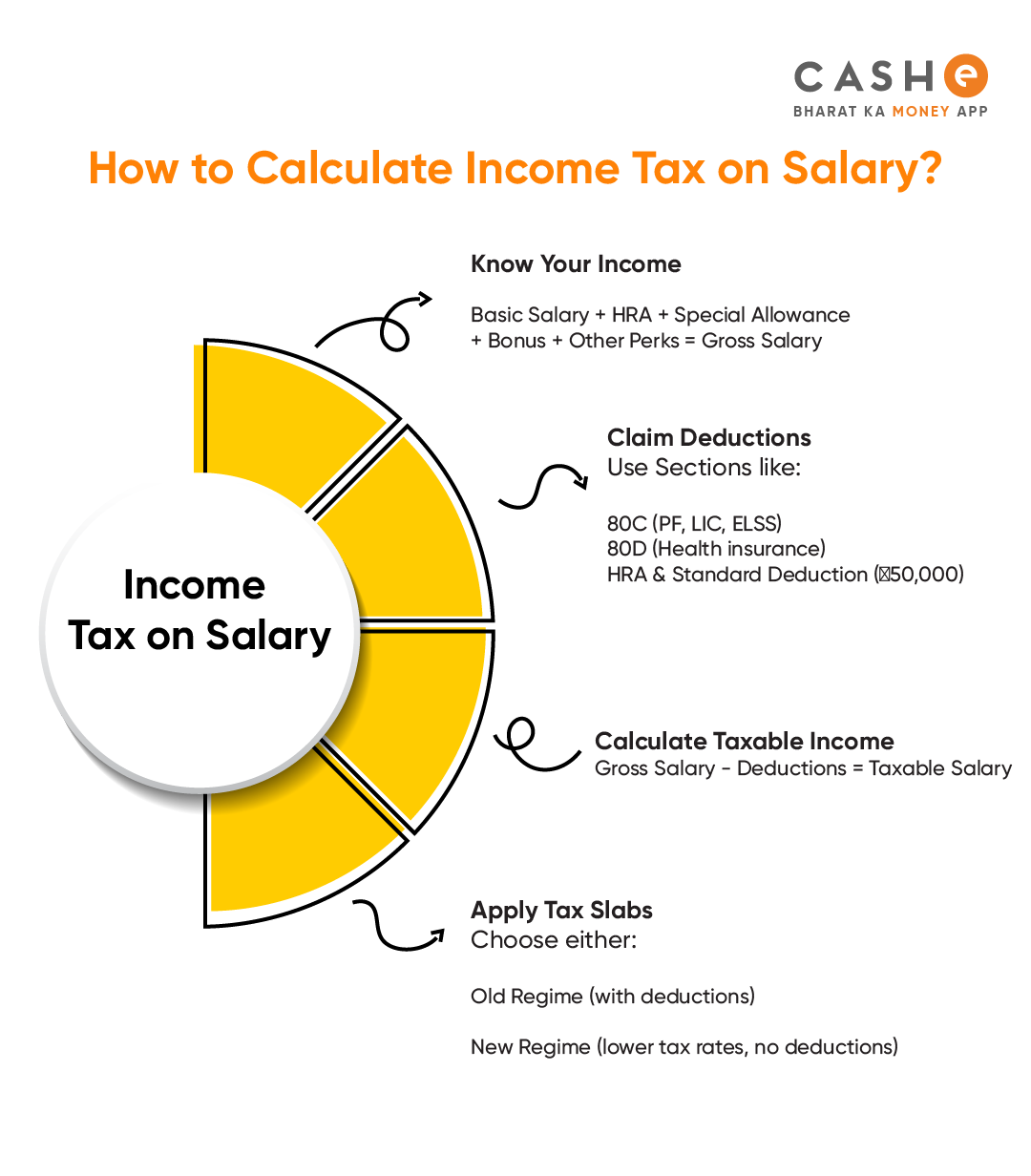

If you are new to income tax and are not aware of its fundamentals, including how to calculate your income tax, then here is the read for you. In this blog, we will talk in detail about the inclusions in your salary, what deductions are, income tax slabs, tax exemptions and more. It is important you know all this, as many people do not understand how income tax on salary works. With this, you will be able to plan your finances and also save tax.

What is Included in Your Salary?

To calculate tax on salary, you need to first understand what salary is. You need to know what is counted as salary. Your salary is more than just your basic pay, and it includes:

- Basic Salary (main part of your pay)

- HRA (House Rent Allowance) – Provided you stay in a rented house

- Dearness Allowance (DA) – To manage rising costs

- Special Allowance

- Bonus or Incentives

- LTA (Leave Travel Allowance)

- Other Allowances (mobile allowance, etc.)

