About CASHe —

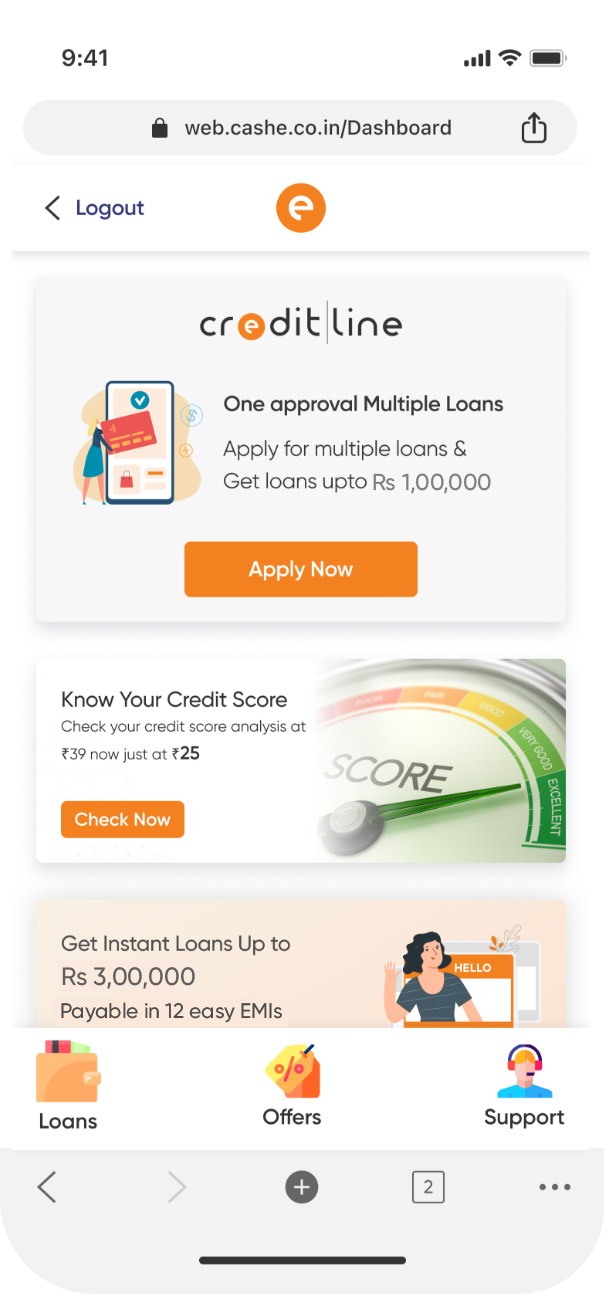

CASHe – Bharat Ka Money App – is committed to serving as a reliable financial partner for people across India. We provide instant personal loans of up to ₹3 lakhs, covering a wide range of needs such as medical expenses, travel, bike, and car purchases. You can also avail a pre-approved CASHe limit of up to ₹2 lakhs with the CASHe online loan app.

The CASHe app is developed by Bhanix Finance and Investment Limited (Bhanix), an NBFC registered with RBI. At CASHe, we strictly believe that everyone deserves access to credit when it matters most. Anytime. Anywhere.

Hence, the CASHe personal loan app offers personalised solutions to address our customers’ financial requirements. By utilising advanced alternative data sources, CASHe is here to make borrowing seamless for salaried professionals, from urban cities to rural heartlands.

Our mission is to promote financial inclusion and empower individuals, thereby, transforming the way Bharat accesses credit.

Our tech sees more than numbers

it sees you —

Our proprietary AI-powered, ML-driven technology shows a truer picture of you beyond credit scores. With decisions in seconds, we make finance possible when you need it most—in the moment and at the point of need.

Explore

We Are Growing and How! —

CASHe carries an inherent social mission: To provide financial inclusiveness to people who are otherwise excluded by traditional banks and lending institutions. In so doing, CASHe is unlocking their economic potential, development and the unfolding of financial benefits to millions of underserved and unserved working millennials.

Our Story

Unlock Possibilities Beyond Credit with CASHe —

— Over 3,00,000 five-star reviews —

Because We Build Trust One Perk at a Time, Here’s How

We have been in the news —

Here's What The Media Has To Say About Us

Check out what makes CASHe tick! —

How CASHe Works —

For those who want more from their Money, there’s CASHe – Bharat Ka Money App.

Frequently Asked Questions —

CASHe is a cutting-edge personal loan app for salaried professionals where you can avail instant personal loans of up to ₹3,00,000. Applying for a personal loan on the CASHe app is easy and hassle-free with minimal documentation and quick loan disbursal within a few hours after your loan is approved. Moreover, the CASHe loan application process is completely online.

