When was the last time you forgot to use your account? Or for how long have you not used your bank account? If this time period is long, then there is a chance that your account may have become a dormant account. When your account has no activity or transactions, whether it is withdrawals or deposits, then your account is considered sleeping. In other words, it becomes dormant.

But what does this refer to? In this blog, we will explain the meaning of dormant accounts, when and why this dormancy happens, what problems it can cause and how to make it active again.

Definition of a Dormant Account

In simple words, a dormant account is a bank account that has not been used for a long time. It means that you have not added or withdrawn any money, have not used your ATM or net banking facilities or have not paid any bills through this account.

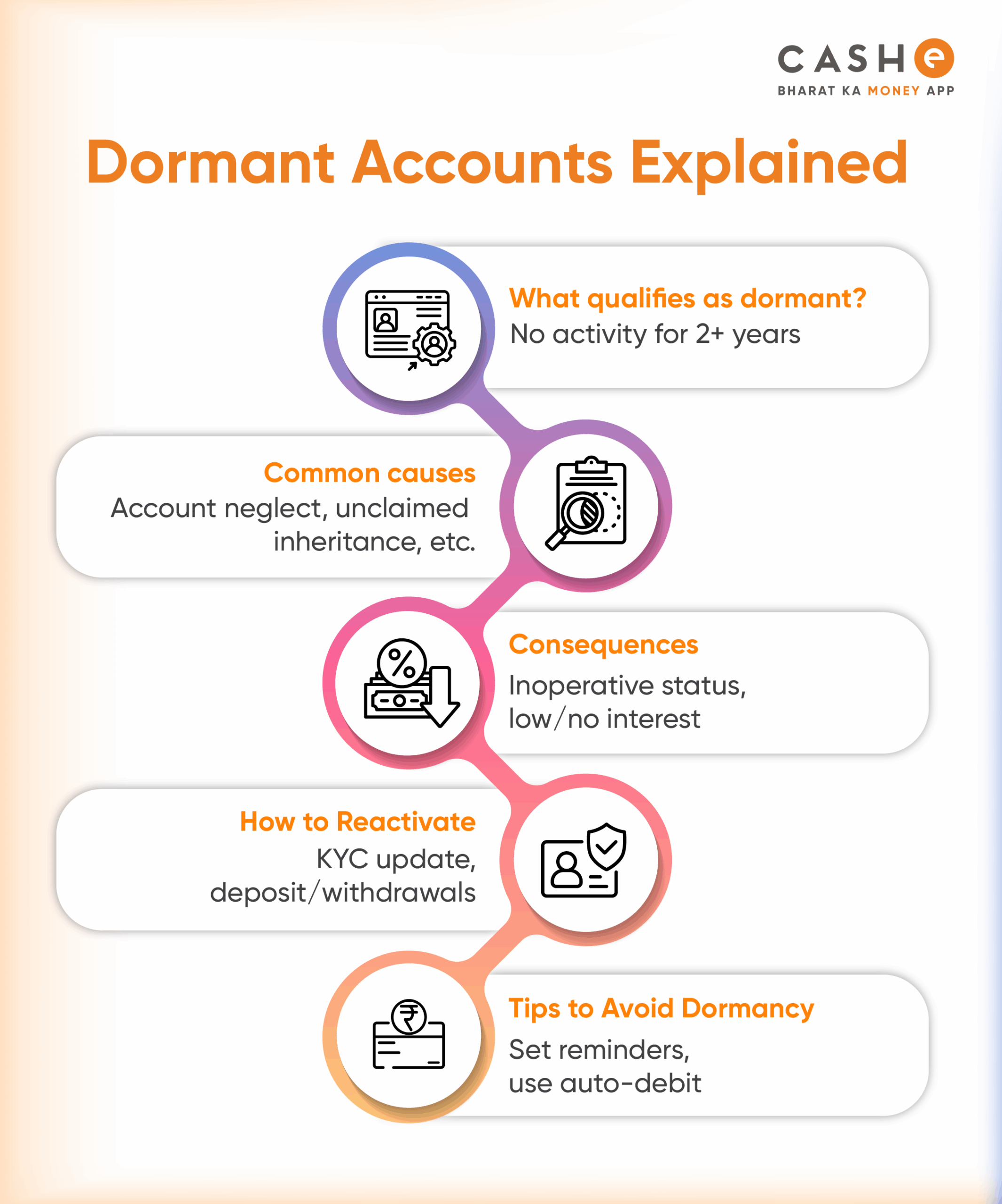

When Does an Account Become Dormant?

As per dormant bank account rules, your account usually becomes dormant if you have not done any transactions in any form for 2 years (24 months). Also, the last transaction must be done by you and not by the bank. So, if you last used your account in January 2023 and do nothing till January 2025, then your account may turn dormant.

Reasons for Dormancy

There are many reasons for a dormant account status. Here are some of the key ones:

- You opened a new bank account and forgot about it.

- Your salary stopped coming into the account when you changed jobs.

- You moved to a new city and stopped using your old bank account.

- The account holder passed away, and the family did not use the account.

Risks of Dormant Accounts

Now, you may think- what’s the big deal if you have stopped using your bank account? But be aware, as it can cause many consequences:

- You may not earn interest anymore.

- The bank may charge fees.

- You would not be able to use the ATM or UPI services until your account is active again.

- In the case of dormancy, it can be hard for family members to get money from the bank account if the account holder dies.

How to Reactivate a Dormant Account

If your account has become dormant, do not worry! You can make it active again easily. Here are the steps you need to follow:

Step 1: Visit your bank branch.

Step 2: Carry your ID proof like Aadhaar or PAN card.

Step 3: Fill out the account reactivation form given by the bank.

Step 4: Provide KYC documents, if needed.

Step 5: Do a small transaction.

Step 6: Your account will get activated again.

Tips to Prevent Dormancy

Here are some simple tips to stop your account from becoming dormant:

- Use the account often, even for small transactions or payments.

- Set a reminder every few months to use it.

- Keep your mobile number updated with the bank.

- Close accounts you no longer need.

Conclusion

Keep in mind the dormancy timeframe of 24 months. Make sure you follow the tips and prevent your account from becoming dormant. However, in case your account becomes dormant, you can always reactivate it by visiting your bank.

Now, if you are looking for quick cash for your urgent requirements, CASHe offers instant personal loans of up to ₹3 lakh at competitive interest rates. You can apply using the CASHe app and get the loan approved within just a few minutes.