Get a Home Renovation Loan from CASHe –

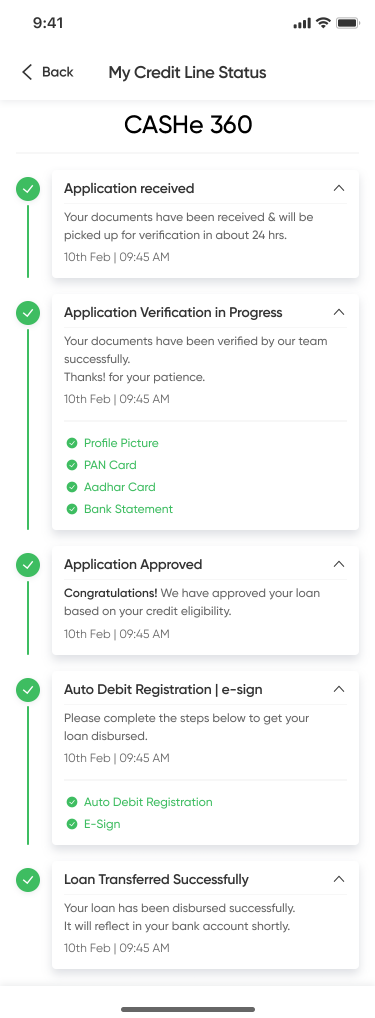

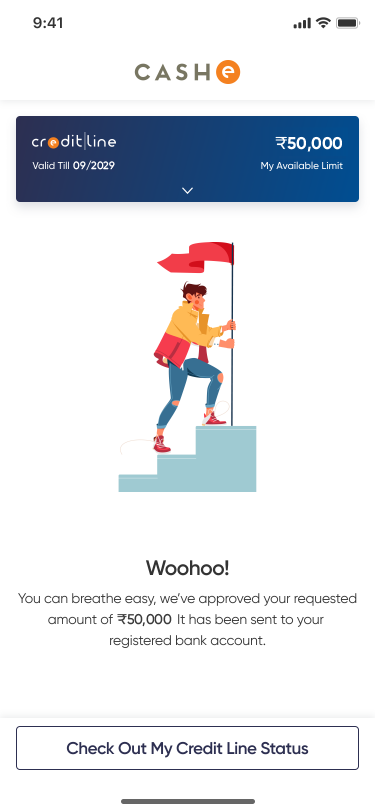

Wait no more to make your home the beautiful space it used to be – CASHe offers an easy home renovation loan that you can avail of within 24 hours.