What Is Gross Income?

Now, let’s talk about gross income calculation. Gross income refers to the full amount you earn in a year before any tax is deducted or any savings are counted.

Gross Income = Basic Salary + Allowances + Bonus + Other Income

For example:Suppose your basic Salary is ₹50,000 per month, and other components are:

HRA = ₹20,000

Special Allowance = ₹5,000

Other Allowances = ₹5,000

Annual Bonus = ₹60,000

Now your gross monthly salary would be:

₹50,000 + ₹20,000 + ₹5,000 + ₹5,000 = ₹80,000

And your annual gross salary would be ₹80,000 × 12 = ₹9,60,000 + ₹60,000 (bonus) = ₹10,20,000.

What Are Exemptions?

Exemptions are the parts of income that are not taxed. Common exemptions are:

- HRA Exemption – If you pay rent and get HRA, some part of it is not taxed.

- LTA Exemption – If you travel within India, some part of the travel cost is tax-free.

- Standard Deduction – All salaried people get ₹75,000 tax-free.

For example: If your annual gross salary is ₹10,20,000 and all exemptions sum up to ₹80,000, then total exemptions would be ₹80,000 + ₹75,000 (standard deduction) = ₹1,55,000.

Now, taxable Income would be ₹10,20,000 – ₹1,55,000 = ₹8,65,000

What Are Deductions?

After exemptions, you can also use deductions. These are savings or expenses that you can use to reduce your taxable income.

Here are some common deductions:

- Section 80C (LIC, PPF, EPF, ELSS, etc.) – maximum deduction limit is ₹1,50,000

- Section 80D (health insurance premium) – the limit is ₹25,000 (₹50,000 for senior citizens)

- Section 80E (education loan interest) – no maximum limit

- Section 80TTA (savings account interest) – deduction up to ₹10,000

- Section 80G (donations to charity) – no maximum limit

Now, let’s understand it with an example:

You invested ₹1,50,000 under 80C and paid ₹20,000 for health insurance under 80D.

Now, total deductions would be ₹1,70,000.

Consequently, your taxable Income would be (after the exemptions) = ₹10,20,000 – ₹1,55,000 – ₹1,70,000 = ₹6,95,000

What are the Latest Income Tax Slabs 2025-26?

With the help of the following latest income tax slabs, you can learn how much tax you need to pay.

There are two options: the Revised New Tax Regime and the Old Tax Regime.

Revised tax slabs for the New Tax Regime 2025-26:| Income Slabs | Income Tax Rates FY 2025-26 |

| 0 to ₹ 4 Lakh | NIL |

| ₹ 4 Lakh to ₹ 8 Lakh | 5% |

| ₹ 8 Lakh to ₹ 12 Lakh | 10% |

| ₹ 12 Lakh to ₹ 16 Lakh | 15% |

| ₹ 16 Lakh to ₹ 20 Lakh | 20% |

| ₹ 20 Lakh to ₹ 24 Lakh | 25% |

| Above ₹ 24 Lakh | 30% |

| Income Slabs | Tax Rate |

| 0 to ₹ 2.5 Lakh | NIL |

| ₹ 2.5 Lakh to ₹ 5 Lakh | 5% |

| ₹ 5 Lakh to ₹ 10 Lakh | 20% |

| Above ₹ 10 Lakh | 30% |

Also Read: Income Tax Slab for FY 2025-26

How to Save Tax Smartly?

Here are a few simple ways to reduce your income tax on salary:

- Invest in PPF, LIC, ELSS or tax-saving FDs (under 80C)

- Buy health insurance and claim a deduction under Section 80D

- Pay rent and claim the HRA exemption

- Donate to approved charities and claim a deduction under Section 80G

How to File an Income Tax Return?

Once you know your total income and tax, file your ITR online in the following steps:

- Log in to the portal https://www.incometax.gov.in.

- Go to “file tax return”

- Select the assessment year and the ITR type. Use the ITR-1 form (for salaried people).

- Validate your details.

- Submit and verify using Aadhaar OTP or EVC

Conclusion

Now, you must have understood that calculating income tax on salary is quite easy. If you know your salary details, just calculate your gross income, remove exemptions and deductions, and use the correct income tax slab. You can also reduce your tax by investing in the right places.

Meanwhile, if you are looking for an instant personal loan, download the CASHe app. CASHe offers quick loans of up to ₹3 lakh at competitive interest rates. Apply on the CASHe app and get approved within minutes.