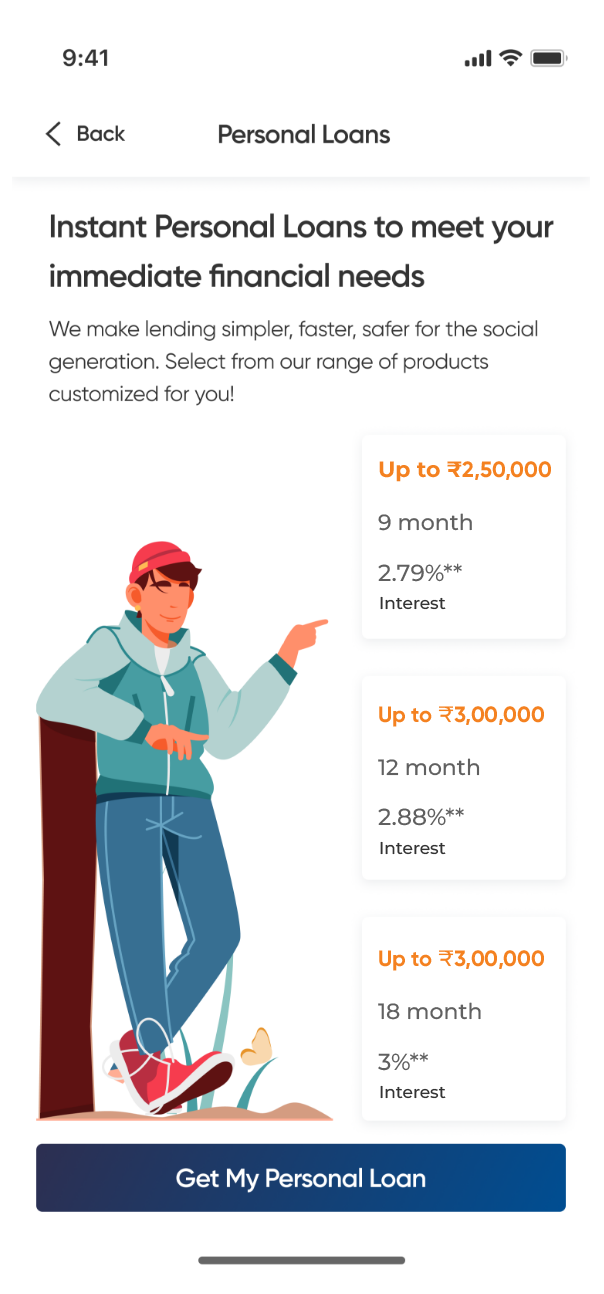

CASHe instant personal loans are unsecured loans that you can avail to meet your current financial needs. We offer personal loans starting from ₹50,000 to ₹3,00,000, with tenures ranging from 9 months to 18 months.

