Mobile Loan —

Stay Connected With The Rest of The World

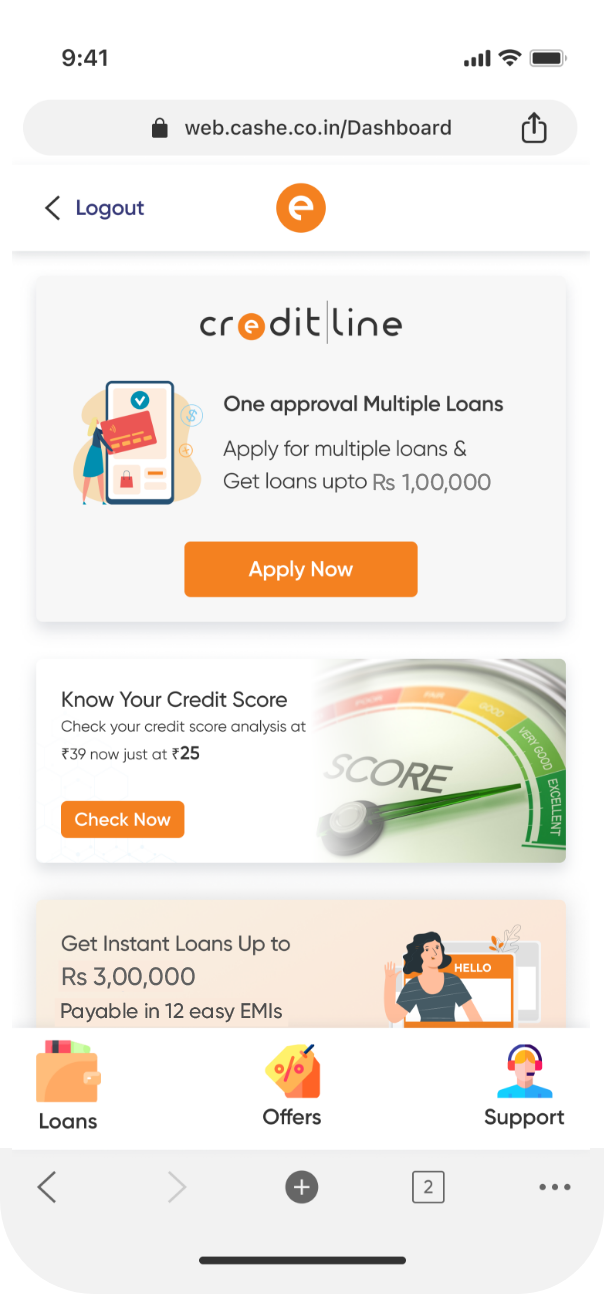

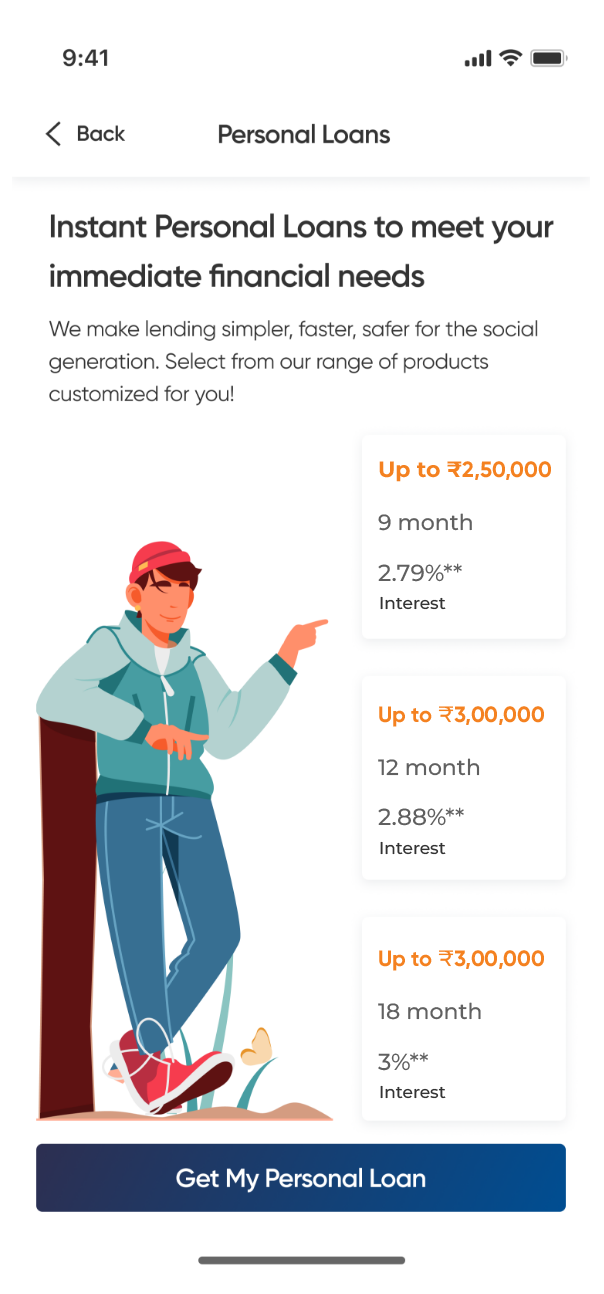

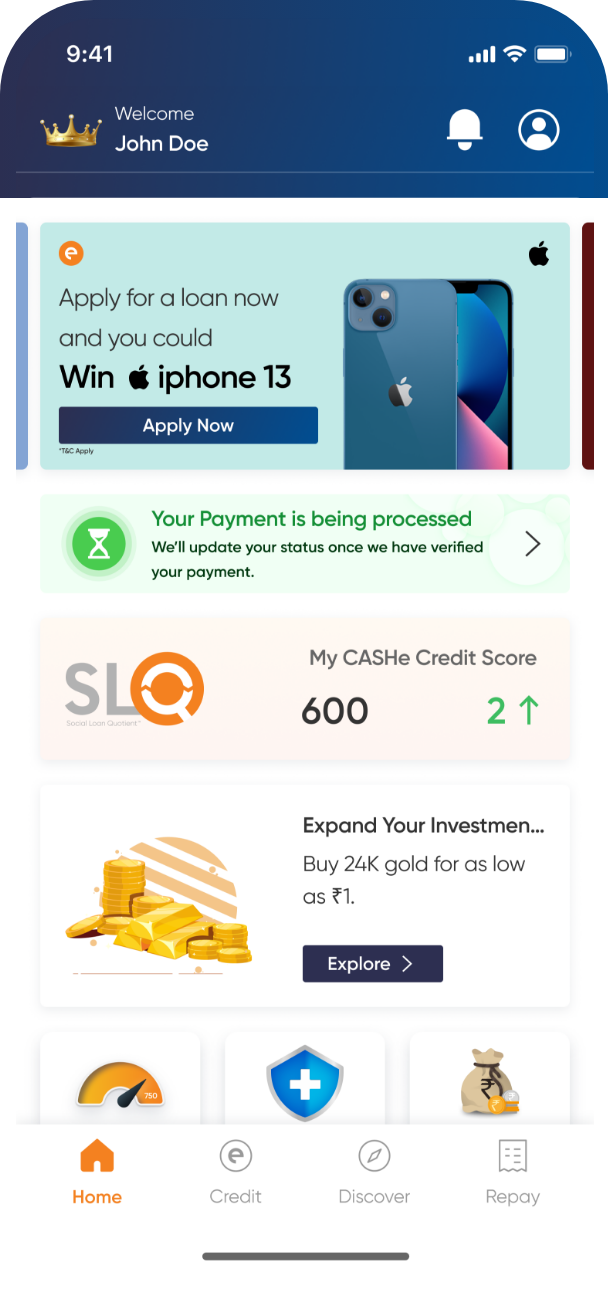

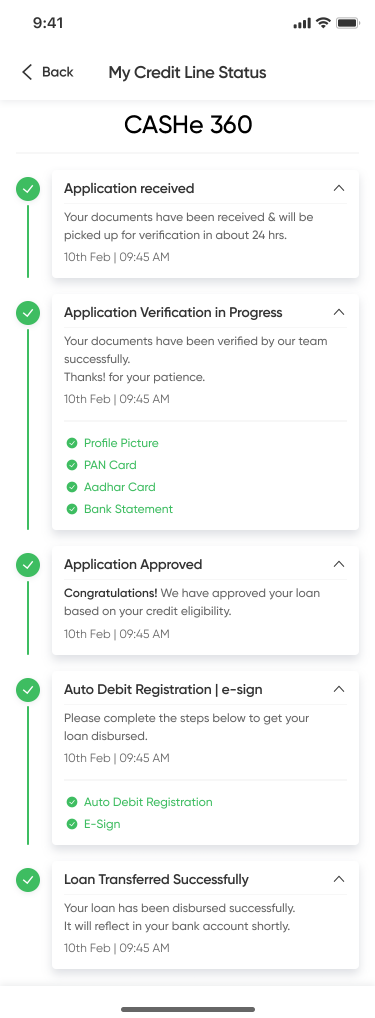

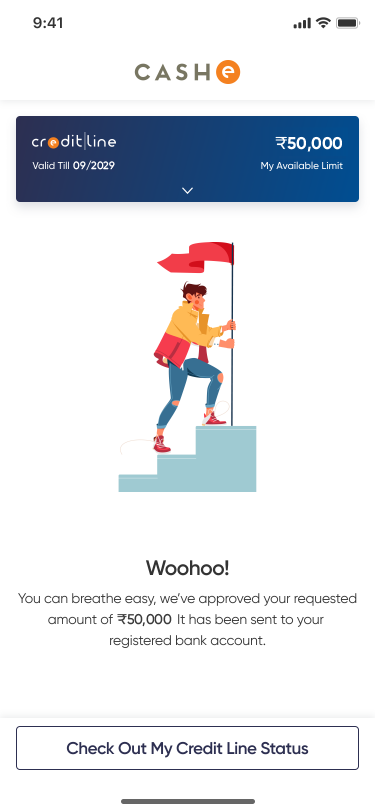

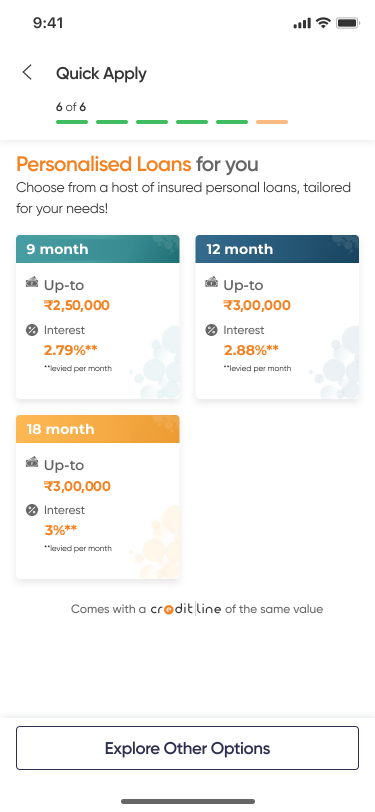

Want to buy a smartphone but it is out of your budget? Just get a Mobile Loan from CASHe!

Mobile phones are more of a basic requirement than a luxury item in today’s world. It has become the most convenient way to stay in touch with people across the globe, conduct your day-to-day business, stay on top of daily news and updates, etc.

You can get mobile phones in all kinds of budgets but if you are looking to invest in a good-quality smartphone, you will have to dig a little deeper into your pockets. While some people may be equipped with the ability to do so, not all are. This is where a mobile loan comes in handy.