Banking and codes go hand in hand. These little codes are responsible for carrying out big roles. They work in the background to make your banking smooth and safe. One such important code is the MICR Code. This code is printed at the bottom of a cheque and conveys a certain meaning. In this blog, we will learn everything about what MICR Code is in detail.

What Is the MICR Full Form In Banking?

The full form of MICR is Magnetic Ink Character Recognition. It is a special technology used by banks to help in the fast and error-free processing of cheques. The MICR code is printed using magnetic ink, and this allows machines to read it even if the cheque is folded or has marks on it. This, eventually, makes cheque processing quick and secure.

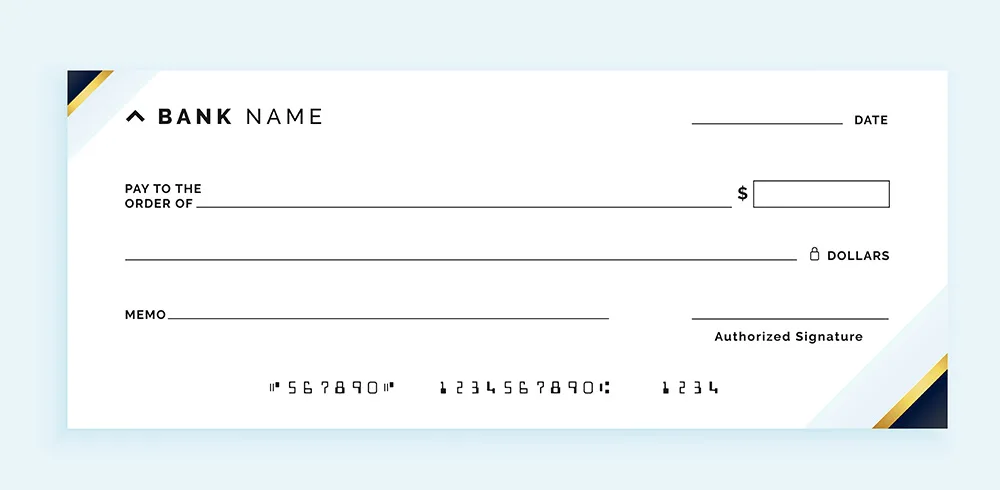

So, next time, if you notice a set of numbers printed at the bottom of a cheque, that’s the MICR code!

Characteristics of MICR Code

The major features of the MICR code include:

- It is a 9-digit code printed at the bottom of cheques.

- The code is printed using magnetic ink and not regular ink.

- Helps banks to process cheques automatically using machines.

- Each bank branch has a unique MICR code.

- It also helps in identifying the location of the bank branch.

Now that you know what MICR code is, let’s see how it’s formatted.

MICR Code Format

The MICR code format is quite simple and always follows a 9-digit structure:

- The first 3 digits represent the city code.

- The next 3 digits refer to the bank code.

- The last 3 digits indicate the bank branch code.

This format is used as it helps banks quickly find the cheque’s origin.

Importance of MICR Code in Banking

So, what is the MICR no. and why is it important? Here’s your answer:

- MICR speeds up cheque clearing as the machine reads the code instantly.

- It reduces human error as machines are involved in the process. Hence, there is less chance of mistakes.

- MICR codes also facilitate quick payments as your cheque can clear even within 24 hours.

- It also improves security as magnetic ink makes it harder to tamper with the cheque.

Where Can I Find the MICR Code?

You can find the MICR number in the following ways:

- Cheque Book: At the bottom of every cheque.

- Passbook or Account Statement: Usually mentioned along with your bank details.

- Bank’s Official Website: You can search for the MICR code by branch name.

- Internet Banking: Log in and check your account information section.

Applications of MICR Code

The MICR code has numerous use cases, and here are a few important ones:

- The main use of the MICR code is in cheque clearance.

- It is also used when payments are processed in bulk, like salaries or pensions.

- It is also helpful in loan processing to verify bank details.

Benefits of MICR in Banking

The significant benefits of MICR in banking include:

- Faster processing of cheques

- Higher accuracy due to machine-based reading

- Reduced fraud because of magnetic ink

- Easy tracking of cheques by location and branch

- Smooth ECS (Electronic Clearing Services) transactions

Difference between the IFSC Code and MICR Code

IFSC stands for Indian Financial System Code and has 11 characters used in NEFT, RTGS, and IMPS methods. On the other hand, MICR Code stands for Magnetic Ink Character Recognition and is a 9-digit number used on cheques. While the IFSC Code is used for online transfers, the MICR Code is mainly for cheque clearing.

Also Read : What is IMPS | What is NEFTConclusion

This is why MICR has become a significant part of modern banking systems. It plays a major role in cheque processing and smooth banking.

Speaking of smooth banking, if you ever need funds quickly without the hassle of paperwork, CASHe offers instant personal loans of up to ₹3 lakh. Download the CASHe app, apply online and get the loan approved in minutes.