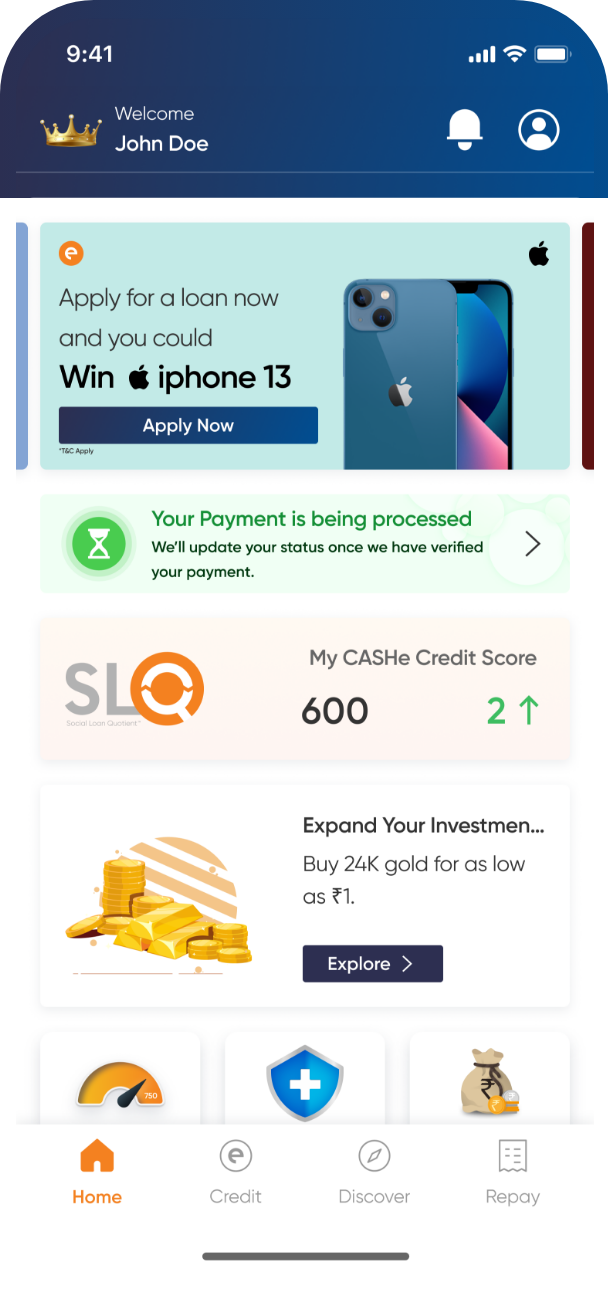

Get a Medical Loan from CASHe

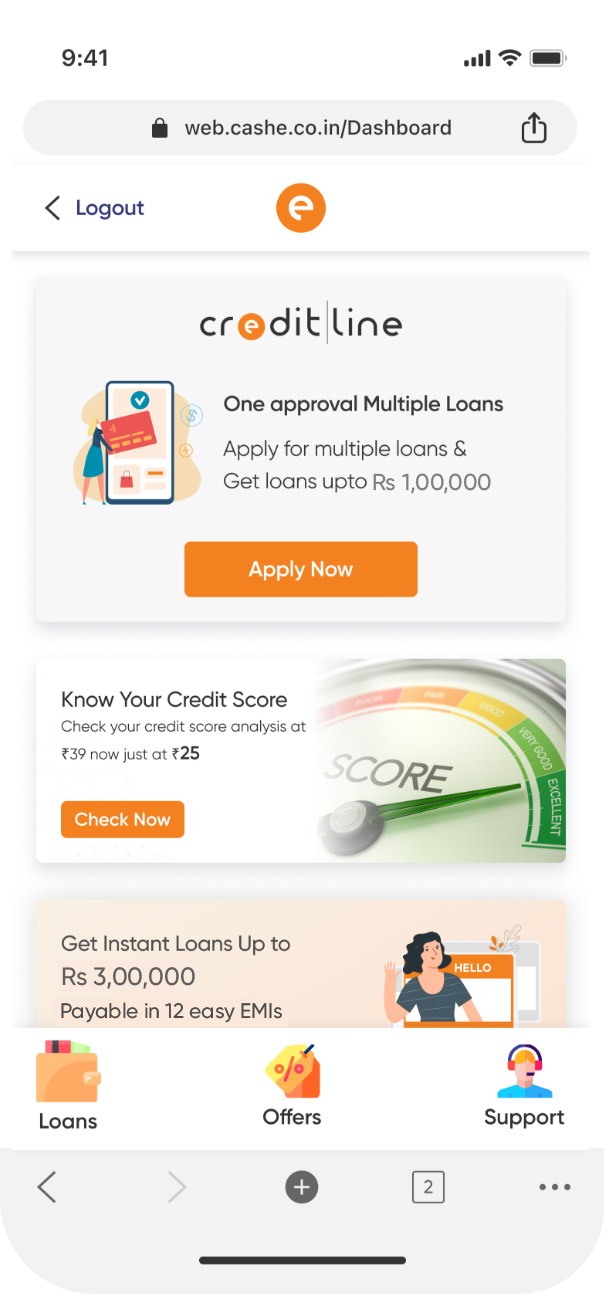

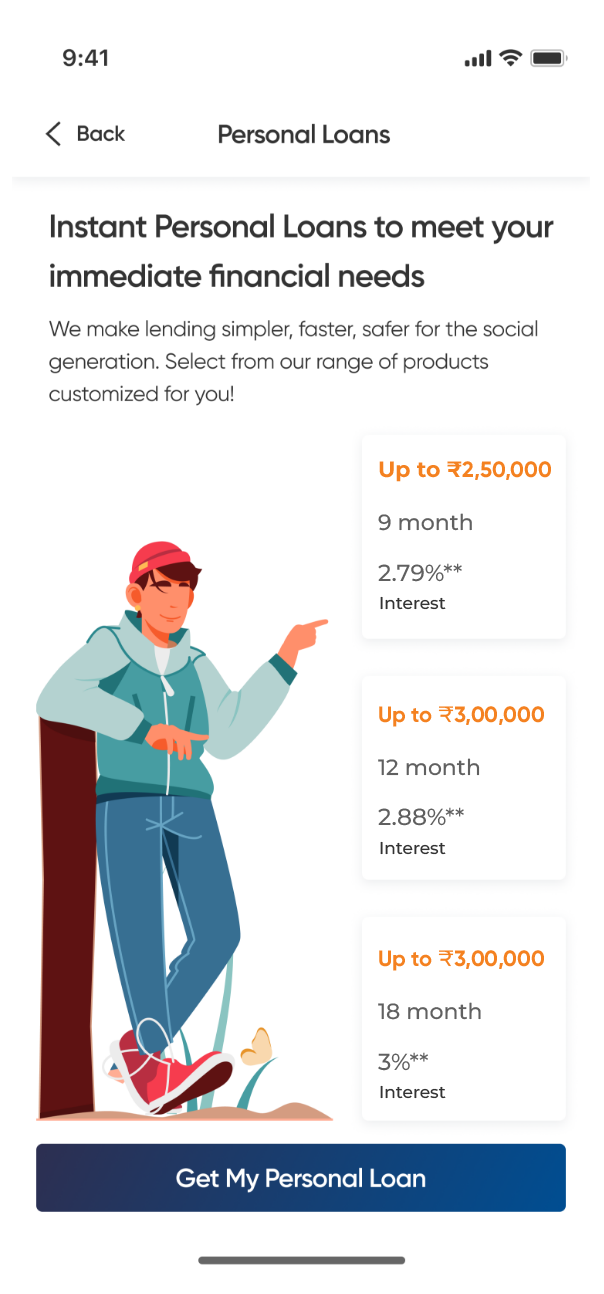

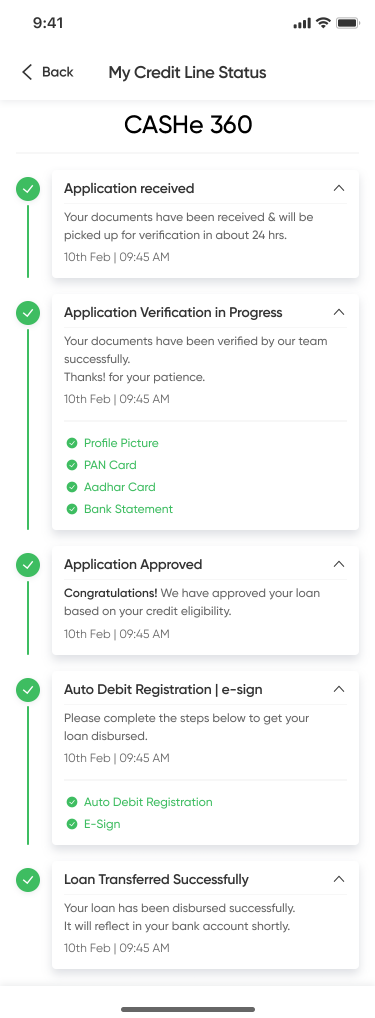

CASHe offers cashless medical loans that are processed quickly, digitally and without any paperwork – all through your smartphone. Apply for the loan on the CASHe app and get it approved within minutes. CASHe, in partnership with AyushPay, offers medical loans of up to ₹3,00,000 with flexible repayment options of 9, 12 and 18 months. With this partnership, get your ailment treated at any of the 5000+ partner hospitals.

Now, you do not need to worry about sudden medical costs. Focus on getting the treatment at the best facilities. The CASHe Medical Loan covers 30+ medical procedures and all expenses, including treatment, surgery, post-surgery care and therapy for the hospitalisation period.

Medical Loan Interest Rate and Other Charges

At CASHe, the medical loan interest rate is calculated on a per-month basis for the loan amount. The interest rate for a CASHe personal loan for medical emergencies ranges from 2.79% to 3% (reducing balance interest) on the loan amount. You also get a 5-day interest-free grace period for you to pay your CASHe medical loan EMI at the end of every month. Any subsequent delay will lead to a 0.1% interest fee penalty per day.

Additionally, we also levy a plain processing fee of 2.5% of the loan based on the medical loan product you are eligible for.

Tips for a Successful Medical Loan Application

In order to ensure that your CASHe medical loan is processed as soon as possible, you need to keep a few things in mind. Here are some tips to improve your chances of getting an urgent medical loan approval at CASHe:

- You must have a clean credit history with CASHe or with other financial institutions. This is crucial as your previous credit rating will have a direct implication on the SLQ scores generated at CASHe.

- Make sure that you upload all the necessary documents in clear and legible formats.

- Apply for a medical loan amount that you can afford to pay back on time.

Expenses Covered in a CASHe Medical Loan

CASHe offers EMI-based medical loans that you can use to pay for treatment, surgery, therapy, etc., during hospitalisation. This can help in taking some of the pressure off your health insurance plan, whose coverage may be insufficient in paying all the expenses.