Saving money is something we all think about, whether we need it for emergencies, travel, or other future goals. But the question is: where should you save so that your money grows safely? Banks today offer different savings options under various types of bank accounts, and two of the most trusted ones are Fixed Deposits (FDs) and Recurring Deposits (RDs). Both are easy, safe, and come with guaranteed returns. But if you are confused and still wondering about FD or RD, which is better, then here’s the guide for you.

In this blog, we will discuss the difference between FD & RD. Let’s get started.

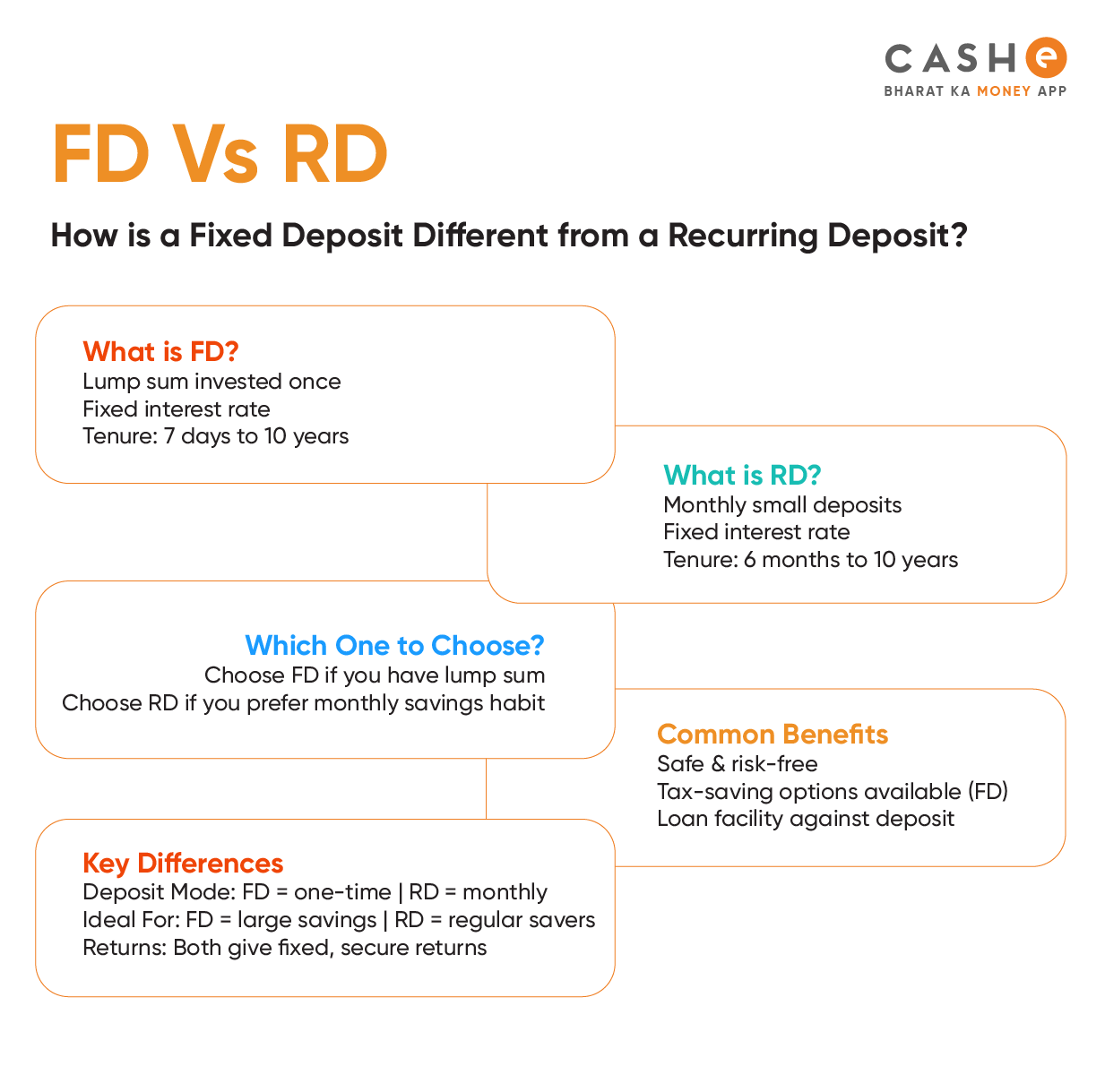

What is a Fixed Deposit (FD)?

As the name suggests, a Fixed Deposit or FD is an investment where you put a lump sum of money for a fixed period. This period could be 1 year, 2 years, 5 years, or 10 years. During this time, the bank locks this money and pays you a fixed FD interest rate. Your money is safe, and you get guaranteed returns.

Hence, it is one of the most popular and safest investment options in the country. However, if you want to withdraw the money before its maturity, you would need to pay a penalty fee.

What Is a Recurring Deposit (RD)?

An RD or recurring deposit is an investment where you do not put a lump sum amount in the beginning. Instead, you deposit a smaller fixed amount every month for a chosen period. The bank then pays you interest (RD interest rate) on your deposits.

If you are a salaried person or do not have enough money to invest, an RD is a great option for you. It does not just grow your money but also helps you build a savings habit. Once it matures, you get back all the money along with interest.

Head-to-Head Comparison: FD vs RD

Here’s the comparison table between fixed deposit and recurring deposit for your reference:

| Feature | Fixed Deposit (FD) | Recurring Deposit (RD) |

| Investment type | One-time lump sum investment | Small deposits every month |

| Interest Rate | The FD interest rate is slightly higher | The RD interest rate is usually a bit lower |

| Tenure | 7 days to 10 years | 6 months to 10 years |

| Returns | Higher | Slightly lower |

| Liquidity | Withdrawals are available with a penalty | Withdrawals are available with a penalty |

| Best For | People with huge savings | People with regular income and savings |

| Loan Facility Available | Yes | Yes |

Ideal Scenarios: When to Choose FD vs RD

If you are still confused about FD or RD, which is better, then here’s the answer for you:

You must choose FD if:

- You are looking for safe and guaranteed returns.

- You have enough money or savings to invest it one go.

You must choose RD if:

- You want a safe investment with good returns.

- You do not have a huge amount to invest now.

- You are ready to invest a fixed amount every month.

Benefits of FDs

- Guaranteed returns

- No risk

- Flexible tenure options

- Higher FD interest rate for senior citizens

- Loan available against FD

- Good for lump sum investments

Benefits of RDs

- Perfect for beginners or salaried people

- Helps you build a regular saving habit

- No need for a big lump sum at the start

- Guaranteed returns, just like FDs

- Loan available against RD

Limitations to Consider

Both FD and RD have certain limitations:

- The returns you get may not always beat inflation.

- You cannot make early withdrawals without penalty.

- Interest earned is taxable.

Drawbacks of FDs

- When you invest in FDs, your money gets locked for the chosen period.

- Even if interest rates go up later, your FD rate stays the same.

- It is not the best option if you need quick access to money.

Drawbacks of RDs

- Returns in RDs are usually a little lower than FDs.

- You must deposit every month without fail.

- If you close it before maturity, it would reduce your earnings.

Conclusion

Both Fixed Deposit and Recurring Deposit are safe and simple ways to save and grow money. Regarding investment, if you have a lump sum, an FD works best. If you want to save and invest small amounts monthly, an RD should be your option. Regardless, both are risk-free and offer good returns.

In case you are short on money and need quick funds, you do not have to break your FD or RD. You can get a CASHe Instant Personal Loan of up to ₹3 lakh. You can easily apply online using the CASHe app and get the loan approved within minutes.