When you invest in stocks or mutual funds, you do it with the aim of growing your money. Though investment in itself is a risky business, you would not want to lose your hard-earned money to scammers.

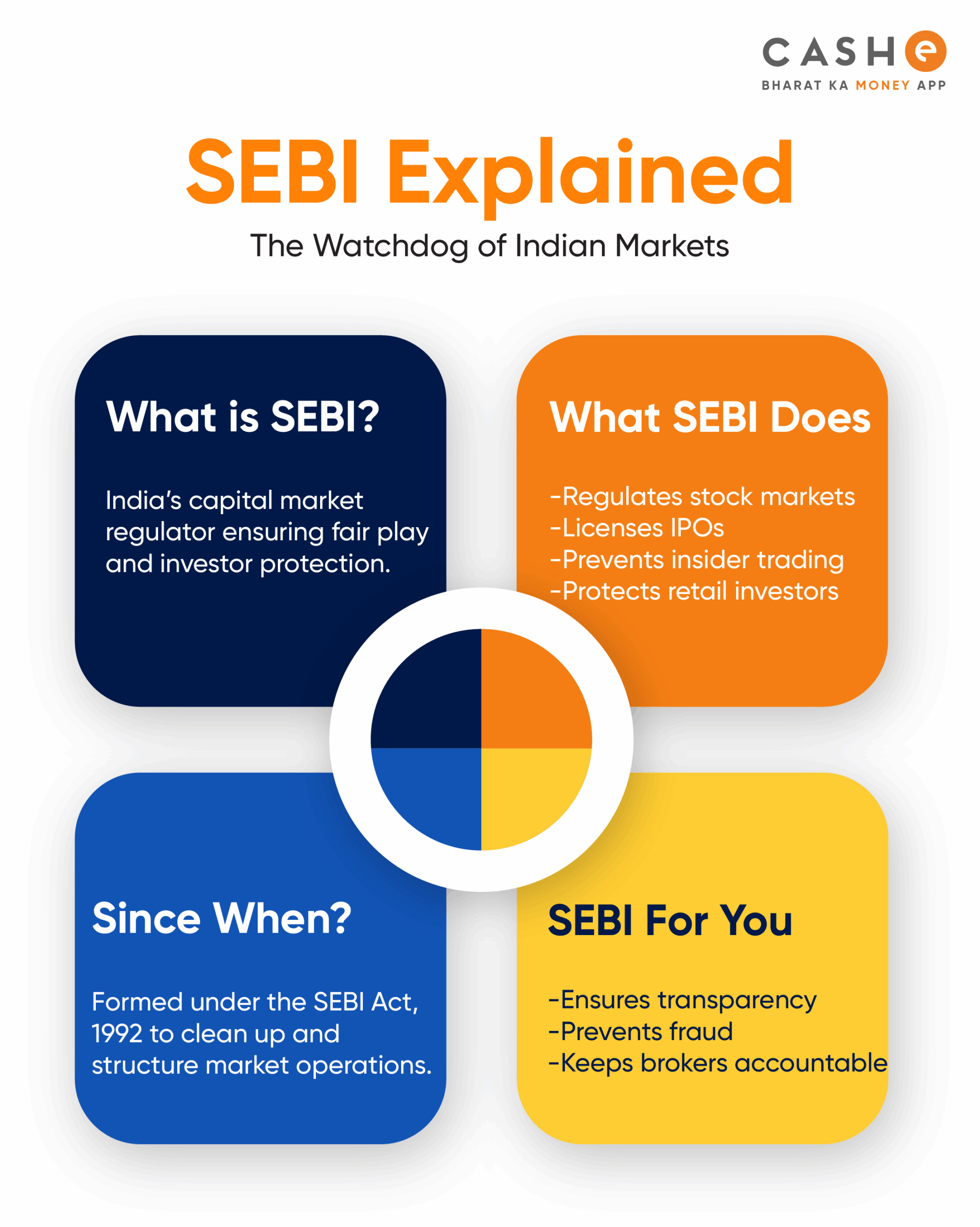

So, to keep everything in check and protect investors, every country has a powerful system in place to watch over the market. In India, it is handled by the SEBI – Securities and Exchange Board of India. This organisation watches over the stock market and protects investors.

Let’s learn more about what SEBI is in the following read and understand why SEBI was created, how it impacts the stock market, SEBI rules and regulations, and how it keeps investors safe.

What is SEBI?

SEBI stands for Securities and Exchange Board of India. It is a government body that controls and looks after the stock markets in India. SEBI makes sure that all investors, companies, brokers, and every entity involved in the market follow fair practices and abide by all rules and regulations. In other words, it is the watchdog of the Indian stock market. SEBI watches the markets closely so that no one cheats or misuses investor money.

History and Formation of SEBI

Let’s first understand about SEBI history and formation, before we move on to other aspects.

So, in the 1980s, when the Indian stock market was growing, it also encountered many problems such as stock scams, cheating, and the involvement of fake companies. People were losing their money due to a lack of proper regulation. So, in 1988, the government formed SEBI to keep an eye on things. However, the board did not have much legal power at that time. Later, in 1992, the Indian Parliament passed the SEBI Act, and this gave SEBI full authority to make rules and take action when needed. This also made SEBI the official regulator of India’s stock market.

Key Functions of SEBI

SEBI has many significant functions to take care of. It does several important things to make sure the financial market runs smoothly. Here are the key functions and powers of SEBI:

- SEBI protects investors and ensures that investors do not get cheated and that companies give complete and correct information.

- It regulates the market, along with setting rules for everyone, including investors, brokers and companies.

- SEBI watches out for malpractices like insider trading, price rigging and fraud. It can take strict action if anyone breaks the law.

- SEBI also registers brokers, advisors and other market players.

- Along with all this, it conducts awareness programs and workshops to teach people about safe investing.

SEBI’s Role in Investor Protection

As mentioned earlier, one of SEBI’s biggest responsibilities is to protect investors. Many people put their life savings into shares and mutual funds. SEBI, hence, works to make sure their money is safe. And it does the same in the following ways:

- Before companies can sell shares to the public, they must follow SEBI’s rules and share complete and honest information.

- SEBI bans unfair trading and keeps a check on people who try to use insider information or manipulate prices unfairly.

- Investors can file complaints through SEBI’s online platform.

Major Regulations by SEBI

Over the years, SEBI has created many important rules and regulations to keep the market safe and trustworthy. Some of the major SEBI rules and regulations include:

- Stop people from using secret company info to make unfair profits.

- Make companies share regular updates with investors.

- Ensure mutual fund houses manage your money responsibly.

- Set rules for companies planning to take over other businesses to protect small shareholders.

- Controls how companies buy back their shares.

SEBI’s Impact on the Indian Stock Market

Here’s how SEBI impacts the Indian stock market:

- Increasing Transparency: SEBI ensures that companies regularly share important updates. This helps investors make better decisions.

- Reducing Scams: With strict checks and quick action, scams have certainly gone down.

- Build Investor Confidence and Global Trust: More people now feel safe while investing, as they know SEBI is watching.

Conclusion

Now that you know that SEBI plays a huge role in keeping the stock market safe and fair, you do not need to worry about falling victim to scams or unfair practices while investing in the market.

Meanwhile, if you need a quick loan for immediate expenses or emergencies, download the CASHe app. CASHe offers instant personal loans of up to ₹3 lakh online at competitive interest rates. Just download the CASHe app, apply and get your loan approved within minutes.