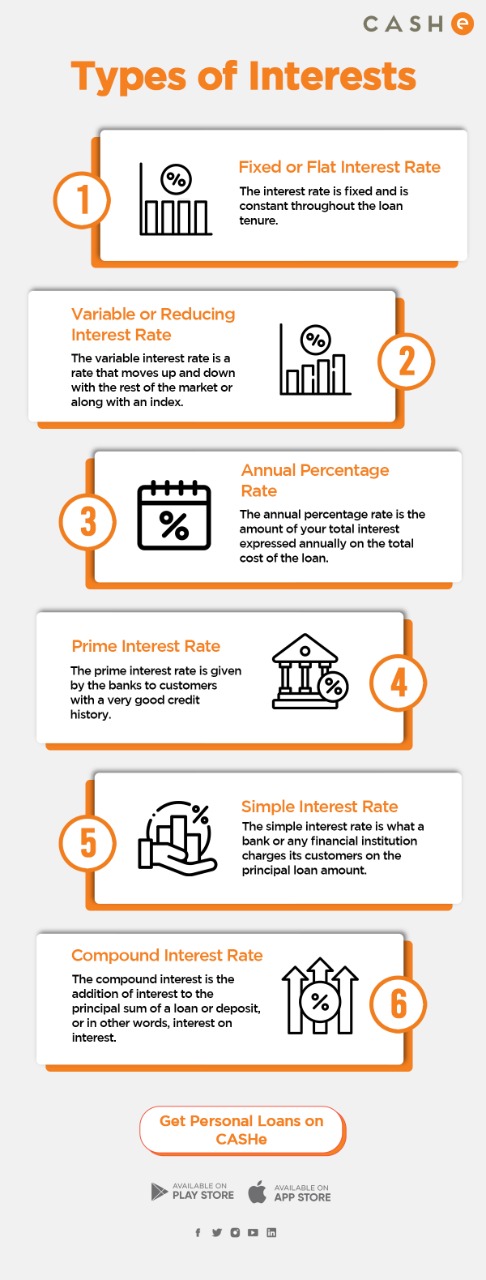

What is an Interest Rate?

An interest rate is a certain amount charged on the principal amount by the lender. There are numerous types of interest rates and it is vital you know and understand these types.

Why is Interest Charged on Loans?

Borrowers pay interest in the return for gaining additional funds. Also, interest is charged because while the borrower has the money, inflation can reduce the real value or purchasing power of the loan.

FAQs

Which type of interest is better?

It depends on the type of loan you are applying for. A fixed rate is generally preferred since the interest rate remains constant.

How much interest does CASHe charge?

CASHe charges a standard 2.50% interest rate per month on the loan amount.

Does the interest rate increase with the increase in the loan amount?

The interest rate might not increase with the increase in the personal loan amount but your credit score will have an impact on the interest rate.

What is the easiest way to calculate the interest rate?

Simple interest is the easiest and quickest way to calculate the interest charged on a personal loan.