Easy Loans

In times of financial emergencies, all one needs is a loan to be made available to him or her quickly and easily. There are many types of loans that can be made available to borrowers easily in a very short period of time, some of which are discussed below:

1) Same day loans – As the name suggests, these loans are granted to the borrowers on the very same day. They require no credit check and minimal documentation.

2) Credit cards – Some credit card companies also offer the facility of getting quick loans at lower rates of interest.

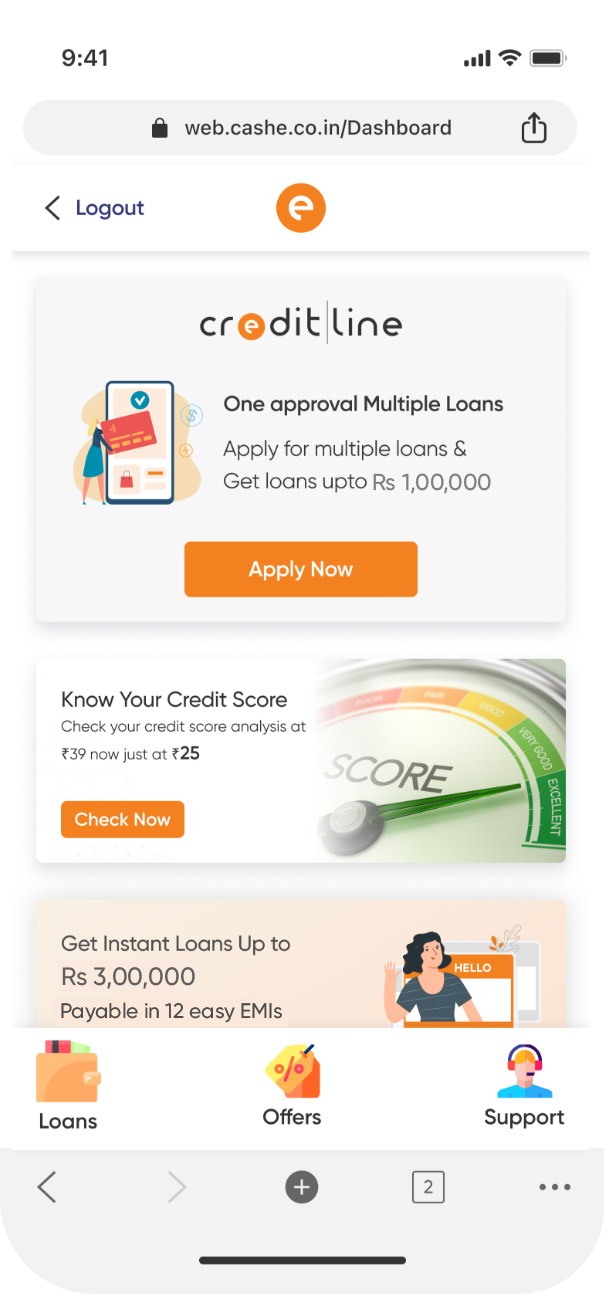

