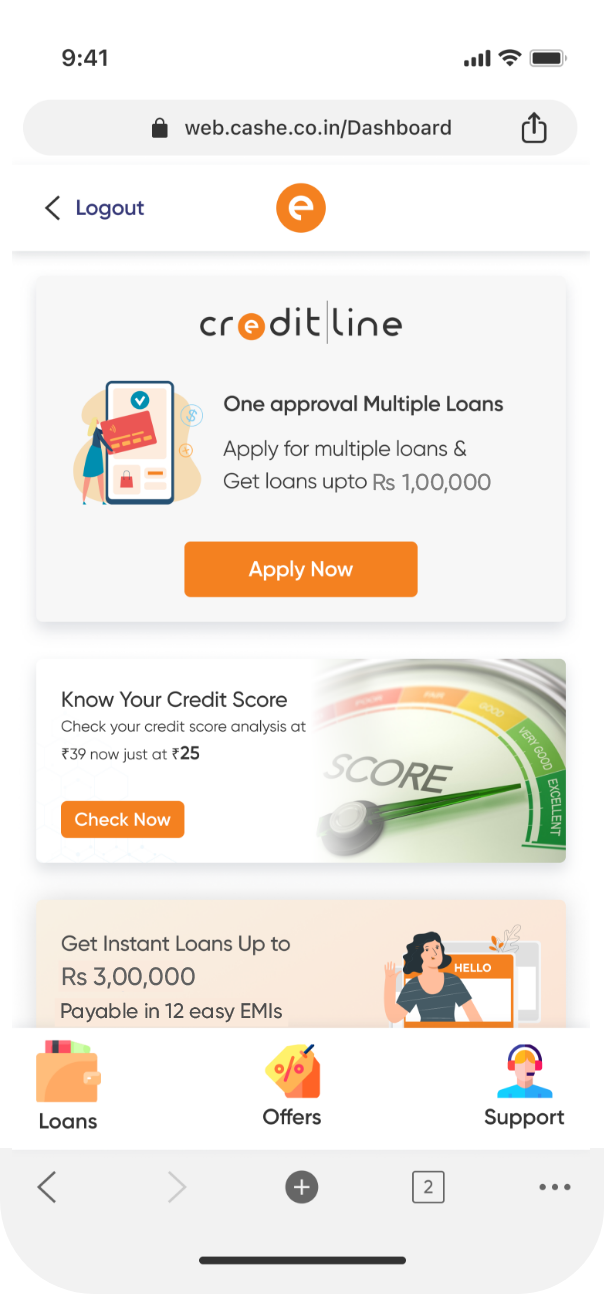

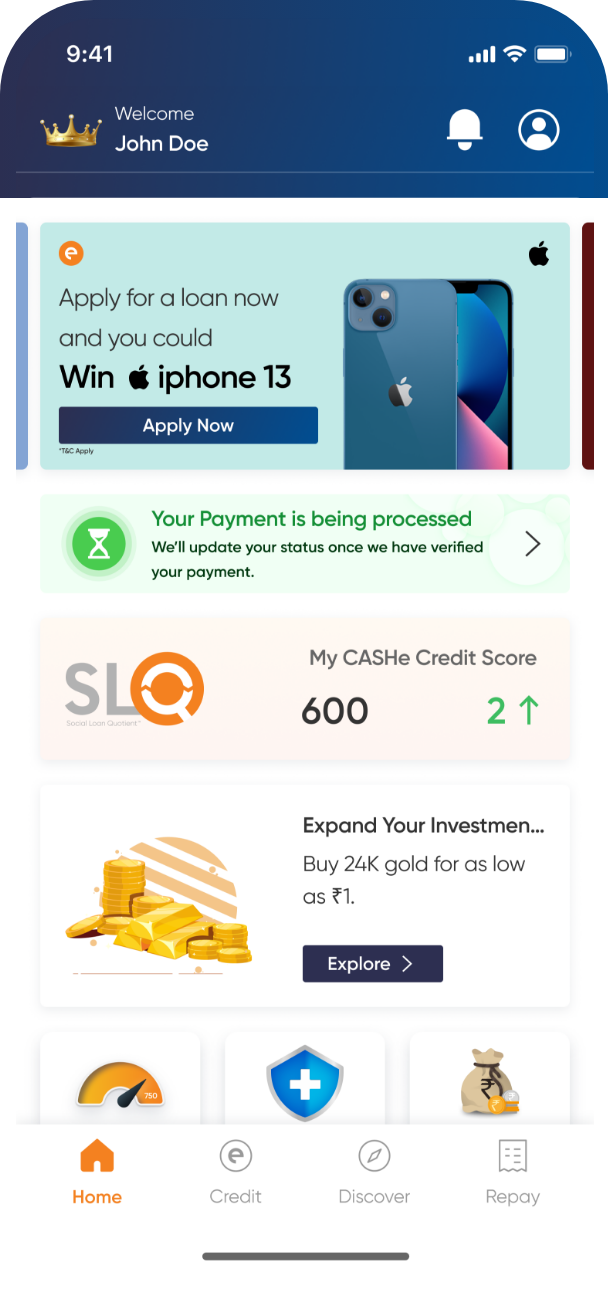

Car Loan

Get your loved ones a wheel of happiness.

