Here Are The Answers To All Your Questions

CASHe – For timely EMI payments or squaring monthly bills, making a major purchase that you so desired, taking a vacation to unwind or meeting a medical or financial emergency, keep the power of CASHe in your smartphone. A personal loan from CASHe that help you stitch in time.

CASHe, a cutting-edge fin-tech product from Aeries Financial Technologies Pvt. Ltd., enables short-term personal loans to young salaried professionals on a simple yet powerful app. Powered by a proprietary predictive algorithm called The Social Loan Quotient (SLQ) that creates a sophisticated credit profile of consumers totally different from conventional banks and credit agencies. CASHe enables young professionals to get loans within minutes, without paperwork and pain. You can now avail loans ranging from Rs. 50,000 to 3,00,000 for Starting from 270, 1 Year & 1.5 year days based on your need. All you require is a salary slip, bank statement, PAN card & address proof clicked on a self-signed white paper and uploaded through CASHe app. Money is in your bank account within minutes.

SLQ is India’s first social behavior-based credit rating system for salaried professionals and young salaried millennials.

As part of a growing digital community, we all create an imprint of our digital presence online in numerous ways. This digital footprint now defines how we exist & behave in the larger social world. This new reality formed the basis for our research scientists to develop an advanced credit ranking system using big data analytics, AI and predictive tools to calculate the Social Loan Quotient (SLQ) for our customers.

Conventional lending agencies like banks work on outdated systems that rely heavily on your past financial transactions. We are interested in your today and how that will impact your tomorrow.

SLQ’s revolutionary approach changes the way credit-risk is calculated. It is linked to a number of data points including mobile and social media footprint, education, monthly salary and career experience. SLQ is a dynamic score and as you interact with us more and spend time in the digital space your SLQ score evolves too.

SLQ is fast, unique and pathbreaking!

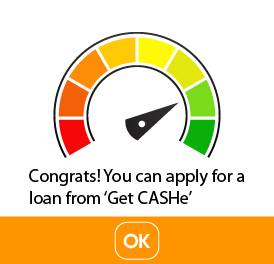

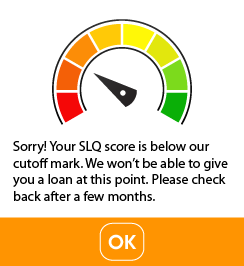

CASHe has now made SLQ accessible for every applicant to know if he/she is eligible for a loan with CASHe. All you need to do is to complete your profile and submit the necessary documents on to the app. Within minutes, the AI-based SLQ engine will let you know your credit profile status. If your profile rating is ‘Good’, you can go ahead and apply for a loan with CASHe using the ‘Get CASHe’ tab. You will then also receive your SLQ Score. However, if your profile rating is Poor, you will not be able to apply for a loan, and may try again later after a few months when your credit profile improves. Additionally, the more you use CASHe responsibly, the better your SLQ score improves.

