When you run a business in India, you are bound to follow certain tax rules and regulations. One of these important rules is filing GST returns if your business is registered under GST (Goods and Services Tax). These returns help the government calculate your net tax liability. Whether your business is big or small, you must file GST returns on time. This helps maintain transparency and claim tax benefits. So, let’s learn everything about how to file GST returns online, including the filing process, types of GST forms, and more, with this brief guide.

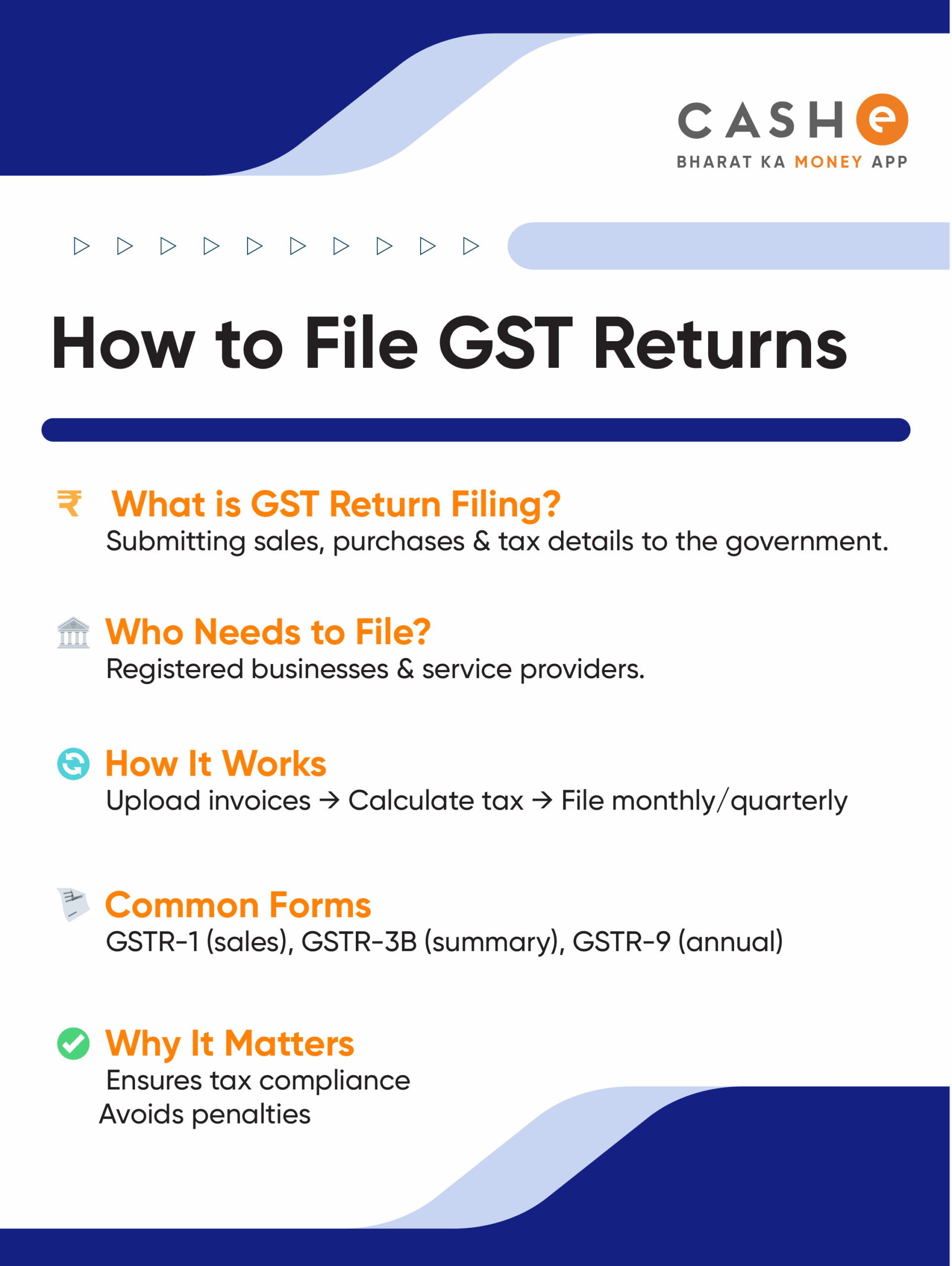

What is the GST Filing Process & Procedure?

