Education Loan —

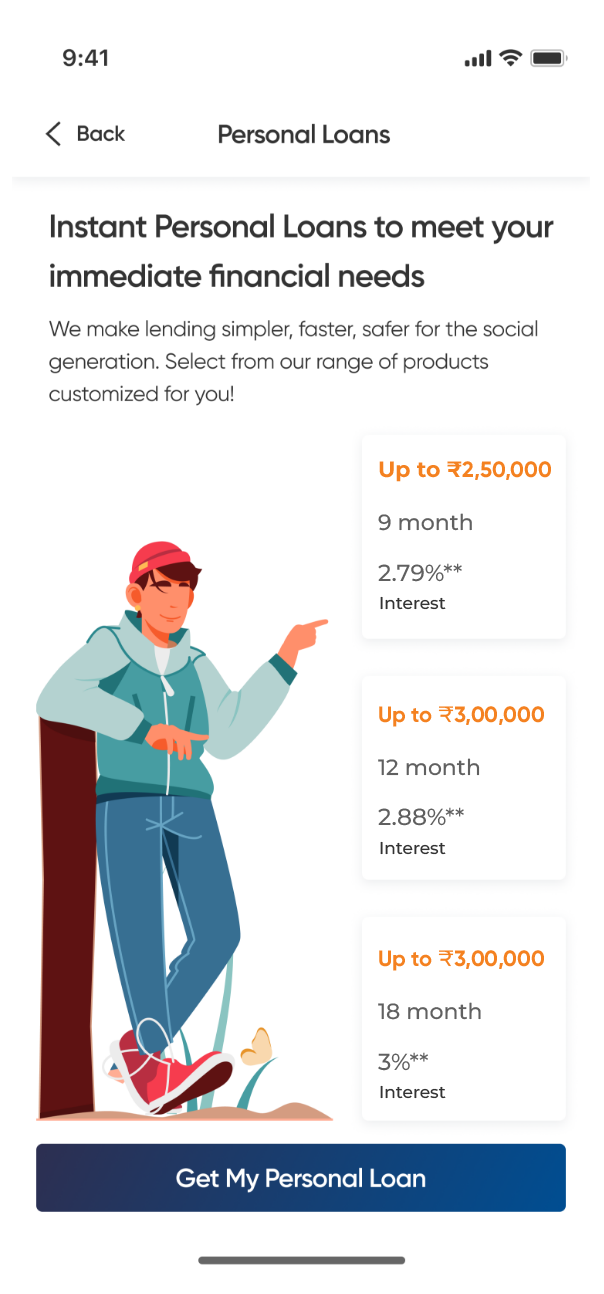

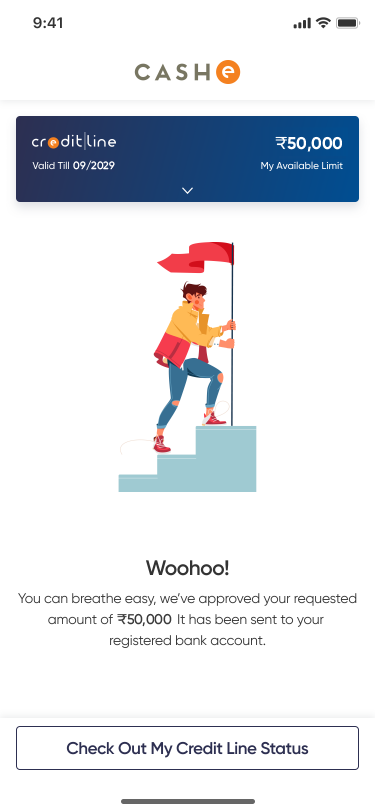

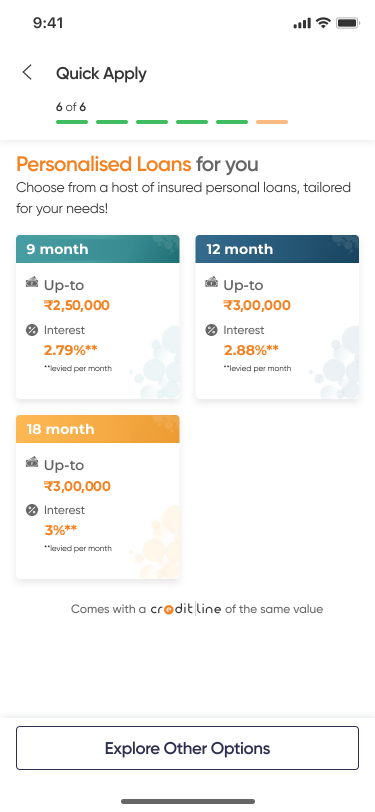

Don’t let a financial crunch hold you back from pursuing higher education. Get an education loan from CASHe!

Having access to the education of your dream is very important. But as you progress ahead in your studies and nurture big dreams such as maybe going abroad for higher education, you require finances to fund it. This can be expensive for many. Getting an education loan is the best option to help you out in such situations.