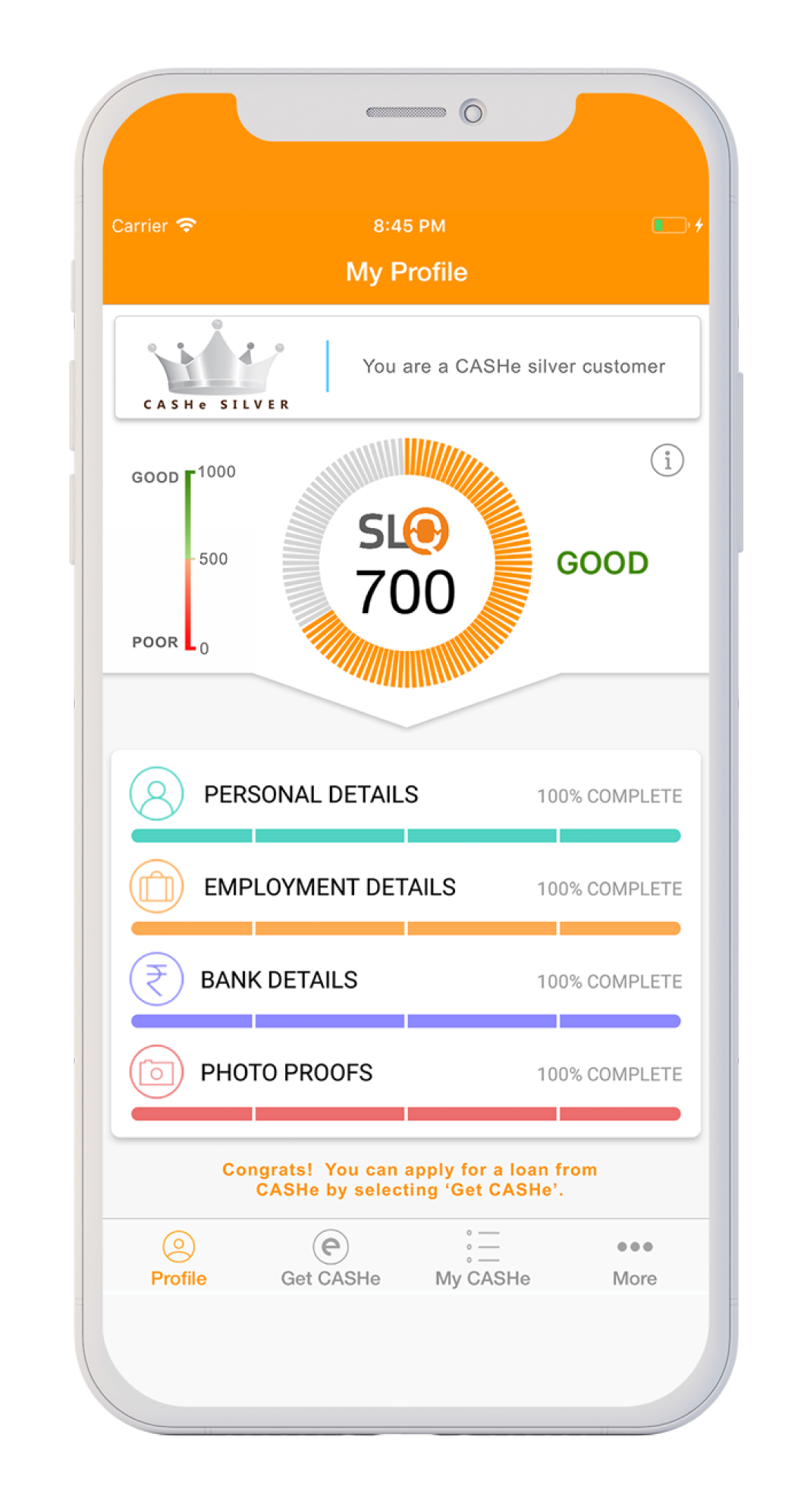

Once you are credit approved, your profile screen will show your SLQ score which looks like this.

SLQ is very different from traditional credit scoring systems which usually deliver a score based only on the applicant’s historical financial behaviour. SLQ is independent of any bureau reports and generates its own scores based on the customer’s social behaviour data.

We welcome everyone to get their SLQ rating (without the need to apply for a loan), and become a part of this exciting new digital world.

CASHe offers loans ranging from Rs 50,000 to Rs 3,00,000 payable over a period of 270 days, 1 year and 1.5 year product.

You can choose to go for the 270-day loan plan which lets you repay the loan in nine equal monthly payments. In the 270 day plan, you can choose a loan from Rs 45,000 upto Rs 2,50,000

For our one- year loan plan you can opt for loan amount up to Rs. 3,00,000 with repayment plan in twelve monthly installments. The minimum eligible amount is Rs. 50,000.

For our 1.5 year loan plan you can opt for loan amount up to Rs. 3,00,000 with repayment plan in eighteen monthly installments. The minimum eligible amount is Rs. 75,000.

Any Indian citizen residing in India, above the age of 18, with a proof of current employment, earning a monthly salary of Rs.40,000 and above, a bank account, a Facebook / Google+ / a LinkedIn account and valid identity and address proof can use the CASHe app to avail loans

CASHe is neither a bank or an NBFC. CASHe is powered by Bhanix Finance and Investment Ltd., an RBI registered NBFC. Following norms laid down by the RBI. Bhanix Finance and Investment Ltd is your lender and all payment terms and conditions are agreed with Bhanix Finance and Investment Ltd and not with CASHe. CASHe is a sophisticated, user friendly, technology platform which provides hassle-free experience to borrow personal loans.