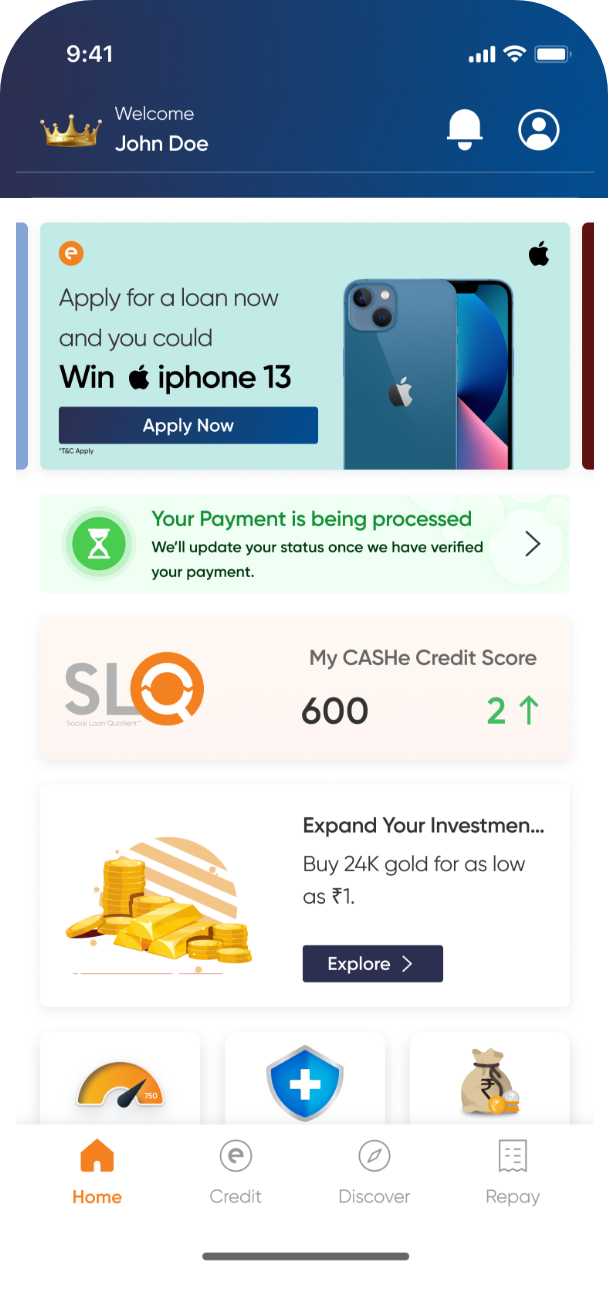

At CASHe, we offer short-term instant personal loans to salaried professionals through our simple yet powerful app. Our app is powered by a proprietary predictive algorithm called The Social Loan Quotient (SLQ), which creates a sophisticated credit profile of borrowers that is different from conventional banks and credit agencies.

With our cutting-edge technology, we enable young professionals to avail personal loans within minutes, without any physical paperwork. All you need to do is install the CASHe mobile app and upload the necessary digital documents like your salary slip, bank statement, PAN card & address proof. Once approved, your personal loan account is transferred to your bank account within minutes.

Any individual who meets the following eligibility criteria can avail a quick personal loan on CASHe:

- Citizenship- Must be an Indian citizen

- Age- Must be at least 18 years of age

- Salary- They should be a salaried professional with a minimum monthly salary of ₹50,000 or more

- Online Presence- Should have a Facebook or a LinkedIn Account

Here are the steps to apply for a loan on CASHe :

- Step 1 – Download the CASHe mobile app.

- Step 2 – Create your account and complete the KYC process.

- Step 3 – Click on the ‘Get Loan’ option.

- Step 4 – Choose the ‘Personal Loan’ option.

- Step 5 – Determine your personal loan amount and your personal loan tenure.

- Step 6 – Wait for CASHe to verify your details and approve your personal loan application.

- Step 7 – Once approved, your personal loan amount will instantly be disbursed to your bank account.

Here is a cash loan documents checklist you will need while applying for a CASHe instant personal loan:

- Photo ID Proof- PAN card and Aadhaar card

- Salary Proof- Salary slip or the latest bank account statement showing the salary credited into the account.

- Permanent Address Proof- Passport/driver’s licence/utility bill showing your name/voter ID card.

- Photo Proof- Your selfie

CASHe offers various types of instant personal loans like-

- Mobile loans

- Home renovation loans

- Two-wheeler loans

- Car loans

- Medical loan

- Marriage loan

- Education loan

- Travel loan

- Consumer durable loan

- Electric two-wheeler loan

You can apply for a CASHe instant personal loan for an amount ranging between ₹50,000 and ₹3,00,000.

CASHe personal loans are approved based on our advanced credit ranking system called the Social Loan Quotient (SLQ). SLQ is linked to a number of data points including mobile and social media footprint, education, monthly salary and career experience.

CASHe is powered by Bhanix Finance and Investment Ltd., an RBI-registered NBFC.

Follow the link for the detailed Terms and Conditions for CASHe Loans.

CASHe personal loans offer various benefits like:

- Minimal online loan paperwork as compared to traditional bank loans.

- Quick personal loan application process that takes just a few minutes.

- You can apply for a CASHe instant loan online anywhere as long as you have internet connectivity.

- Quick loan amount disbursal as soon as the loan is approved.

- No collateral is required to avail CASHe personal loans.

You can apply for a CASHe personal loan from the comfort of your home or anywhere in India, including major cities like Bengaluru, Delhi, Chennai, Hyderabad, Mumbai, Pune, Kolkata, and Ahmedabad, as long as you have internet connectivity to use the CASHe application.

Yes, it is absolutely safe to apply for a personal loan on CASHe online. CASHe is powered by Bhanix Finance and Investment Ltd., an RBI-registered NBFC, and follows all the norms laid down by the RBI.

CASHe also offers credit lines, Flipkart Buy Now Pay Later (BNPL), and Digital Gold investment products apart from instant personal loans.

“Awesome service Initially I thought it as fake but omg it’s really awesome yaar you guys rock I got loan amount in minutes of time post verification. Awesome service Initially I thought it as fake”