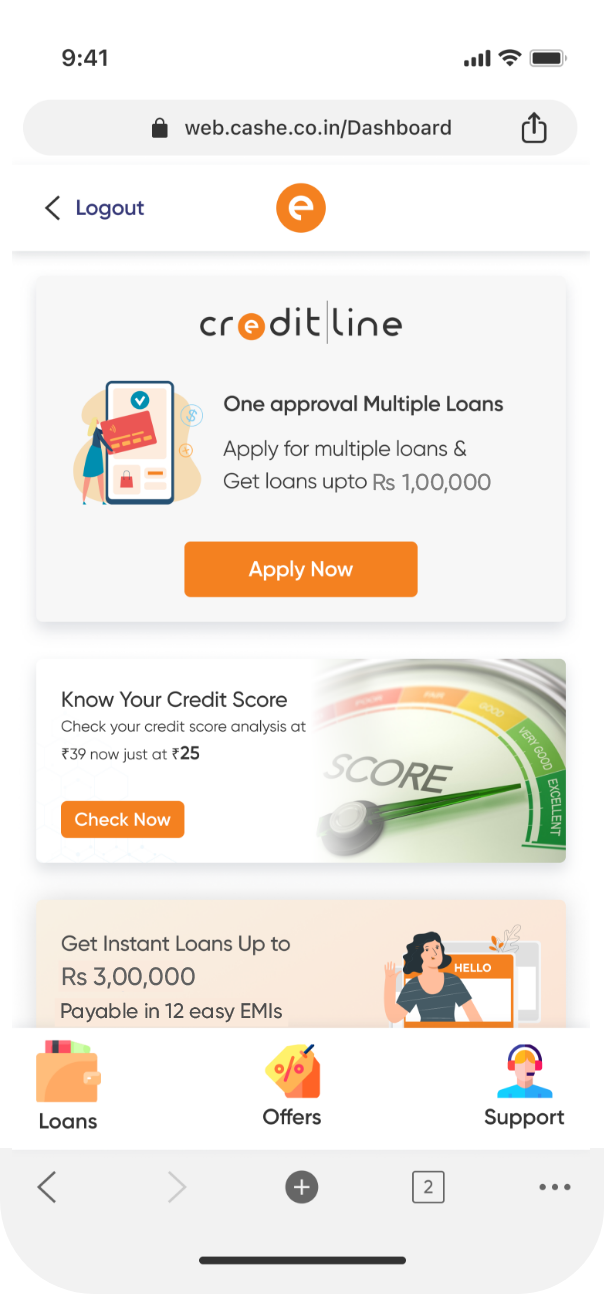

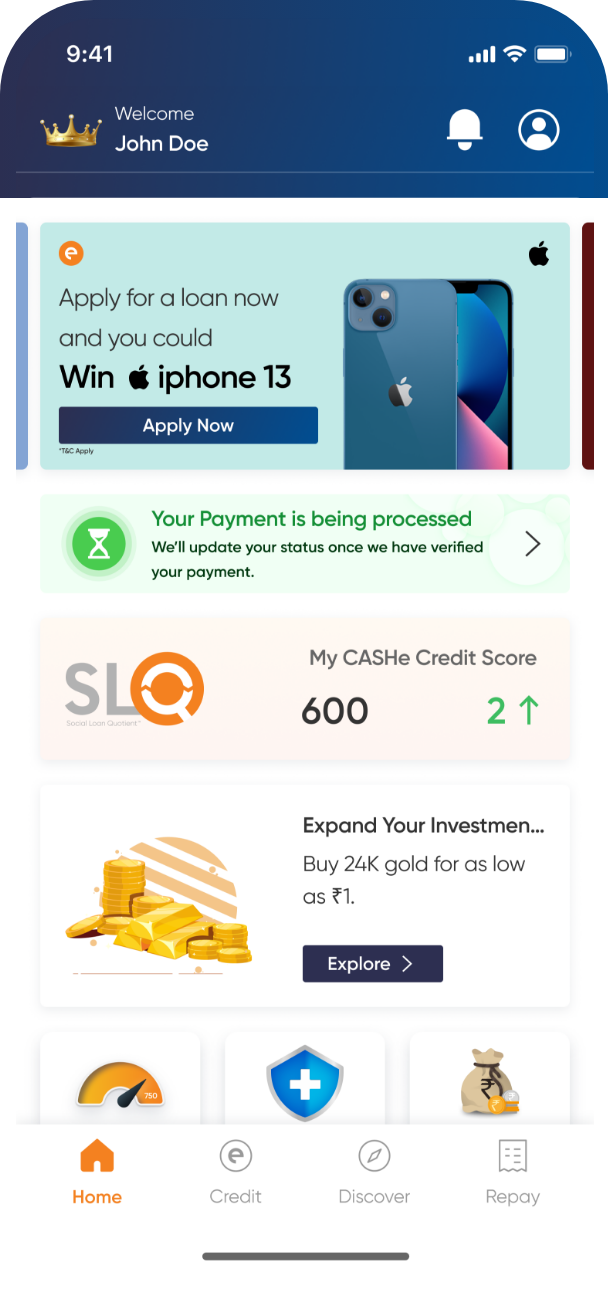

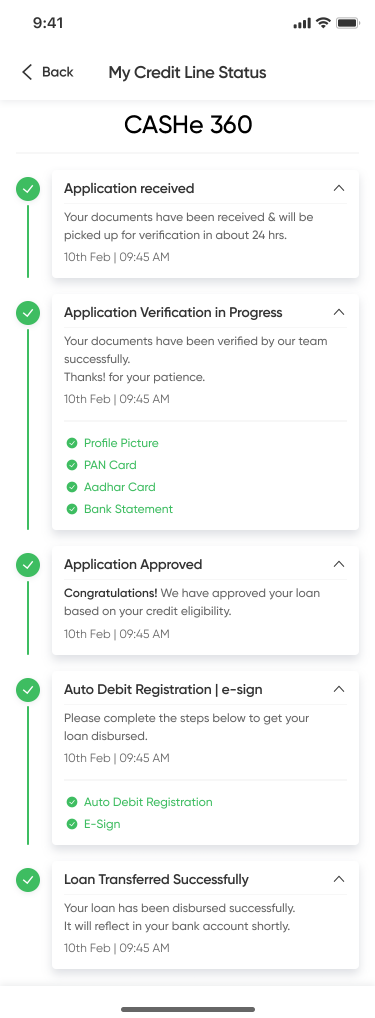

Gone are the days when the thought of applying for a loan caused a wave of panic and worry. With the introduction and rise of instant loan apps, getting a loan to fund your education has become so much easier.