The salary you get from your company comprises several components such as basic pay, travel allowance, and more. House Rent Allowance, or HRA, is one such important part of the salary. It is given to an employee to help them pay their house rent. It is a useful allowance as it can reduce your taxable income if you live in a rented house. That’s the reason many salaried employees in India get HRA.

In this article, we will learn the basics of HRA and understand everything about how it works, how to calculate it, and how to claim tax exemption.

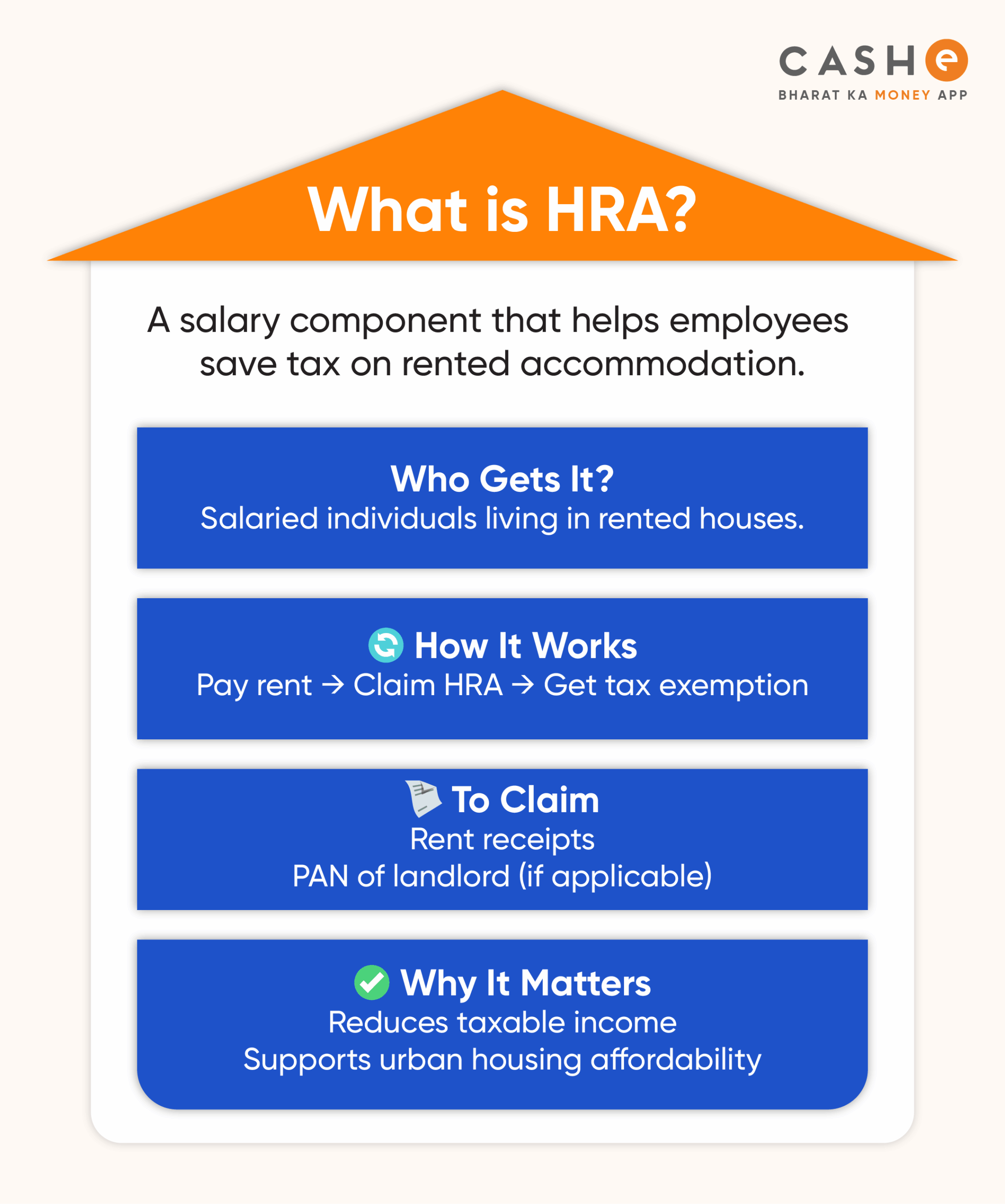

What Is House Rent Allowance?

House Rent Allowance (HRA) is a part of your salary and is paid to help you manage your house rent expenses. If you live in a rented house, you can claim tax exemption on HRA under Section 10(13A) of the Income Tax Act. For that, you would need to submit a valid rent proof.

If you do not live in a rented house, HRA is still a part of your salary. However, in this case, you cannot claim any tax exemption on it.

Why is HRA Important?

House rent is often a big chunk of a salaried employee’s expenses, especially in metro cities where the rent can be quite high. The HRA component in the salary can help ease this financial strain. Here are two significant reasons why HRA is important:

- HRA helps you pay your rent. If you are staying in a rented house, HRA makes it easier to handle rent expenses.

- It also saves tax as you can claim HRA exemption and reduce your taxable income.

Who Can Get HRA?

The answer to this question is simple – only salaried employees can get House Rent Allowance. However, to get HRA tax benefits, you must:

- Be a salaried person.

- Receive HRA as part of your salary.

- Live in a rented house.

- Have proof of rent payment.

Note: If you are self-employed, you cannot claim HRA exemption.

HRA Calculation: How to Calculate HRA Exemption?

Wondering how much you can claim as tax exemption under HRA? Well, it is the lowest of the following amounts:

- The HRA amount received from your employer.

- Rent paid minus 10% of your basic salary.

- 50% of basic salary (if you live in a metro city like Delhi, Mumbai, Kolkata, or Chennai)

- 40% of your basic salary (if you live in a non-metro city)

Example of HRA Calculation:

Let’s assume you live in Delhi and your basic pay is ₹30,000/month, the HRA received is ₹12,000/month, and the rent you pay is ₹10,000/month.

Based on these details, let’s calculate the HRA tax exemption:

- Actual HRA received = ₹12,000

- Rent paid – 10% of basic salary = ₹10,000 – ₹3,000 = ₹7000

- 50% of basic salary (since Delhi is a metro city) = ₹15,000

The lowest of these is ₹7000.

Hence, you will be able to claim ₹7000 per month or ₹84,000 per year as a tax exemption.

How to Claim HRA Exemption?

To claim HRA exemption, you need to submit rent receipts or a rent agreement to your HR or employer. However, keep in mind that if your rent is above ₹1,00,000 per year, you would also need to submit the PAN details of the landlord.

In case you missed submitting documents to your company HR, you can still claim HRA at the time of filing your Income Tax Return (ITR).

Note: HRA tax exemption is not available under the New Tax Regime.

Also Read – Best Ways to Save Income TaxConclusion

So, House Rent Allowance (HRA) is a very helpful part of your salary if you live in a rented house. It not only supports your rental expenses but also gives you a good tax benefit. Whether you stay in a metro or non-metro city, make sure you know how to calculate and claim HRA so you save more money.

Meanwhile, if you are looking for quick funds to cover your personal or emergency expenses, download the CASHe app. CASHe offers instant personal loans of up to ₹3 lakh at competitive interest rates. All you need to do is apply for a quick loan on the CASHe app, and you will get your loan approval within a few minutes.