Sometimes, the things we wish to buy cost more money than how much we can pay at once. That’s when we think of taking a loan or credit and buying things on EMIs. But before giving the loan, the bank or lender usually asks us to pay a small part of the amount. This first payment is called a down payment.

In this blog, we will explain in detail what is down payment, how down payments work, the types of down payments, and more. We will also learn how much you should pay and how a down payment affects your monthly loan payments.

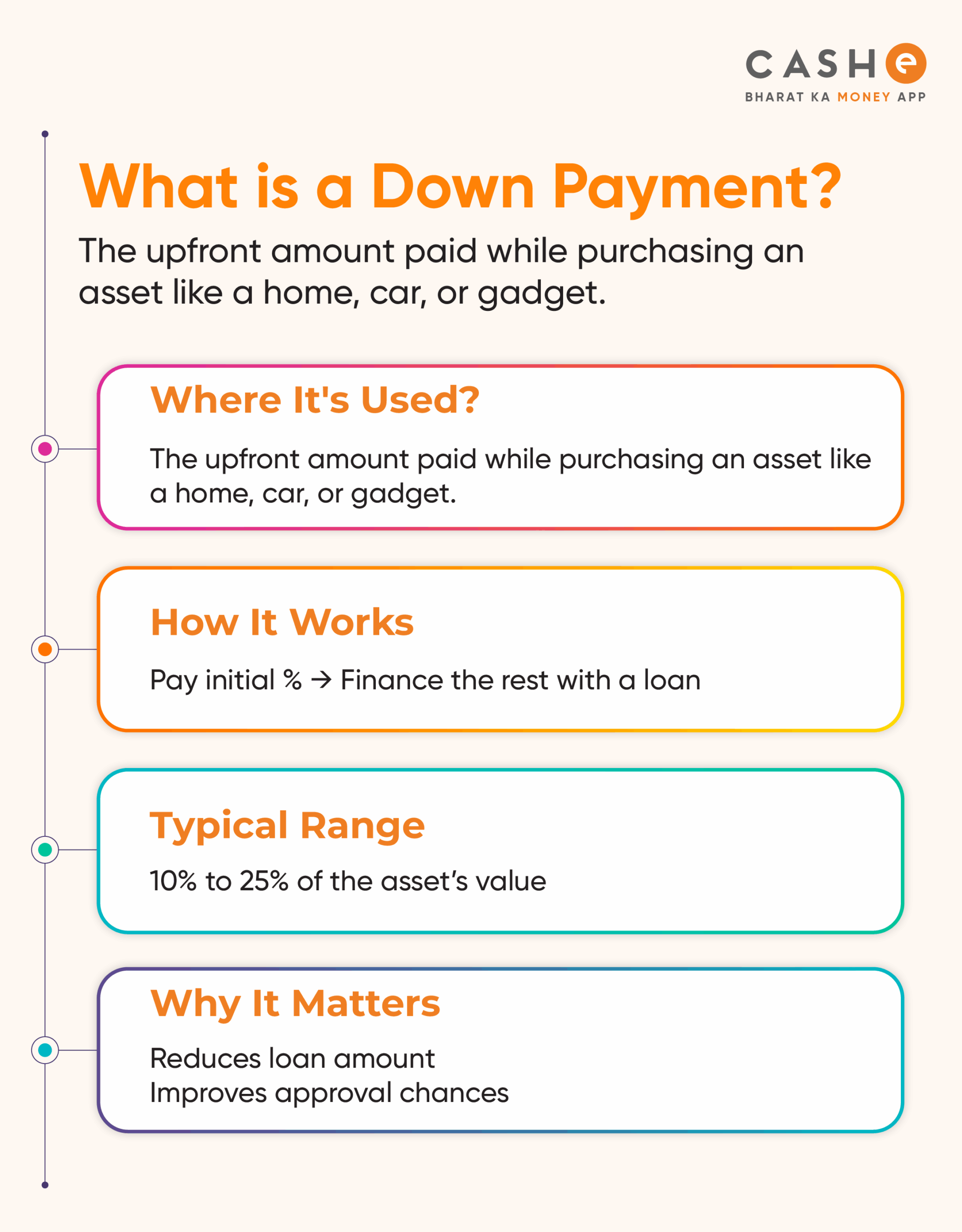

What is a Down Payment?

A down payment is the amount you pay upfront when you buy something expensive on a loan, like a house or a car, on EMIs. With this, the lender is sure about your purchase.

For example, if you are buying a car worth ₹20 lakh and you pay ₹5 lakh from your savings, then this ₹5 lakh is your down payment. The remaining ₹15 lakh will come from a car loan that the lender would provide you with.

How Do Down Payments Work?

There is no complex mechanism to understand how down payments work. First, you choose what you wish to buy. It could be a car, a house, or anything else. Now, you calculate and check how much money you can pay from your savings. You can pay this amount from your pocket as a down payment and take the remaining amount as a loan. Then you repay the loan in monthly EMIs.

Down Payment Example

Suppose you want to buy a house that is priced at ₹50,00,000, and the down payment you need to pay is 20%.

Now, the down payment (20%) is ₹10,00,000.

And the loan amount will be ₹40,00,000.

So, you pay ₹10 lakh right now and take a home loan for ₹40 lakh, which you would repay every month through EMIs.

That’s how a down payment on a home loan works.

Types of Down Payments

There are different types of down payments, based on what you buy:

- Home Purchase Down Payment: When you take a home loan, you need to pay a part of the house cost first. In India, banks usually ask for 10% to 25% of the total price.

- Auto or Vehicle Purchase: When you buy a bike or car on loan, you need to pay a small part of the price upfront. It is usually around 10% to 20% of the total cost. It also depends on your credit profile and the vehicle you buy.

- Gold Purchase: If you want to buy gold on EMI, you may need to make a down payment first. This can be a fixed amount or a small percentage of the total gold price.

What is a Down Payment Calculator?

A down payment calculator is a simple tool that helps you know how much money you should pay upfront and how much loan you would need. Overall, it estimates your monthly EMI for a loan or credit.

To use the down payment calculator, just enter the price of the house or car, the percentage of down payment, and your loan duration. The calculator does the rest.

Pros and Cons of a Larger Down Payment

Here’s what happens when you pay a bigger down payment:

| Pros | Cons |

|---|---|

| You only require a smaller loan | You need to spend more savings |

| You have lower monthly EMIs | May impact your emergency funds |

| Better chance of loan approval | May delay your purchase |

| You pay less interest during the loan period | You have less money left for other needs |

Pros and Cons of a Smaller Down Payment

Now let’s look at what happens when you pay a smaller down payment:

| Pros | Cons |

|---|---|

| Easy to manage upfront cost | You will need a bigger loan amount. |

| You can make the purchase quickly | Higher EMIs |

| You have more savings in your hands | More interest during the loan period |

How Much Should You Put Down as a Down Payment?

Well, there is no fixed answer to this question. But as per experts, it is suggested to pay about 20% of the total value for a home purchase and about 10% of the total value for a car and other purchases. You can always use a down payment calculator online for help.

Tip: Do not use all your savings for the purchase.

Also Read : How to Repay Your Personal Loan In TimeConclusion

So, these were the fundamentals of a down payment. Whether you are buying a house, car, or anything else, make sure you always plan your down payment wisely.

Now, if you need quick money for a down payment or personal use? Download the CASHe app. With CASHe, you can get quick loans of up to ₹3 lakh. Apply on the CASHe app and get approved for a loan within a few minutes.