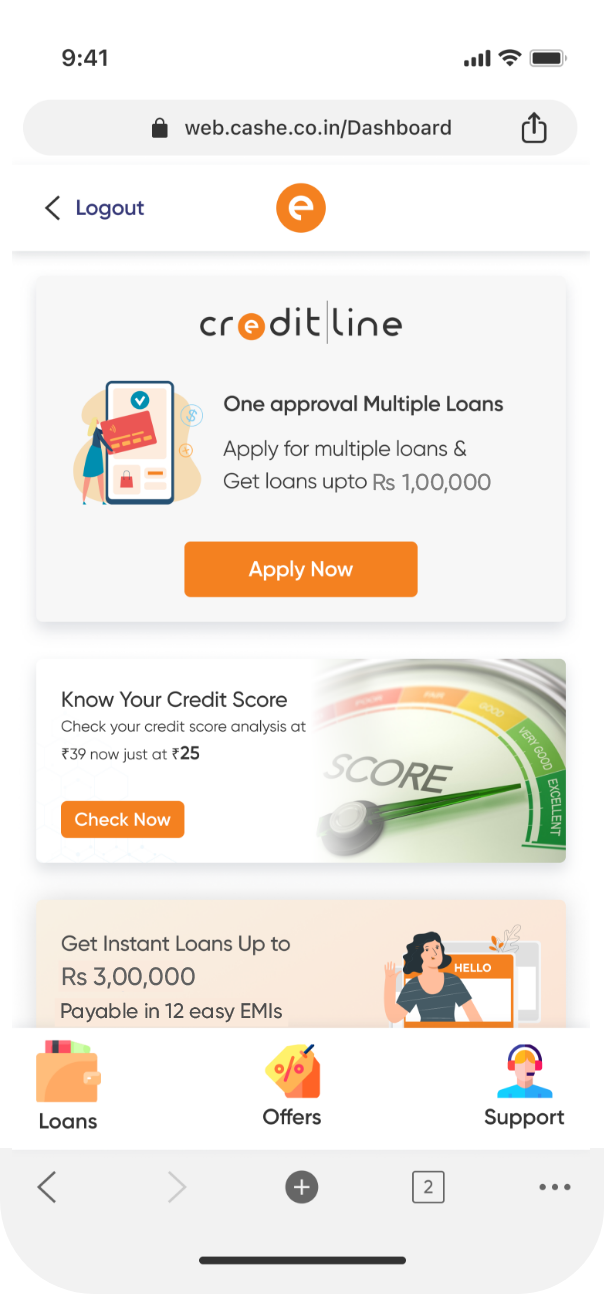

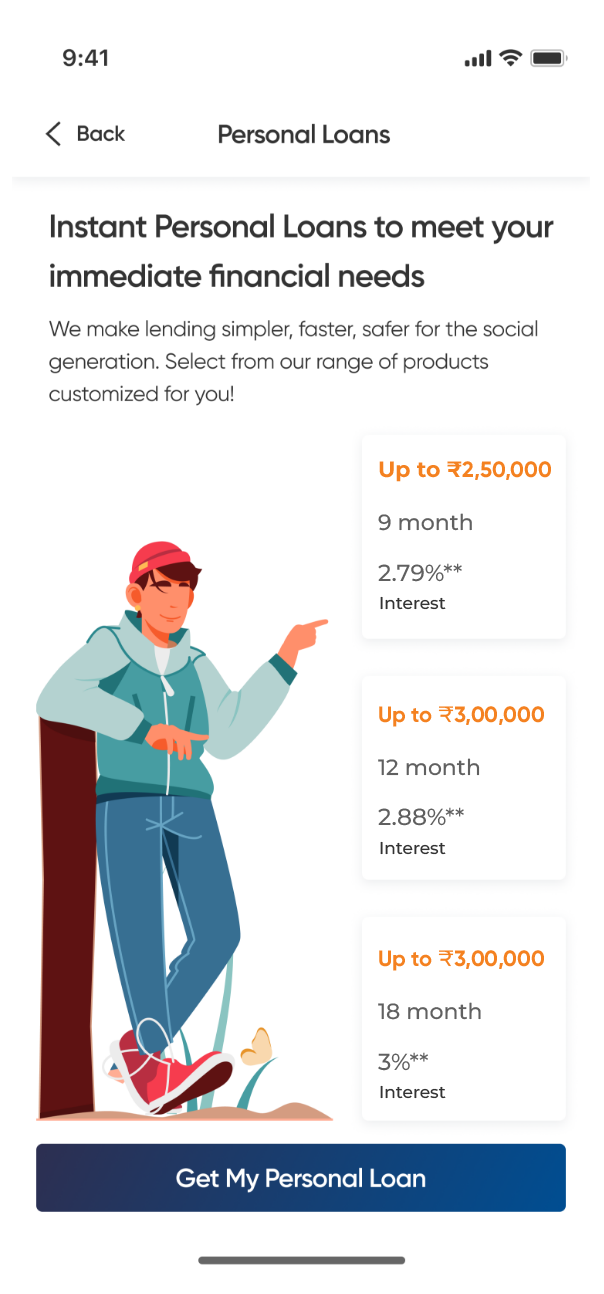

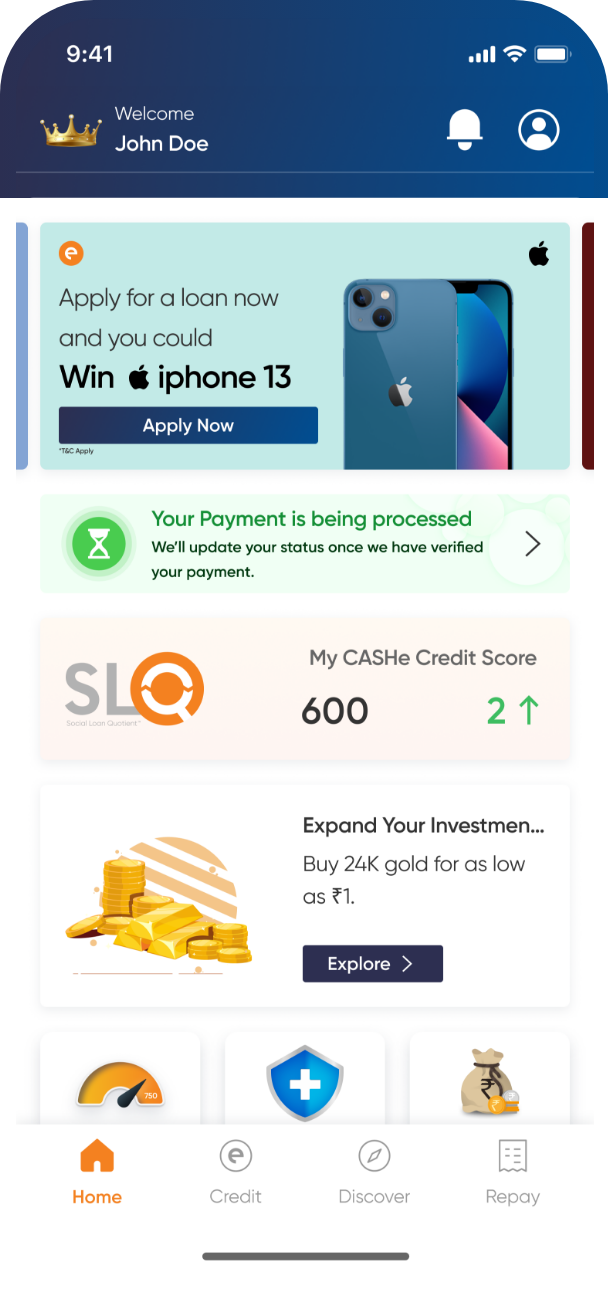

Short-Term Loan

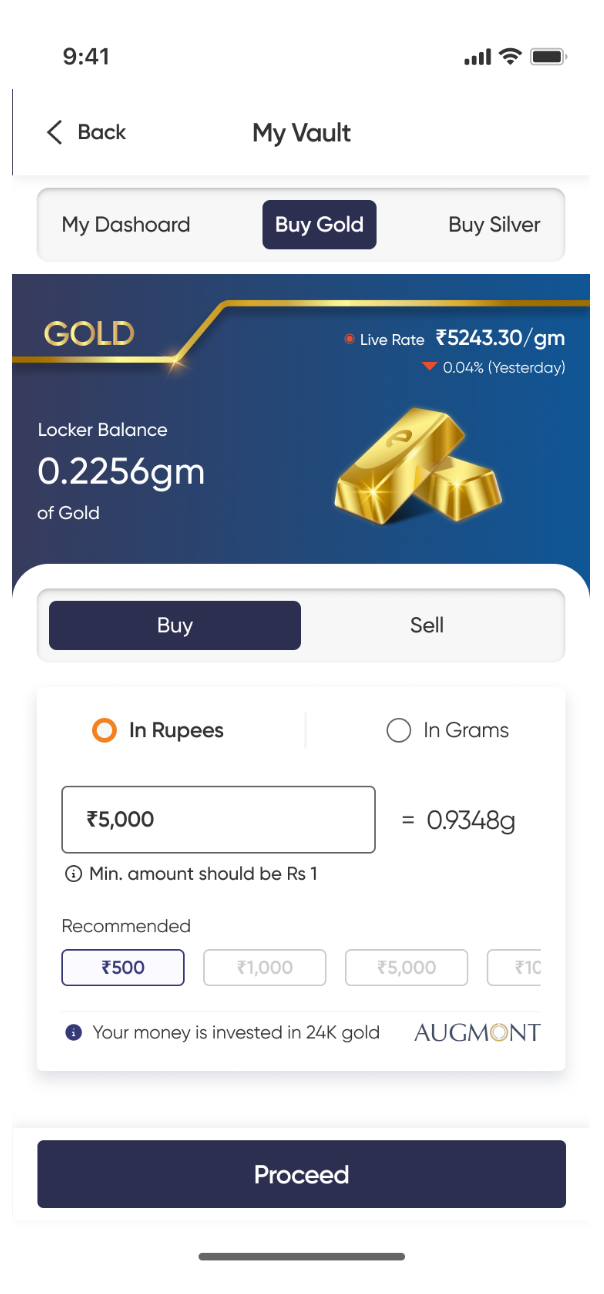

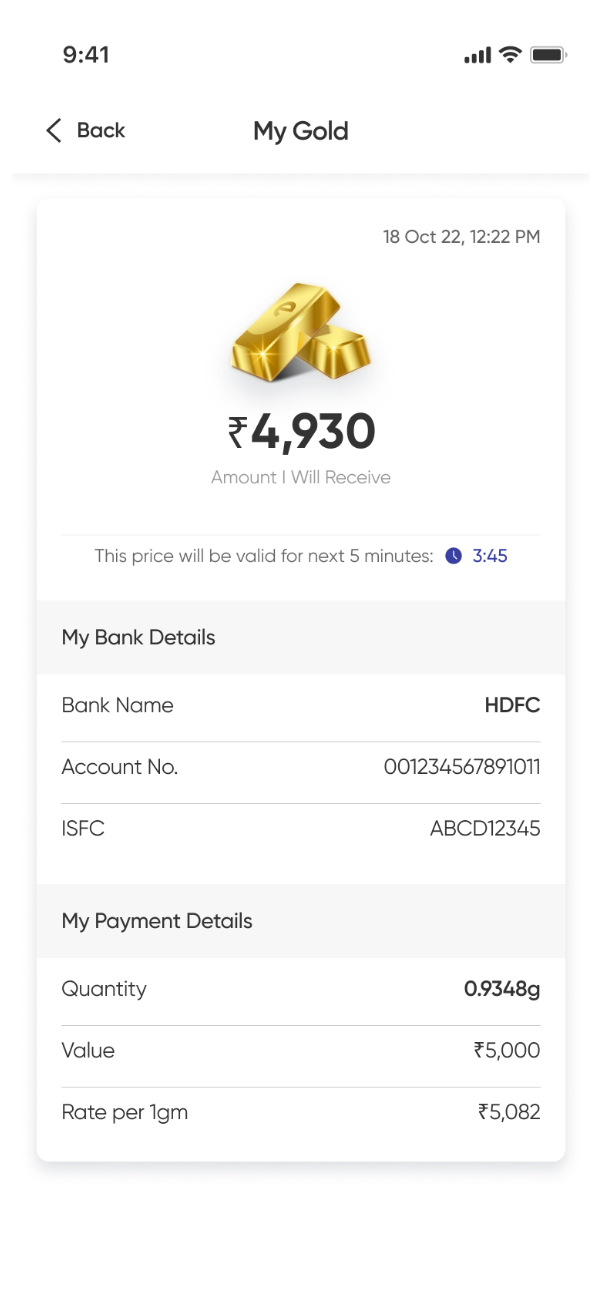

Have short-term financial needs? CASHe’s short-term loans are here to help you get quick access to funds. Consider a short-term personal loan with CASHe when unexpected expenses arise and get the immediate financial assistance you require without any delay. At CASHe, short-term personal loans come with an easy repayment plan that ensures you manage your finances effectively. So, whether you are looking to cover unforeseen bills or emergency purchases, our short-term loans are here to fulfil your urgent cash requirements. Apply for short-term loans now and enjoy numerous benefits.