No. CASHe is a mobile app. And this app won’t work if you don’t have a smartphone. We’d really like to help, but we can’t. Sorry!

CASHe aims to revolutionize the process of borrowing wherein we use your internet presence on social networking sites as a reliable benchmark to assess your creditworthiness. Your social networking activities provide valuable information on who you are, and whether you fit our ethos. It’s younger, simpler and more convenient.

CASHe is simply assisting Lender to try and get a picture of who you are using industry standard access levels in terms of your network, contacts and activity. Relax, because under no circumstances will your information be shared with third parties, nor will CASHe retrieve personal data without your consent. Please refer our Privacy Policy.

With our multiple loan options now available on tap, you can now opt to borrow personal loans starting from Rs.50,000 to a maximum of Rs 3,00,000 with a repayment period of 9 months, 12 months and 18 months.

You sure can shift your loan tenure from 270/1 year/1.5 year as soon as you have cleared all outstanding of your previous loan. Please ensure timely repayments of your existing loans to have a positive SLQ scores with CASHe.

We do not interact with our customers on phone. Please email us at support@cashe.co.in for any queries related to the loan products, we will ensure that you are responded to as quickly as possible. In case you would like to know on enterprise package, please send an email to partner@cashe.co.in

Just upload these 4 basic documents and you can get yourself credit approved with CASHe

Photo Identity Proof – PAN card

Latest salary slip

Aadhar Card

Permanent Address Proof – Any one (1): Passport/Driving License/Voter’s Identity Card or Utility Bills i.e. Electric/landline phone bill/ Gas Bill (not more than 2 months old) If Current Address is different from Permanent Address, then additionally: Utility Bill- Electric/landline phone bill/ Gas Bill of current address (not more than 2 months old), Leave & License Agreement/Rent Agreement

Latest statement of your Bank Account, showing your salary credit

We would also ask you to upload your selfie as proof of your photograph.

Your information will only be used internally. Promise.

Upload the following self-attested documents in jpg format. Also, make sure the documents you upload on the app are clearly legible and self-attested in order for us to speedily process your loan request.

Verification Process:

PAN Card shall be verified electronically from Income Tax Website so as to ascertain correctness of the PAN Number and corresponding name from Income Tax web site. The said verification may be carried out by an independent Agency.

Similarly Aadhar Card & Voter’s Identity Card shall be verified through Independent Agency.

Utility Bills and Passport will be used to verify address.

Borrower will electronically upload his/her selfie on the CASHe app.

For more information on this you may contact us on support@cashe.co.in

CASHe aids the Lender in using a proprietary system to determine whether your creditworthiness and your documents depict that you are a responsible Borrower. Don’t worry, this information is for internal use only. The security of your information is of the utmost importance to us. For more information, feel free to go through our Privacy Policy.

Relax. We trust you. We require no collateral. Simply provide us your valid documents so we can determine your eligibility and you’re all set!

For 270-Day loan, you can avail loan amount upto 170% of your net take home salary.

For the 1 year loan plan, you can avail loan amount up to 210% of your net take home salary.

For the 1.5 year loan plan, you can avail loan amount up to 300% of your net take home salary.

If you haven’t uploaded the required documents, furnished false information, lack a job or the means to repay, or your profile does not include the qualities required of a user of CASHe app, or if we are unable to verify your information, your application could be rejected and the same shall be communicated to you. This isn’t a reflection on your credibility, it’s simply that your profile does not fit as per our algorithm. Better luck next time.

No, you will not get a loan if you don’t qualify as per the internal credit rating criteria.

Absolutely. If you feel that your application should be reviewed or if you believe that there have been material improvements in your creditworthiness since you last applied, do re-apply after 3 (three) months from the rejection of your previous application. We will look into it. However, approval remains solely at the discretion of Lender.

