The Indian government has launched many schemes in the past for the welfare of the country and its people. These schemes do not just focus on the basics of food and housing but also on education and savings. One such popular scheme launched to help those working in the unorganised sector is the Atal Pension Yojana (APY).

This scheme is designed to improve the lives of farmers, labourers and small shop workers & owners. But how exactly does Atal Pension Yojana help? Let’s find out in detail with the following read. In this blog, we will discuss what the Atal Pension Yojana is, the Atal Pension Yojana registration process and other relevant details.

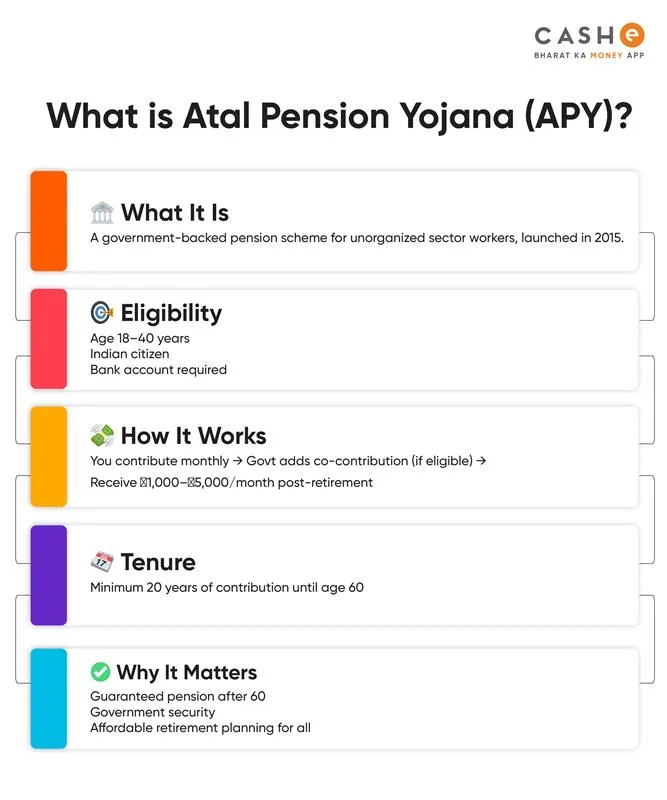

What is Atal Pension Yojana (APY)?

Atal Pension Yojana is a welfare scheme by the Government of India, and it aims to help people get a fixed monthly income or pension after they turn 60. The scheme started in 2015 and is managed by the Pension Fund Regulatory and Development Authority (PFRDA).

Once you become a part of the scheme, you will get a guaranteed pension of ₹1,000, ₹2,000, ₹3,000, ₹4,000 or ₹5,000 every month after you retire at 60. The amount you receive will depend on your contributions and your age of joining the APY. The scheme is mainly for those who do not get any pension from their job, especially those in the unorganised sector.

Objective of the Atal Pension Yojana Scheme

The major goals of the Atal Pension Yojana include:

- To provide social security.

- To support those who do not have any formal pension from their jobs.

- To provide a steady monthly income for old age.

- To promote awareness about pension schemes.

- To ensure everyone has a secure future.

Also Read : What is Subhadra Yojna

Also Read : What is Subhadra Yojna

Atal Pension Yojana Benefits

Here are some of the major Atal Pension Yojana benefits:

- You get a guaranteed pension between ₹1,000 and ₹5,000 every month after the age of 60.

- You can make a small contribution to the scheme to avail the benefits in old age.

- In the unfortunate event of a subscriber’s death, the spouse continues to receive the pension.

- If both the subscriber and the spouse die, the pension amount is given to the nominee.

- If the subscriber dies, the pension continues for the spouse.

- You do not have to visit any office to submit the amount as the bank auto-debits the contribution amount.

Atal Pension Yojana Eligibility Criteria

There are certain conditions you need to fulfil to join the Atal Pension Yojana scheme. Here’s the eligibility criteria:

- Must be an Indian citizen.

- Must not be an income taxpayer.

- Your age should be between 18 and 40 years.

- You must have a savings account.

- You should not be part of any other social security scheme like EPF.

What is the Procedure for Opening an APY Account?

There are two ways for Atal Pension Yojana registration: Online and Offline.

Atal Pension Yojana Online Application:

Step 1: Visit your bank’s website, provided they offer an online Atal Pension form facility.

Step 2: Fill out the application form by providing details like savings account number, Aadhaar number, contact details, etc.

Step 3: Complete the KYC process.

Step 4: Select your desired pension amount (₹1000, ₹2000, ₹3000, ₹4000 or ₹5000)

Step 5: Submit the application form.

Step 6: Post verification, your APY account will be opened.

Atal Pension Yojana Offline Application:

Step 1: Visit your bank or post office branch.

Step 2: Collect the Atal Pension form and provide the required details.

Step 3: Submit the form.

Step 4: Your APY account will be opened post verification.

Note: You would be provided with a PRAN number through which you can manage and access your APY account.

How To Download the APY Form?

You can get an APY form directly from your bank or post office. To download it online, here are the steps involved:

Step 1: Go to the official website https://www.npscra.nsdl.co.in.

Step 2: Select “Atal Pension Yojana” from the drop-down menu of the “Home” tab.

Step 3: Go to “Forms” >> APY subscriber registration form.

Step 4: Download the form.

How to Contribute to Atal Pension Yojana?

Once your APY account is opened, your selected contribution will be auto-debited every month from your savings account. You can choose to pay monthly, quarterly or half-yearly during the application process.

Withdrawal Procedure of APY

Once you join the APY scheme, you need to submit the “account closure form” to your bank or post office to close it. You can also exit it in special cases like death or serious illness. After 60 years of age, you start getting a pension.

Fees and Charges Related to the Maintenance of APY Account

There are only minimal charges for an APY account maintenance.

| Fees & Charges | Amount |

| APY account opening | ₹15 |

| APY annual maintenance charge | ₹20 |

| Account downgrade or upgrade charges | ₹25 |

| Late payment penalty | ₹1 for every ₹100 of the contribution amount |

Tax Benefits for APY Subscribers

- The money you put into APY is eligible for tax benefits under Section 80CCD(1) of the Income Tax Act.

- You can claim deductions up to ₹1.5 lakh per year.

Other Important Facts about APY

- You can change your APY pension amount only once a year.

- If you do not pay on time, your account might get frozen (after 6 months) or closed (after 24 months).

- You can always check your Atal Pension Yojana details online or through your bank.

Conclusion

The Atal Pension Yojana is a great way to plan for the future, especially for those who work in the unorganised sector and do not have a formal pension from their job. With just small monthly contributions, you can secure your retirement age.

Meanwhile, if you are looking for urgent funds, download the CASHe app. CASHe offers instant personal loans of up to ₹3 lakh at a competitive interest rate. You just need to apply online and get the loan approved in minutes.

Also Read: What is Ladli Behen Yojna