APP ONLY LOANS

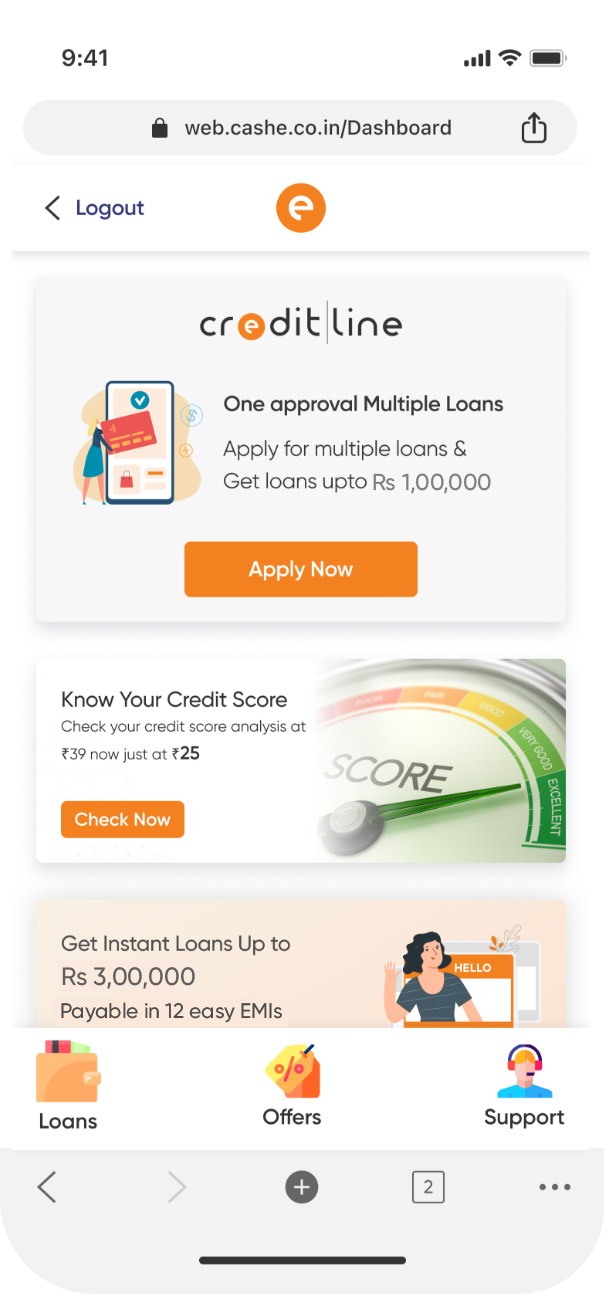

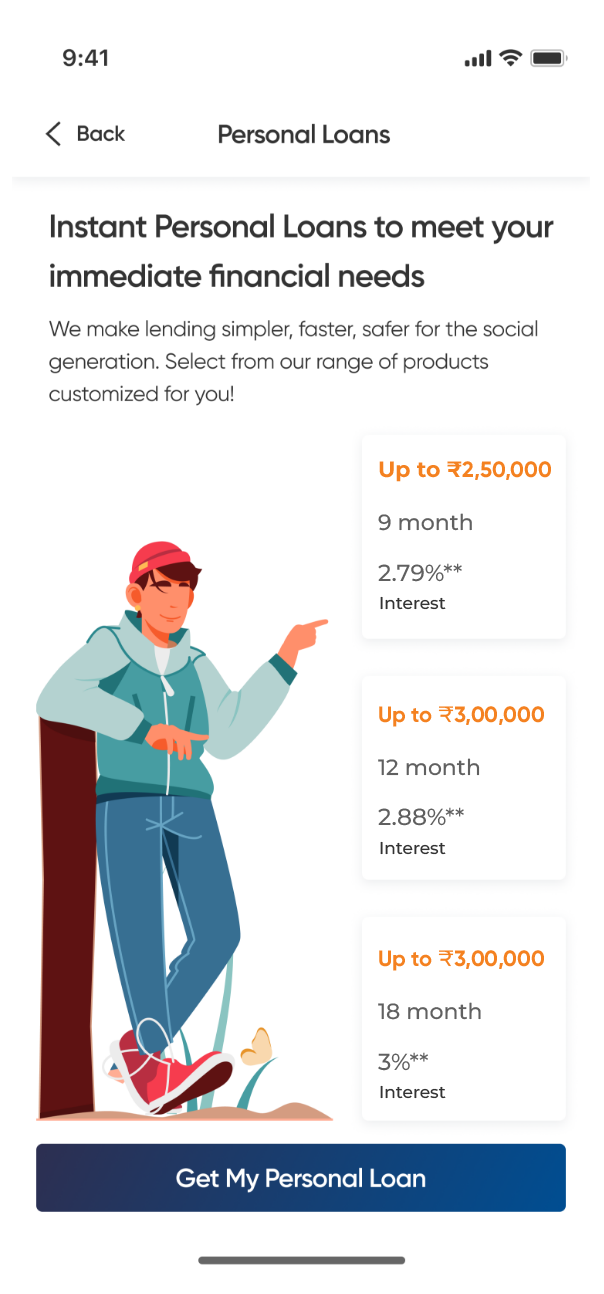

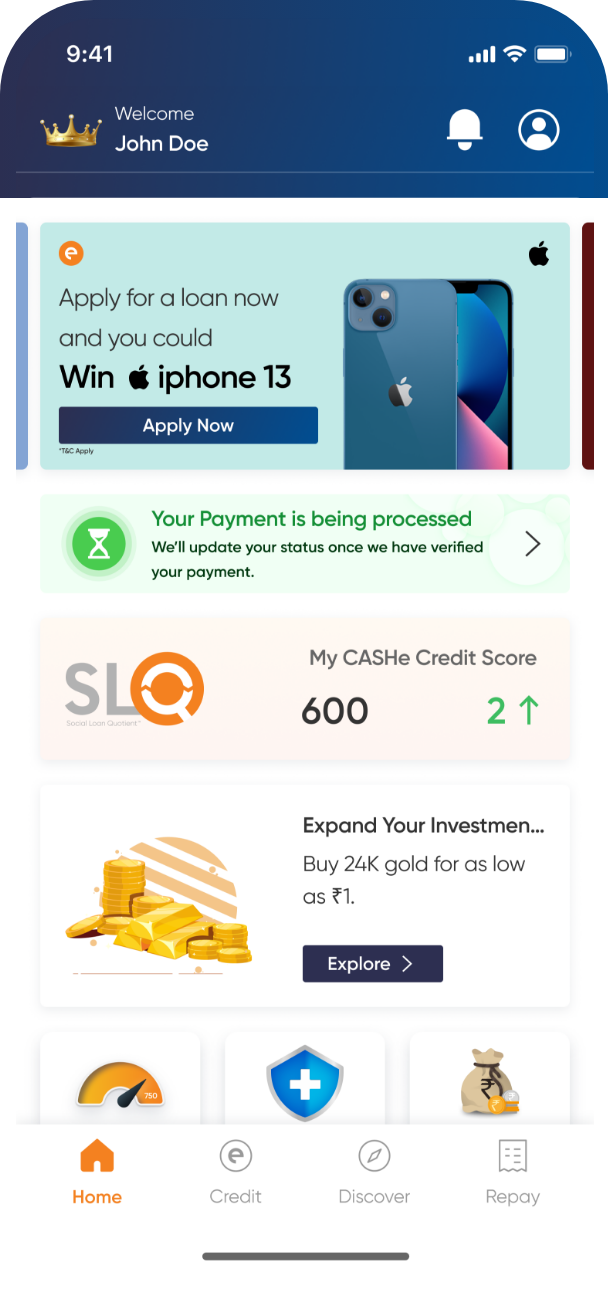

Young professionals are constantly looking out to explore and keep up with their hobbies and passion along with their jobs. Traveling to that desired destination, buying that dream phone, shopping for the latest trends during the festivals, taking up those hobby classes for the weekends are some of the things which millennials are looking out for. Taking up a personal loan from the bank might not be convenient considering the busy lifestyle. Many young professionals are now choosing app only loans over traditional loans.

The advantage of these online platforms is that they are quick and the process is time-saving. The loan money is disbursed quickly and there is no lengthy paperwork involved in application process. The loan application doesn’t involve any traveling to the bank or visiting any branch and spending time in the long ques. The application can be sent from anywhere as long as there is internet connectivity and scanned digital copies of the documents are ready to attach.