In simple words, a GST return is a document that you submit to the government with details of all your business income, sales, expenses, and purchases. You also report any tax you collected and the tax you paid.

The GST return filing process includes:

- Reporting all sales and purchases.

- Claiming input tax credit (ITC) on your purchases.

- Paying the final GST.

- Submitting the return online on the GST portal.

Different Types of GST Return Forms

There are different GST return forms for different types of businesses:

| GST Return Form | Who Should File It | Frequency |

| GSTR-1 | Regular taxpayers | Monthly / Quarterly |

| GSTR-3B | Regular taxpayers | Monthly / Quarterly |

| GSTR-4 | Composition Scheme taxpayers | Annual |

| GSTR-5 | Non-resident foreign taxpayers | Monthly |

| GSTR-5A | OIDAR service provider | Monthly |

| GSTR-6 | Input Service Distributor | Monthly |

| GSTR-7 | Individuals required to deduct tax at source (TDS) | Monthly |

| GSTR-8 | e-Commerce operators liable for collecting tax at source (TCS) | Monthly |

| GSTR-9 | Regular taxpayers | Annual |

| GSTR-9C | All taxpayers | Annual |

Note: GSTR-2A and GSTR-2B are filed monthly and are auto-generated by the system.

How to File GST Return Online?

Here are the steps to file your GST return online:

Step 1: Go to the GST portal (https://services.gst.gov.in/services/login) and log in using your GSTIN and password.

Step 2: Fill in the details of the GST return filing period, including the financial year, period, and quarter.

Step 3: Click on “Search”.

Step 4: From the options, choose the form that fits your business, like GSTR-1, GSTR-3B, etc.

Step 5: Enter the details such as your sales, purchases, input tax credit, and tax payable.

Step 6: Review and submit.

Step 7: Go to “Payment of Tax” and pay the remaining tax, if any.

Step 8: Use your Digital Signature (DSC) or Electronic Verification Code (EVC) to finish filing.

Note: Make sure you have your GST Identification Number (GSTIN) handy.

Who Should File GST Return?

Wondering if you should file a GST return or not? Well, anyone who is registered under GST must file returns. This includes:

- Businesses (selling goods) with a yearly turnover above ₹40 lakhs.

- Businesses (providing services) with a yearly turnover above ₹20 lakhs (₹10 lakhs in some special states).

The list of these special states includes:

- Arunachal Pradesh

- Assam

- Sikkim

- Himachal Pradesh

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Tripura

- Uttarakhand

Note: You must file returns even if there was no business in a month. In this case, you need to file a Nil GST return.

Due Dates to File GST Return

It is important to file GST returns on time as this would help you avoid late fees. Below are the most common GST return due dates:

| Return Type | Due Date |

|---|---|

| GSTR-1 (monthly) | 11th of next month |

| GSTR-1 (quarterly) | 13th of the month after the quarter |

| GSTR-3B (monthly) | 20th of next month |

| GSTR-3B (quarterly) | 22nd or 24th of the month after the quarter |

| GSTR-4 | 30th June of the next financial year |

| GSTR-5 | 13th of next month |

| GSTR-5A | 20th of next month |

| GSTR-6 | 13th of next month |

| GSTR-7 | 10th of next month |

| GSTR-8 | 10th of next month |

| GSTR-9 and GSTR-9C | 31st December of the next financial year |

Note: GSTR-2A and GSTR-2B are auto-generated by the system.

Also Read : GST on Personal Loan

Conclusion

Now that you know how to file GST returns online, make sure you always follow the right steps and file your returns on time. With this, you would also be able to claim your input tax credit properly. Also, ensure you choose the right return form for your business.

Now, if you need quick money for business, education, travel, or home renovation loan, you can get an instant personal loan of up to ₹3 lakh from CASHe. Just download the CASHe app and apply for an instant loan to get it approved within minutes! It is 100% online and collateral-free.