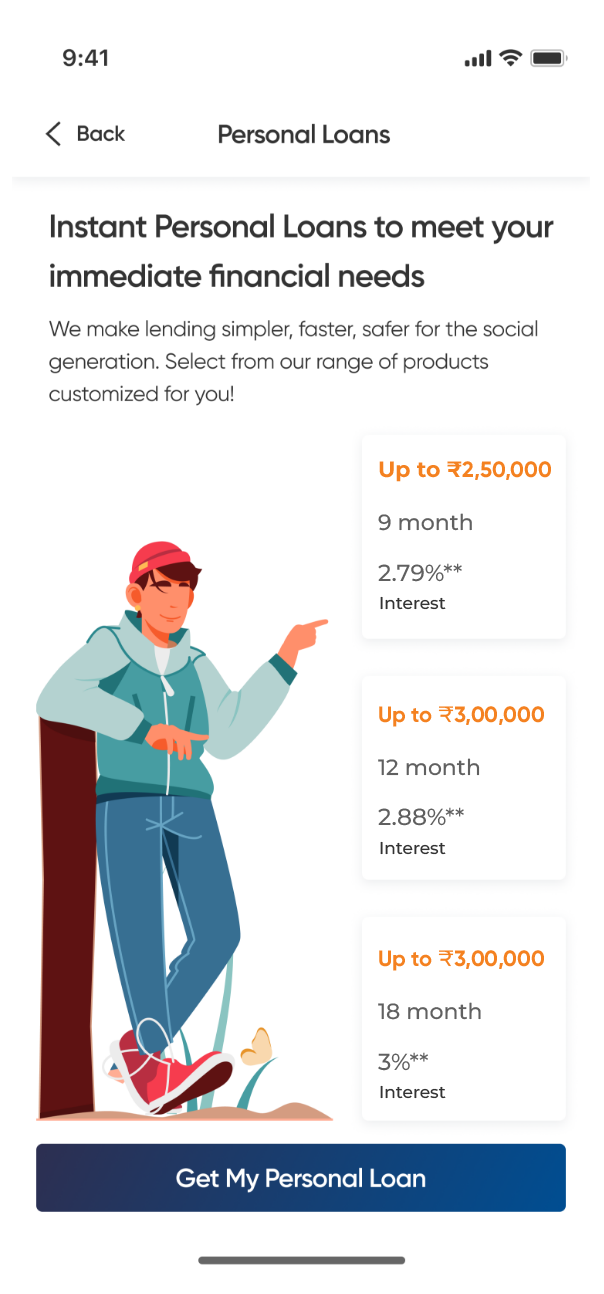

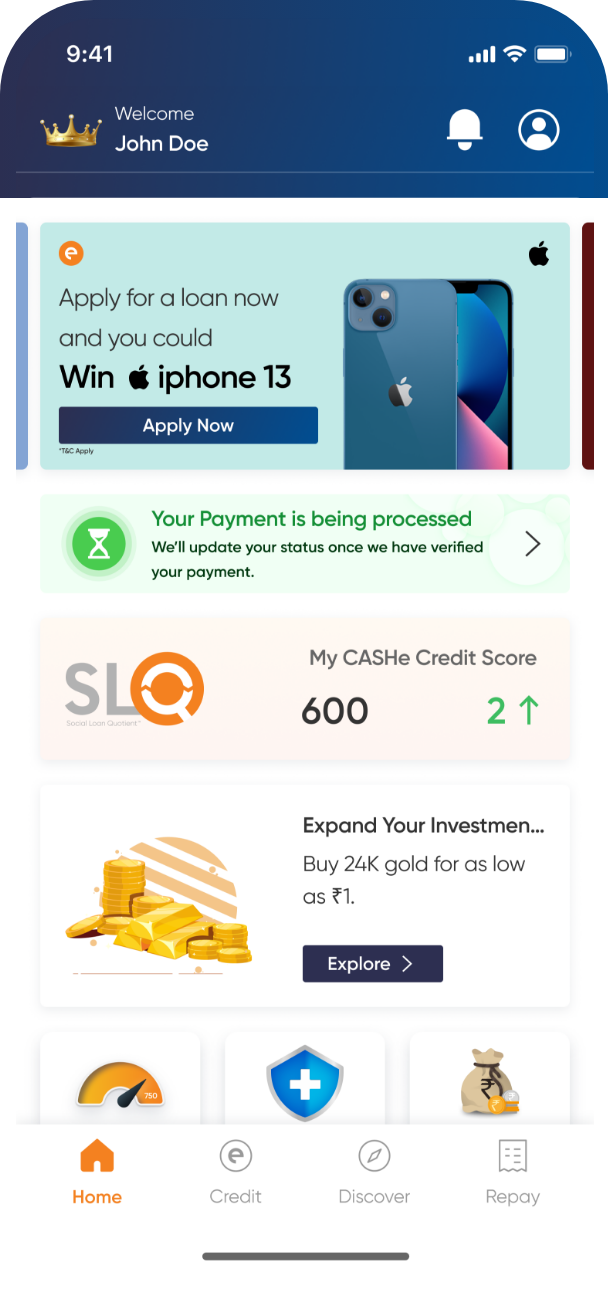

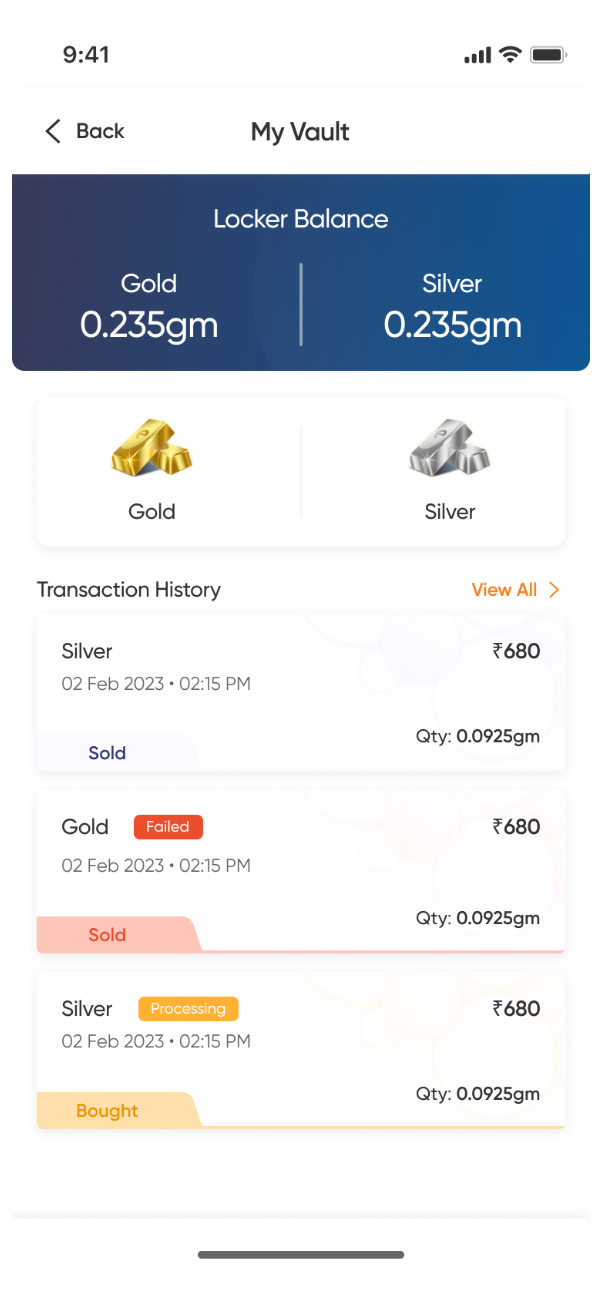

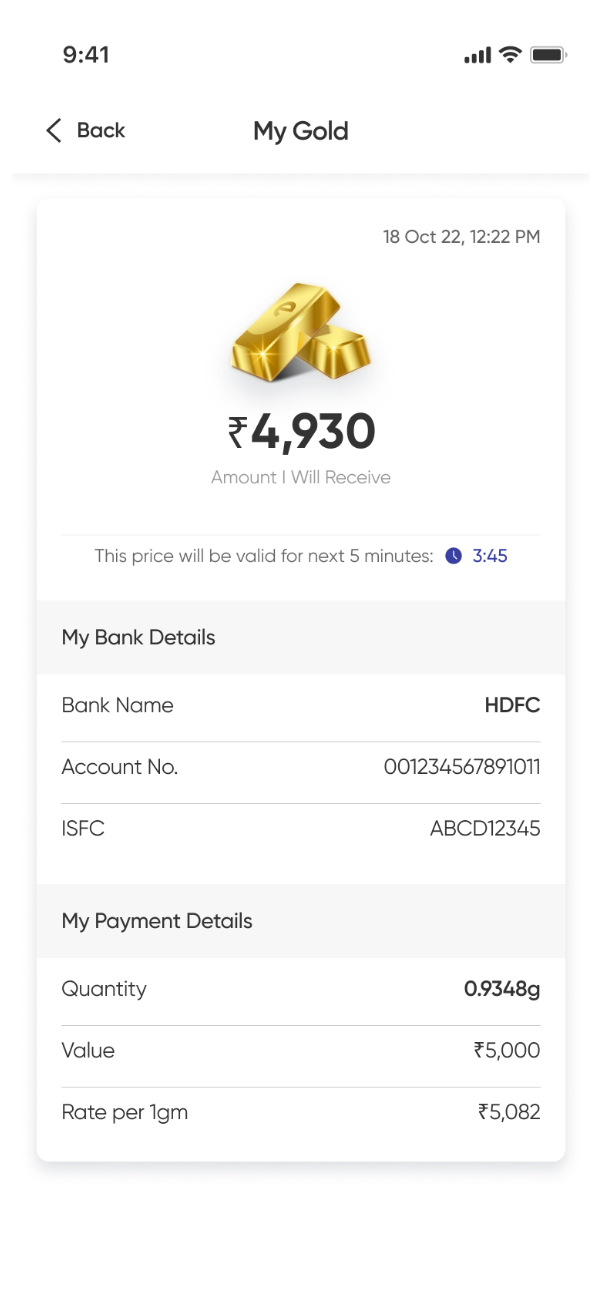

3) Personal loan apps – Mobile phone applications like CASHe are emerging in India which provides easy and unsecured short term loans through a simple process.