Education, in today’s life, is as important as the right to freedom. However, getting a good education can be costly. Many students in India dream of studying in good colleges or even abroad. But when it comes to arranging money for fees, books or accommodation, it becomes a challenge. That’s where the PM Vidyalaxmi Scheme comes in. This scheme offers a simple way to apply for an education loan online through the Vidyalaxmi Portal.

With the Vidyalaxmi portal application, students can apply to multiple banks for loans. In this guide, we will help you understand how this scheme works, its benefits, who can apply and more.

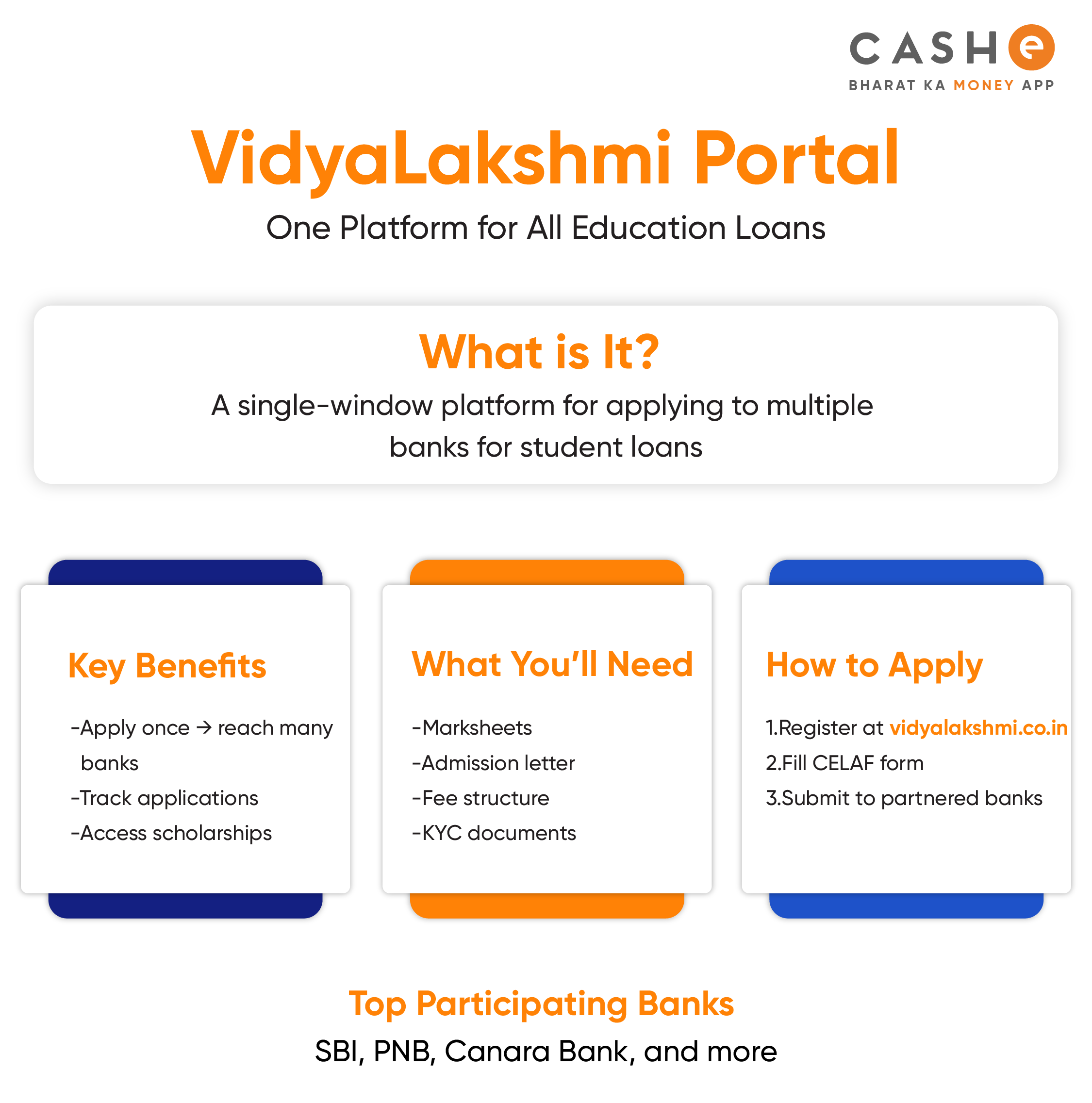

What is the Vidyalaxmi Scheme?