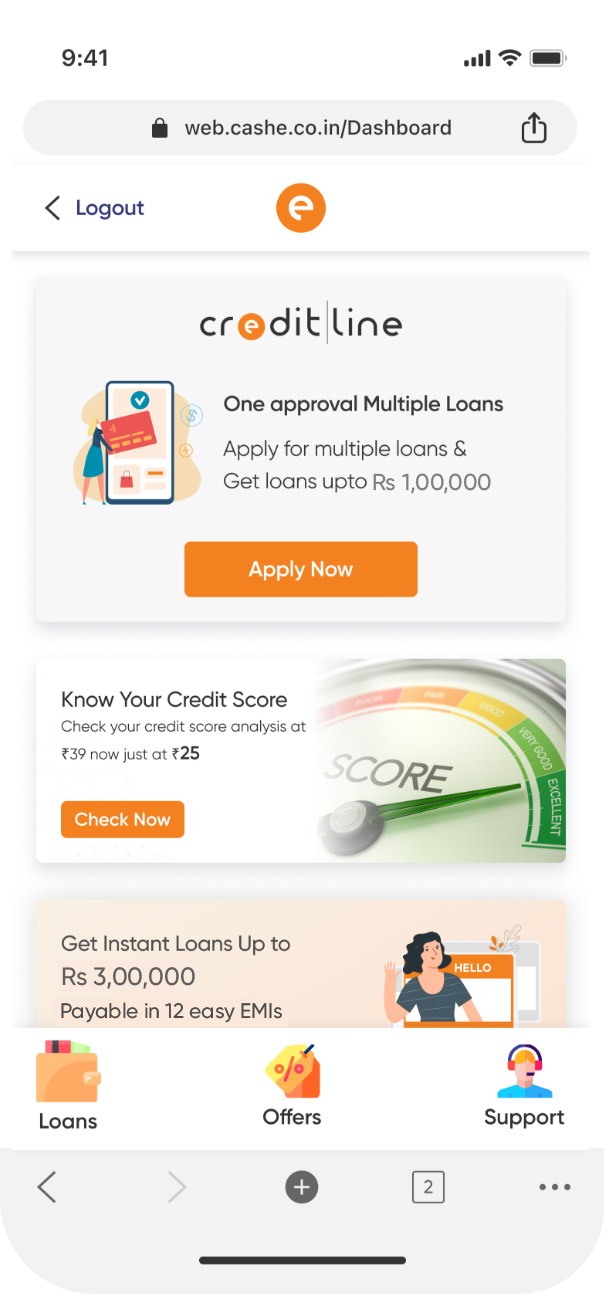

Today, many lenders in India offer home renovation loans. However, in most cases, you may have to wait for a few days for the loan amount to be disbursed to your account. On the contrary, at CASHe, the home renovation loan amount is disbursed within 24 hours of application. So, you can now avail instant personal loans at CASHe and take advantage of our affordable home renovation loan interest rates.

Uses of Home Renovation Loan –

The home renovation loan amount can be used for expenses related to internal and external home renovations. This includes painting, whitewashing, tiling, flooring, waterproofing, plumbing, sanitary work, etc.