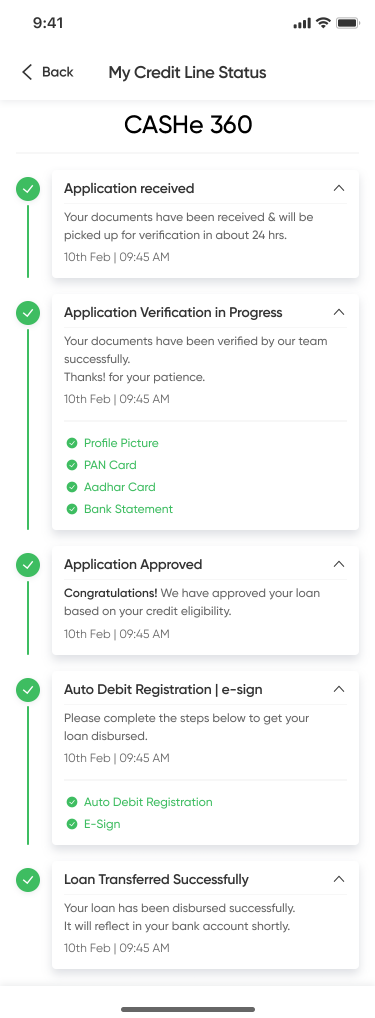

Log on to CASHe and secure a car loan to buy your favourite car.