The PM Vidyalaxmi Scheme is a central scheme started by the Indian Government in 2024 to make education loans easier and more accessible for students. The scheme can be availed on the online platform called the Vidyalaxmi Portal. This portal allows students to apply for education loans online by connecting with multiple banks.

You need to fill out the Vidyalaxmi portal education loan application form called CELAF (Common Education Loan Application Form) to avail the loan. Applicants can also track their loan status anytime on the portal.

Benefits of Vidyalaxmi Portal

Here are the major benefits you can avail by using the Vidyalaxmi Portal:

- One form for all banks: Instead of visiting multiple banks and filling out different forms, you just need to fill out one form and send it to multiple banks.

- Time-saving process: As everything is online from registration to tracking your loan status, you do not need to stand in long queues or visit branches.

- Free Access: You do not need to pay any money for the Vidyalaxmi portal application.

- Transparency: You can check updates about your loan status and see if the bank has accepted or rejected it.

- Safe and secure: As the portal is managed by government agencies, it is reliable.

Eligibility Criteria For Vidyalaxmi Portal Application

Before you apply for an education loan through the Vidyalaxmi portal, make sure you check if you are eligible. So, here’s the eligibility criteria you need to fulfil:

- You must be an Indian citizen.

- You must have secured admission in a recognised college/university.

- You should not be benefiting from other government schemes.

- Your family should meet the bank’s income criteria.

How to Apply for an Education Loan via Vidyalaxmi

Here are the steps you need to follow to apply for an education loan via Vidyalaxmi Portal:

Step 1: Visit the portal: www.vidyalaxmi.co.in.

Step 2: Register yourself as a new user by filling in the required details such as name, number, email ID, etc.

Step 3: Once your account is created, log in to it using your credentials.

Step 4: Fill out the CELAF form wherein you need to provide personal details, family’s income, course details, college details, documents such as Aadhar Card, etc.

Step 5: Select the preferred banks. You can apply to up to 3 banks at the same time.

Step 6: Submit the Vidyalaxmi education loan application.

Note: You can track your application and check the loan status by logging into the portal anytime.

List of Partner Banks Under the Vidyalaxmi Scheme

The Vidyalaxmi Portal has tied up with about 38 well-known banks in India, and the list includes:

- State Bank of India (SBI)

- Punjab National Bank (PNB)

- Canara Bank

- Bank of Baroda

- Union Bank of India

- Central Bank of India

- HDFC Bank

- ICICI Bank

- Axis Bank

- IDBI Bank

- Kotak Mahindra Bank

- Bank of India

- Bank of Maharashtra

- Karnataka Bank Ltd.

- Indian Bank

- Yes Bank

So, you have plenty of options to choose from based on interest rates and repayment terms.

Common Application Mistakes

Mentioned earlier, the Vidyalaxmi portal is quite easy to use. However, there are small mistakes that you can avoid.

- Make sure to fill in all the details in the Vidyalaxmi education loan application form.

- Upload clear and correct documents, as incorrect files can lead to rejection.

- You can apply to 3 banks with a single form. So, do not miss this chance as more banks mean more chances.

- Enter your college or course name exactly as written in your admission letter.

- Log in regularly to stay updated.

Final Thoughts

The PM Vidyalaxmi Scheme is a great initiative by the central government to help students who want to study further and need financial support. If you are eligible, apply for the loan on the Vidyalaxmi Portal today.

But if you need quick money for fees or any urgency, download the CASHe app. CASHe offers instant personal loans of up to ₹3 lakh with fast approval within minutes. Apply on the CASHe app and get the money straight into your bank account.