For 270 day loan product: We charge 2.5% on the loan amount

For 1 Year Plan :

We charge 2.5% on the loan amount

For 1.5 Year Plan :

We charge 2.5% on the loan amount

The processing fee is charged every time you take a loan from CASHe. But don’t worry, the fee is nominal

The charges are as follows

For 270 day Product

We charge a plain processing fee of 2.5% on the loan amount

1 Year : We charge a plain processing fee of 2.5% on the loan amount

1.5 Year : We charge a plain processing fee of 2.5% on the loan amount

For 270-day loan, we charge you a fixed Rate of Interest of 2.79% per Month (Equivalent reducing balance interest rate) on loan amount

For 1 year the Rate of Interest is 2.88% per Month (Equivalent reducing balance interest rate) on loan amount

For 1.5 year the Rate of Interest is 3% per Month (Equivalent reducing balance interest rate) on loan amount

Your loan is generally transferred instantly as soon as all your documents are verified. In order to process your loan quickly, we advise you to upload the necessary documents in the necessary formats and make sure they are clear and legible.

This is unlikely – CASHe is designed to complete your credit appraisal within hours. Once that’s completed, you will be informed immediately of your eligibility. In some cases, some additional information may be required to disburse cash. But, whatever the case, we’ll ensure that you’re always kept in the loop.

You can not make changes to your loan amount post final approval is given to your loan request.

The lenders reserve the right to recall, with due notice, any cash disbursed to Borrower for failure to disclose materially valuable information to determine your credit profile. If you’ve provided false or misleading information, the Lender will call for the amount to be repaid within 24 hours, following which you will be categorised as a defaulter, with the attendant penalties and appropriate steps may be taken by appropriate authorities.

Default is a failure to repay the full amount due including Interest within the time frame (including extended periods) from date of disbursement of loan amount. If you fail to repay within the stipulated time period allotted to you, you will be classified as a defaulter with CASHe and you will be unable to take a loan with CASHe

CASHe is an enterprise of trust. As a user of CASHe app, Lender lends you cash because it believes in your creditworthiness, and in your ability to return it. So, should you default despite the trust bestowed, the Lender will be forced to make your status as a defaulter public on the CASHe app and website, Lender’s website and on your social network and take necessary steps for recovery. Lender will also inform CIBIL and other credit rating agencies.

Is that even a question?? Absolutely! In fact, making payments before they are due raises your SLQ score. However, the interest payments are deducted at source at the time of disbursement and it will not be reduced/ reimbursed in such instances.

We accept payments through NEFT/IMPS/UPI only. We do not accept CASH/CHEQUE for repayments.

Enter your CASHe CLN # as account number in the field called Account number and choose Account name as Bhanix Finance and Investment Ltd

Please ensure that the IFSC code is KKBK0000958.

Please make sure that you enter the above information correctly while transferring funds

Please write to support@cashe.co.in if you need further assistance.

CASHe is powered by Bhanix Finance and Investment Ltd – a RBI registered NBFCs, which determines the borrower’s eligibility, disburses loan amounts to users of CASHe as well as recovers the same.

Once you have registered your UPI ID with CASHe, and ready for your loan repayments with CASHe, you need to go to the ‘My CASHe’ screen of the app and click the ‘Current Due’ tab which indicates your amount due to CASHe. Click on the tab and ‘Repay with UPI’. The following screen will feature the amount to be transferred and your UPI ID to which the amount needs to be transferred. Then, select ‘Repay’. Kindly note, your repayment with UPI is valid for a period of 60 minutes which will be indicated in the status screen of the app following your transaction. If for any reason your transaction doesn’t get fulfilled within the allotted 60 minutes, you will need to redo the procedure once again until your repayment transaction is a success.

You also have an option to make the payment through UPI from the “How to Repay’’ screen of your app. This screen is auto populated with your UPI ID if you have your Virtual Payment Address (VPA) registered with us.

If you are an existing customer, you will get a pop-up message in the app to enter your UPI ID in the bank details screen. However, you do have an option to enter the UPI ID at a later stage in the app. But we strongly recommend you create your unique UPI ID with your registered bank (if you don’t have one) and register it with CASHe. If you are a new customer, you are required to fill in your UPI ID in the bank details screen of the app.

This feature initiates a ‘Collect’ request on the due or overdue amount if you have registered your UPI ID with CASHe. It is an automated feature wherein you need to “Approve” the request sent by us to initiate your due amount through your UPI ID. It’s simple, and easy. You do not have to go through the existing procedure of making the payment through IMPS or NEFT. The UPI interface does this for you automatically in seconds, thus saving time in doing so.