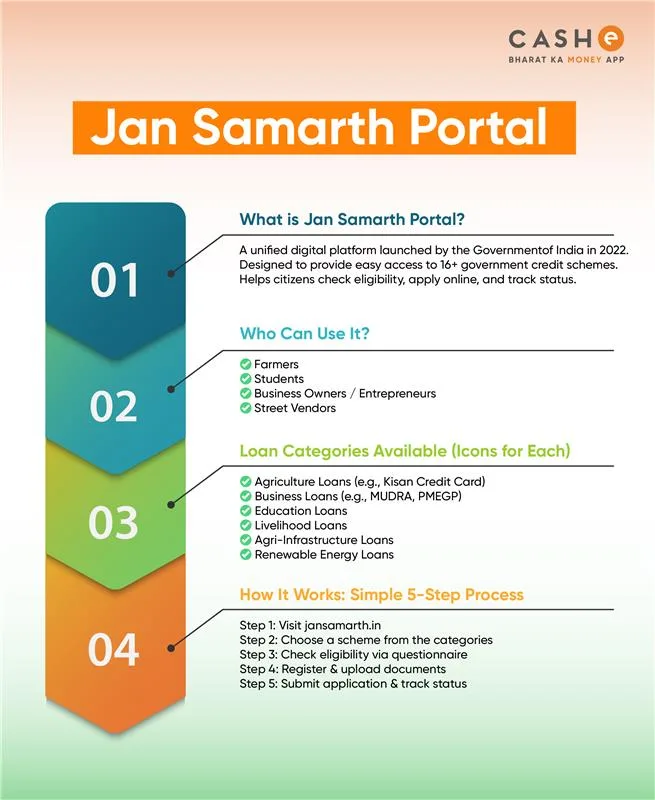

Back in the day, availing government loans wasn’t as easy as it is today. Earlier, people had to visit offices, stand in queues and fill out numerous forms to get a government loan or credit. However, now with the Jan Samarth Portal, the scenario has changed. The Government of India launched the Jan Samarth Portal in the year 2022 to help people get access to various government credit schemes. With this common platform, people can now apply for different government loan schemes easily from their phone or computer.

So, if you are someone who wants to take a government loan, then the Jan Samarth Portal can help you. Whether you are a farmer or a business owner, you can get loans on the portal in simple steps. Wondering how? Read on to learn everything you need to know about Jan Samarth Portal, including features, benefits, Jan Samarth Portal registration, Jan Samarth Portal login and more.

Key Features and Benefits of Jan Samarth Portal

Here are some of the significant features you should know about the Jan Samarth Portal:

- It is a perfect one-stop solution for those looking for government loan schemes in one place.

- You can check your eligibility easily by answering a few questions on the portal.

- Based on your details and requirements, the portal would automatically suggest the most suitable schemes for you.

- You can apply online from anywhere, anytime.

- You would need to upload your documents online.

- After applying, you can check if your loan is approved or not.

- The Jan Samarth Portal login is safe, and hence, you need not worry about the safety of your information.

- The portal is easy to use, even for first-timers.

List of Schemes Available on the Portal

As of now, the portal has 16 government schemes, divided into 6 loan categories, with 600+ lenders on the platform. These 6 categories are:

Renewable Energy Loan

If you want to install your own solar power system, this is the loan you can avail. However, make sure you have registered at pmsuryaghar.gov.in before applying for the loan. The scheme under this category is:

- Roof Top Solar Installation Financing (SOLAR)

Agriculture Loans

These loans are specifically for farmers. The schemes under this category are:

- Kisan Credit Card (KCC)

- Kisan Credit Card – Fisheries (KCCFIM)

Agri Infrastructure Loans

The schemes under this category are:

- Agri Clinics and Agri Business Centers Scheme (ACABC)

- Agricultural Marketing Infrastructure (AMI)

- Agriculture Infrastructure Fund (AIF)

Business Loans

If you are someone who wants to run a small or medium-sized business or expand an existing one, then you can avail the following schemes under this category:

Prime Minister’s Employment Generation Programme (PMEGP)

Weaver Mudra Scheme (WMS)

Pradhan Mantri MUDRA Yojana (PMMY)

Pradhan Mantri Street Vendor Aatmanirbhar Nidhi Scheme (PM SVANidhi)

Stand Up India Scheme

Self-Employment Scheme for Rehabilitation of Manual Scavengers (SRMS)

Also Read : What is Business LoanLivelihood Loans

This is to encourage livelihood opportunities for the poor. The scheme under this category is:

- Deendayal Antyodaya Yojana-National Rural Livelihoods Mission (DAY-NRLM)

e-KISAN Upaj Nidhi

This is for farmers who have their stocks kept at WDRA-registered warehouses. To avail this loan, the farmers need to pledge their electronic Negotiable Warehouse Receipts (e-NWRs) for the stocks stored. The scheme under this is:

- e-Kisan Upaj Nidhi (EKUN)

Who Can Use the Jan Samarth Portal?

Anyone looking for a loan can use the Jan Samarth portal, as it is for every citizen of the country. However, the person applying for it must check their eligibility under the required loan category.

Whether you are a farmer looking to buy machines for agriculture or a business owner looking to expand your business, you can use the Jan Samath Portal to avail a government loan.

How to Use the Jan Samarth Portal?

Just follow these simple steps to apply for a loan on the Jan Samarth Portal:

Step 1: Visit the website www.jansamarth.in.

Step 2: Go to the “Schemes” section and select the loan category you want to apply for.

Step 3: Check your loan eligibility.

Step 4: Based on your eligibility, the most suitable scheme will be suggested to you.

Step 5: Click on “Apply Now”.

Step 6: Next, the registration page will appear. Complete the Jan Samarth Portal registration by filling in the required details.

Step 7: Submit the loan application and note your application number.

Step 8: Check your loan status through the Jan Samarth Portal login.

Documents Required for Jan Samarth Portal Registration

The documents you may need to submit for your online Jan Samarth Portal registration include:

- PAN Card

- Aadhaar Card

- Voter ID

- Bank statements

Conclusion

Now that you know what the Jan Samarth Portal is, its loan categories and how to apply, avail the benefits today. Just register, log in and apply online.

Meanwhile, if you are unable to get a loan on the Jan Samarth Portal, worry not! CASHe is here to help you with instant personal loans of up to ₹3 lakhs. Download the CASHe app, apply and get the loan approved within a few minutes. CASHe offers Instant personal loans, travel loans, education loans, home renovation loans and more at competitive interest rates.

Apply now!