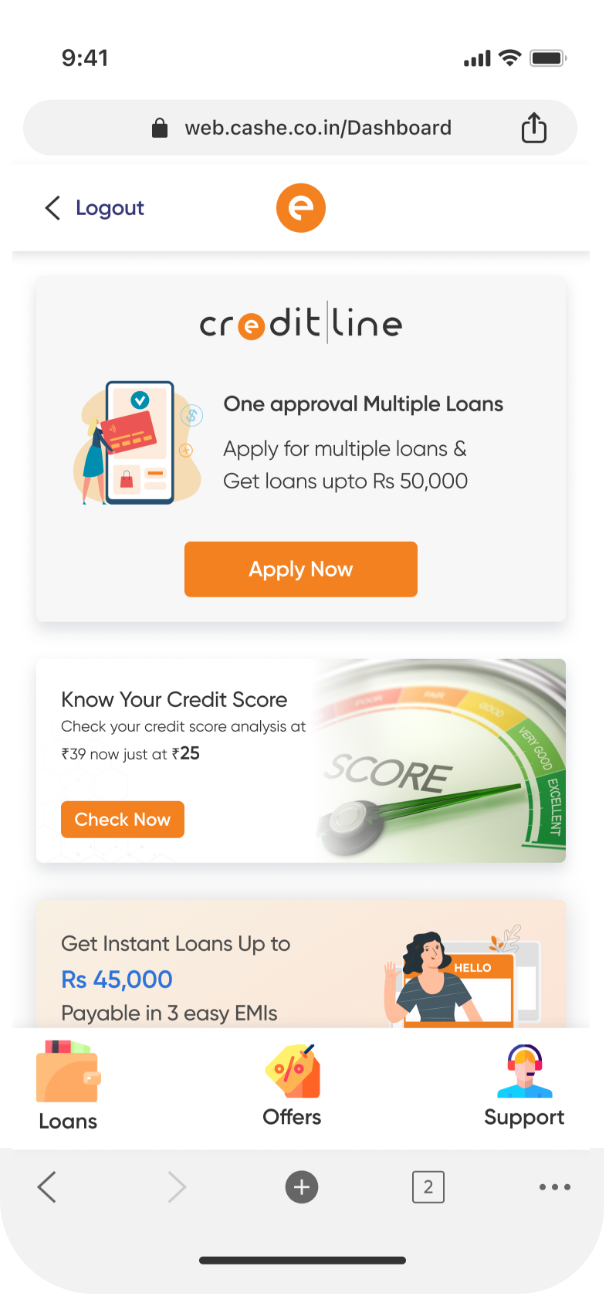

How to Apply for a Money Loan?

Applying for a money loan with CASHe is a simple process. Apply for it now and get an instant cash loan within few hours without any physical documents. Here are the steps you need to follow to avail a money loan:

Step 1: Download the App

Download the CASHe app available on the App Store or Google Play Store on your phone.

Step 2: Create an Account

Now, sign up and create an account by providing basic information such as name, PAN card, address proof, etc.

Step 3: Profile Verification

Submit the information and wait for profile verification.

Step 4: Select the Loan Amount

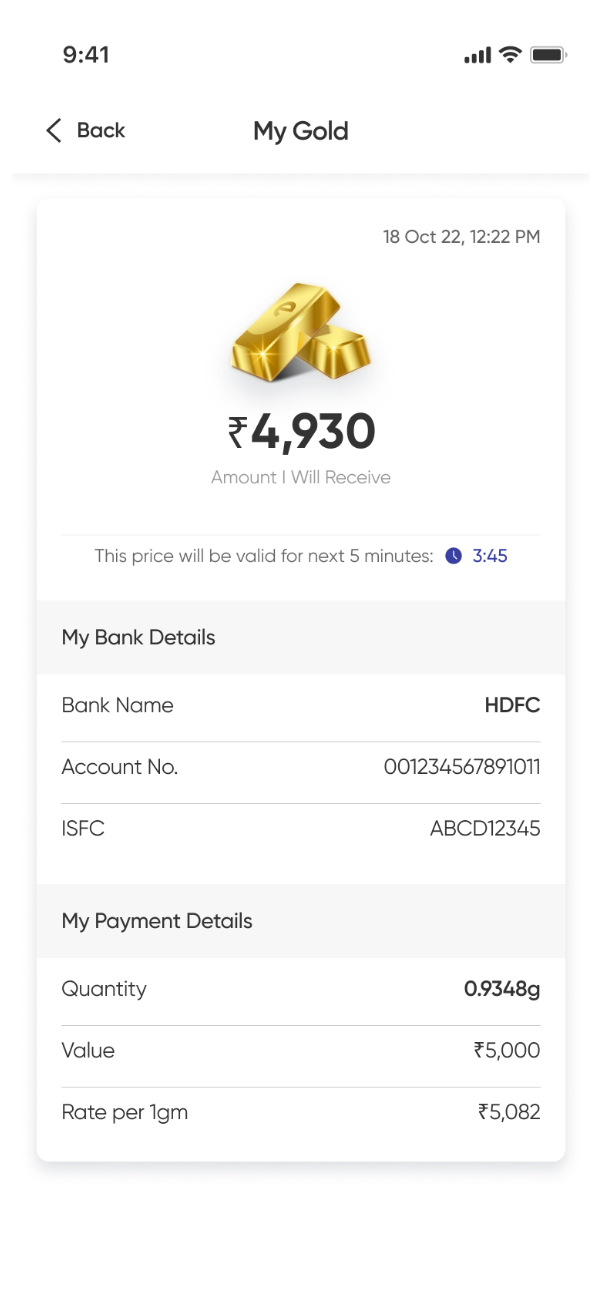

Once your profile is verified, go to the loan section and select the loan amount you wish to take.

Step 5: Fill in Required Information

Provide required information such as repayment tenure.

Step 6: Submit

Submit the loan application and wait for approval.

Once your instant money loan is approved, you will get the loan amount directly in your bank account.

Documents Required For Money Loan

To apply for an instant money loan with CASHe, you need to provide the following documents:

- ID Proof: Voter ID card, passport, driving licence, and Aadhar card – you can provide any one of these as ID proof.

- Address Proof: You can submit your ration card, utility bills like telephone bills, electricity bills, gas bills, etc., or the rental agreement as an address proof.

- Passport-size Photos: You also need to provide your latest passport-size photo to get the loan approved.

Make sure all your documents are up-to-date and meet our requirements to quicken the loan approval process.