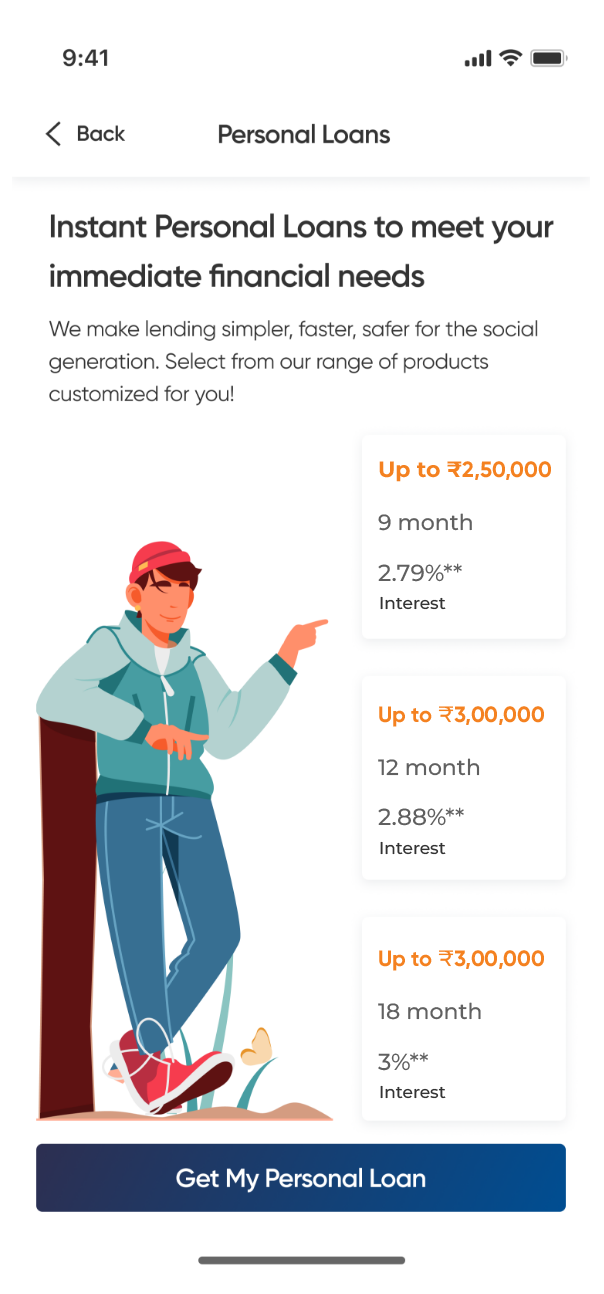

Home Renovation Loan Interest Rate –

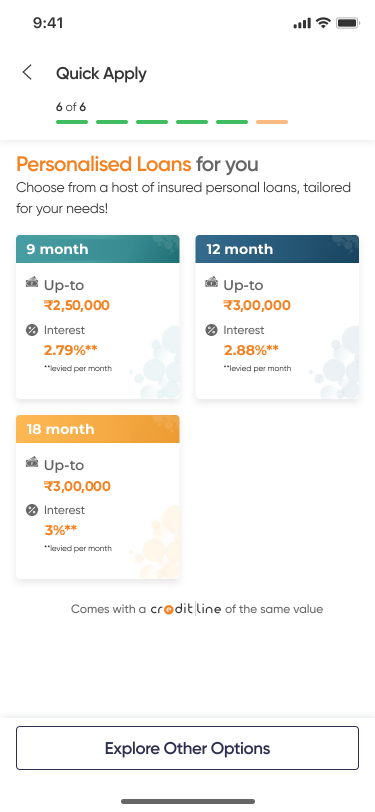

The home renovation loan interest rate at CASHe is calculated on a per-month basis for the amount. The home renovation loan interest rate ranges from 2.79% up to 3% (reducing balance interest) on the entire home renovation loan amount. You will also get a 5-day interest-free grace period to pay your home renovation loan EMI at the end of every month. Any subsequent delay in EMI payment will result in a 0.1% interest fee penalty per day.

Additionally, we also levy a plain processing fee of 2.5% based on the home renovation loan product you are eligible for.

Tips for Successful Home Renovation Loan Application –

In order to make sure that you get your home renovation loan from CASHe easily, you need to keep a few things in mind:

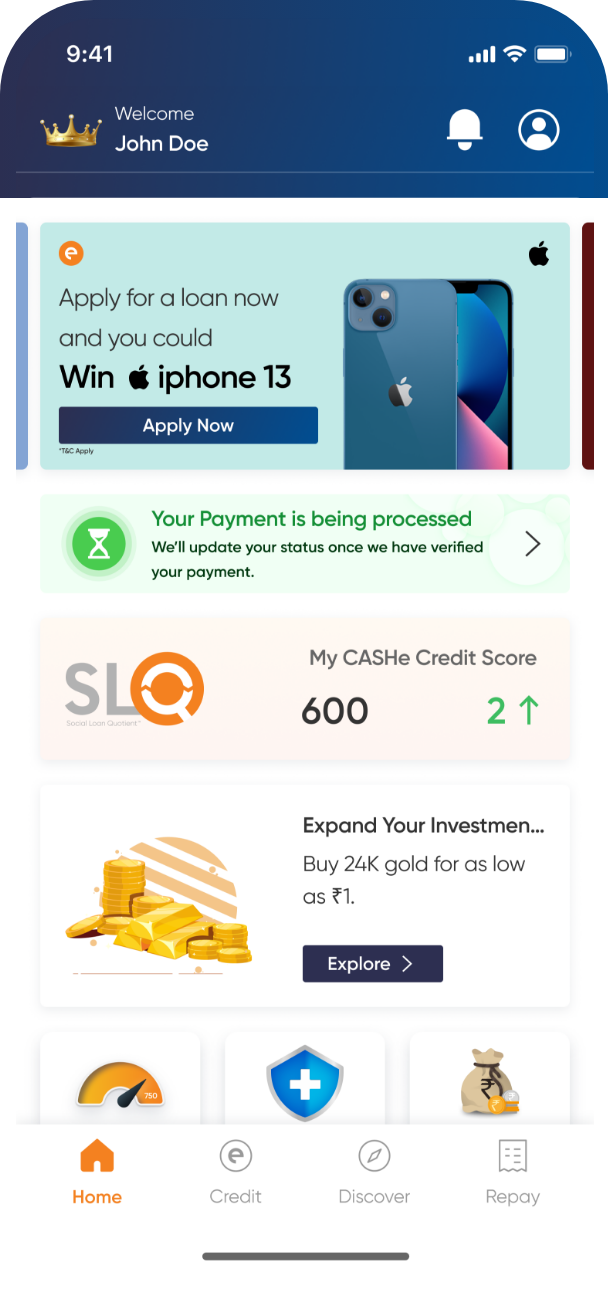

- Ensure that you have a clean credit history with banks and other lending institutions. This is important as your previous credit score will have a direct implication on the scores generated by CASHe on the SLQ.

- You must upload all the necessary documents in clear and legible formats to ensure that your home renovation loan is approved in the quickest possible time.

- Only apply for a loan amount that you can pay back.