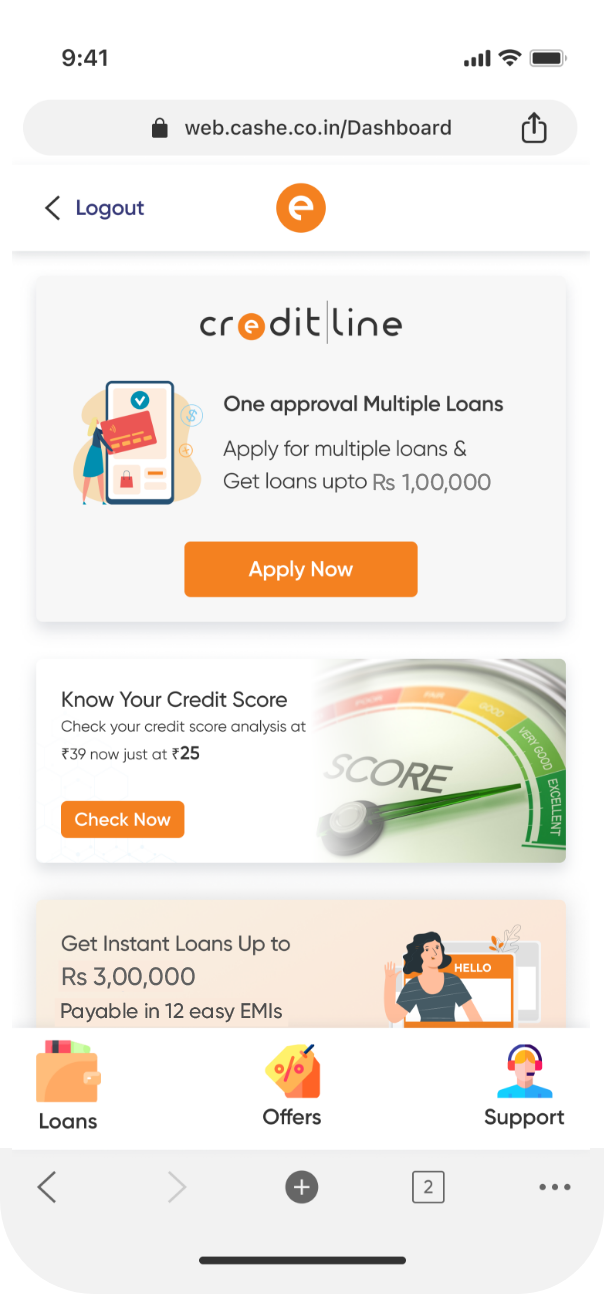

Cash Loan App

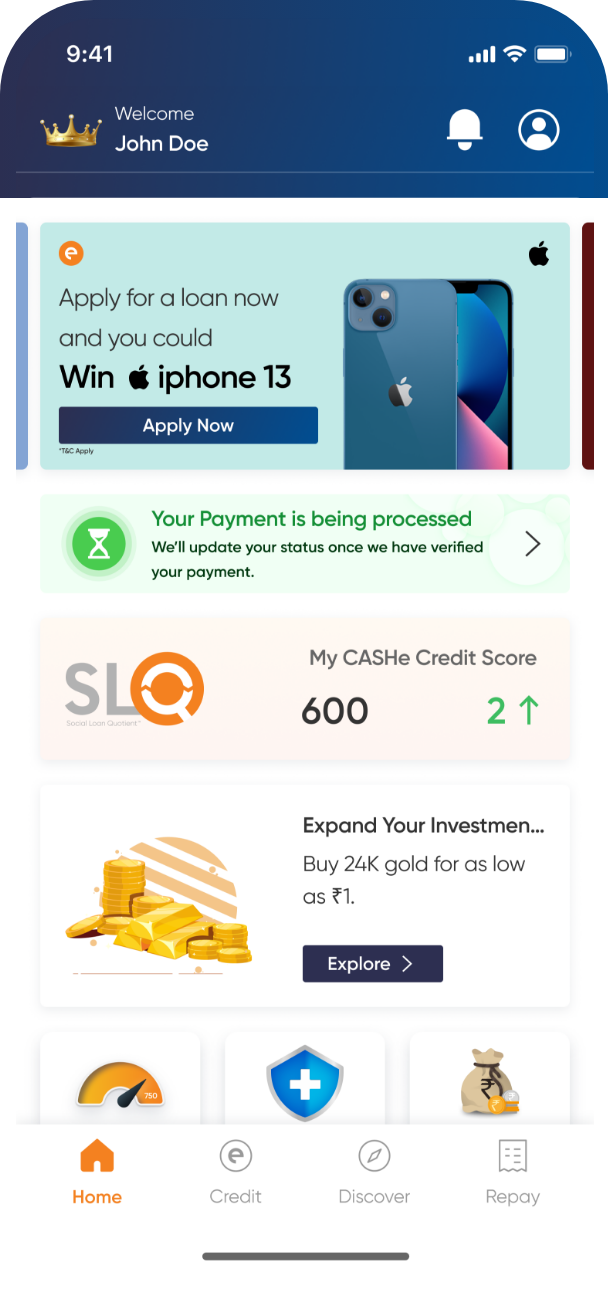

We live in times where we need instant personal loans for our desired purchases, EMIs or an unexpected bill payment. Where the bank procedures can be time-consuming, cash loan app will save your time as well as your efforts.

India is getting digitalized, from a pen to a smartphone, everything can be bought online. Why not a personal loan?

What is a Cash Loan?

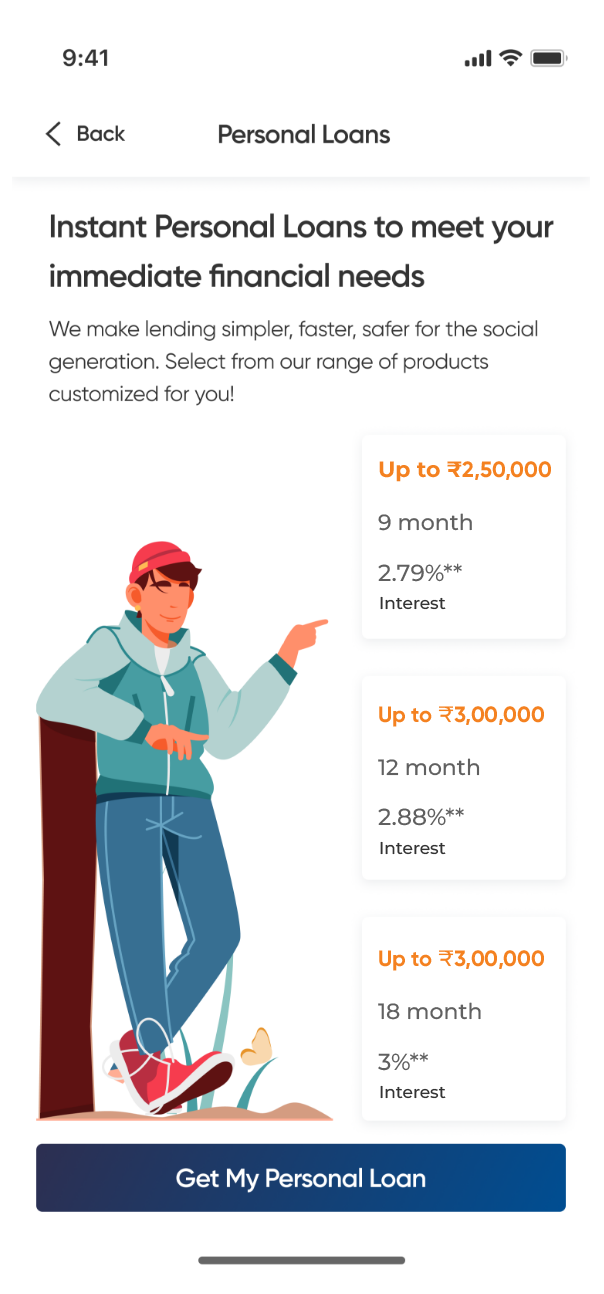

A cash loan is a short-term loan which you can avail during the times when you need urgent cash for your personal needs. This instant cash loan provides you with quick access to small amounts of money for your immediate expenses. With CASHe, the process of availing such quick cash loans is fast and straightforward. Consequently, you get your loan approved within a few minutes. Unlike traditional loans, collateral is also not required, making it suitable for those with poor credit or no assets.