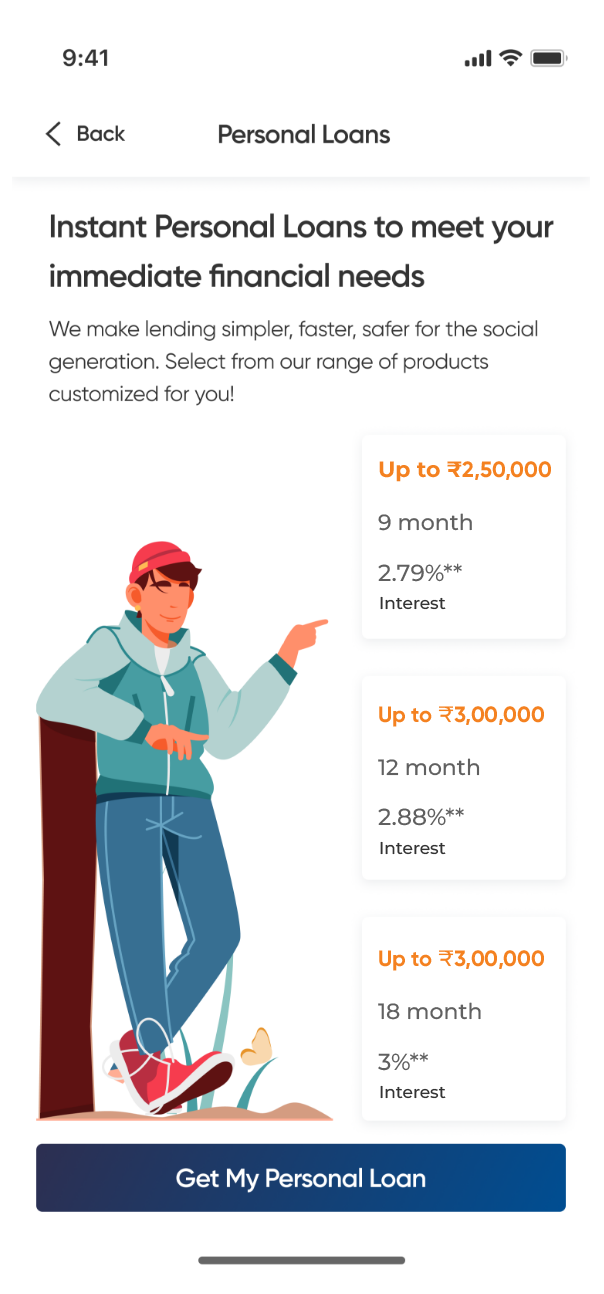

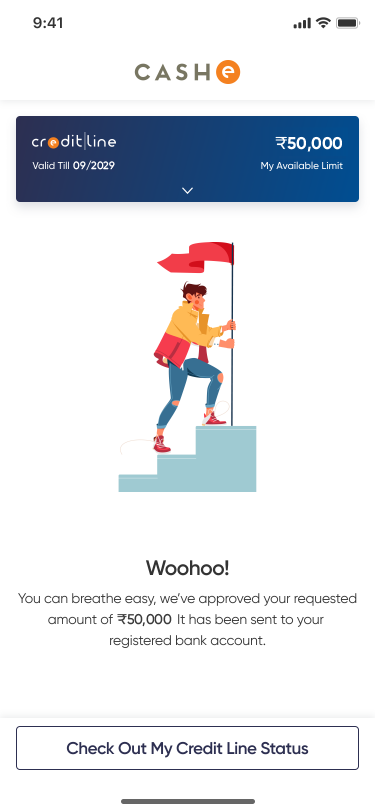

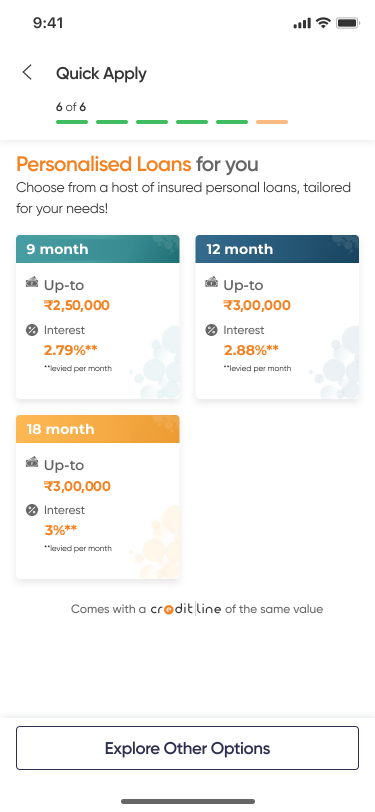

Don’t put off your dream to buy your favourite car. CASHe offers instant personal loan up to ₹3 lakhs. Benefit from our quick approvals and disbursals with flexible pocket-friendly EMIs.

Nowadays owning a car is more of a necessity than a luxury.

However owning a 4-wheeler comes at a high price, and not everyone can finance a car – new or secondhand – only with their savings. Here’s when a car loan can be of great use.