Consumer Durable

Loan—

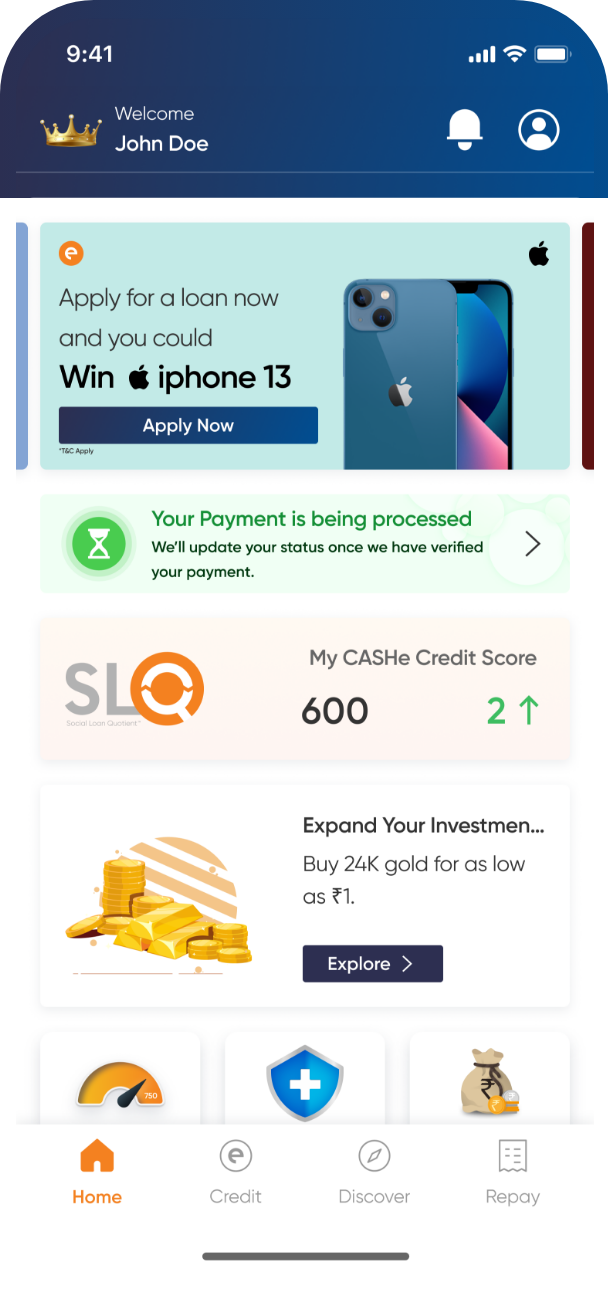

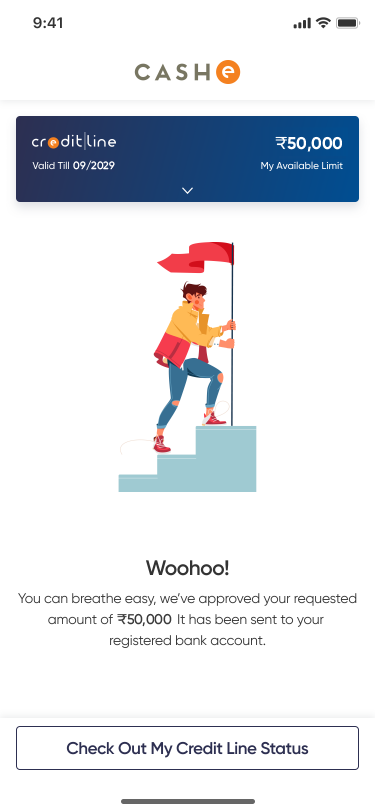

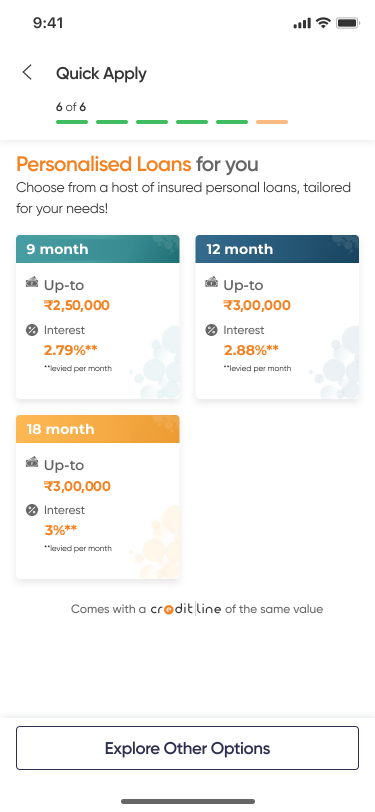

Indulge in luxury shopping without the stress of a shortage of funds to hold you back!

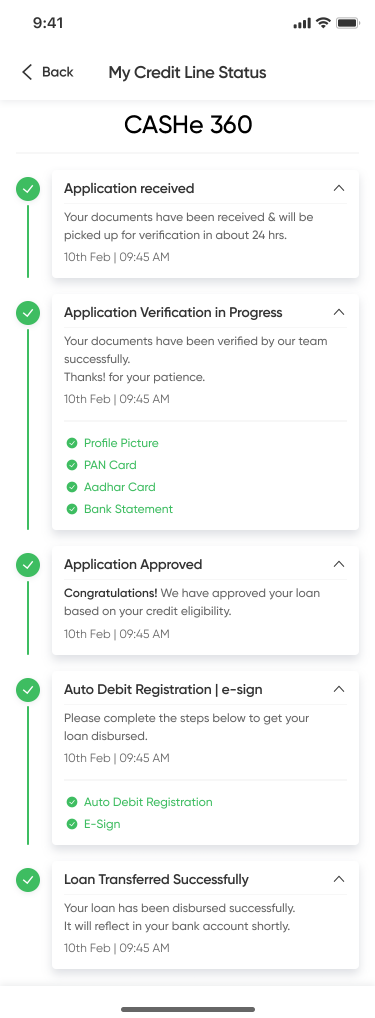

It is not possible for everyone to save a certain amount of money by the end of each month. Some run their house from paycheck to paycheck, making it difficult to even purchase essential household items. In such situations, you need a helping hand and it comes in the form of a Consumer Durable Loan.