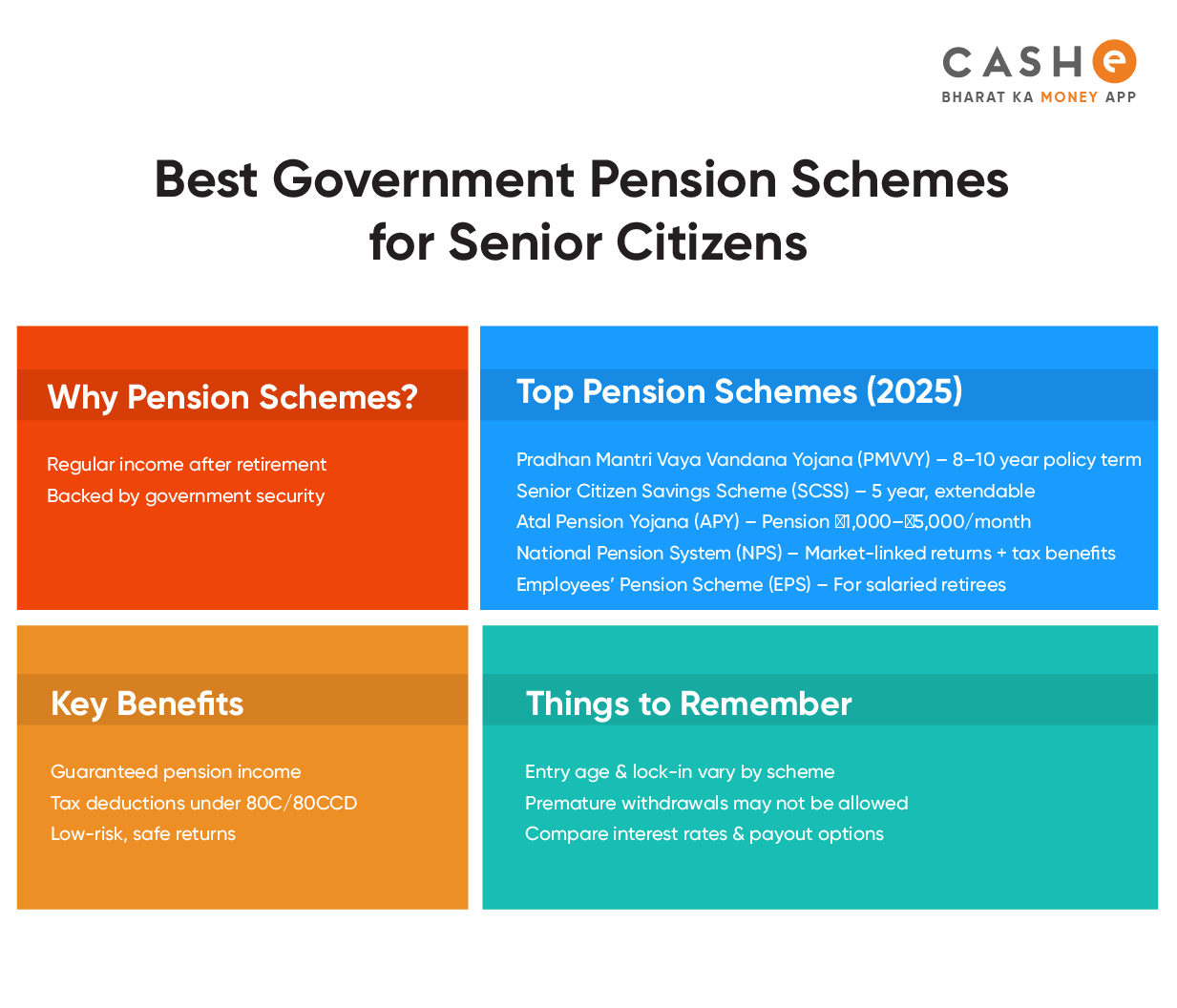

Government schemes are a way to support people when they need it the most. For senior citizens, one of the biggest concerns after retirement is a regular income. Because expenses never stop, and medical treatment costs are rising. So, the Government of India offers many government pension schemes that offer financial stability as well as peace of mind for senior citizens.

Let’s learn more about the best government pension plans for senior citizens and understand how they work, and take care of people.

Why Senior Citizens Need Government Pension Schemes

After retirement, many senior citizens may not have a fixed monthly income. Just relying on savings is not always enough, and many people do not wish to depend on children, as it can be stressful. This is where government pension plans help. They make sure the senior citizens get:

- Regular monthly income

- Safe investment options backed by the government

- Some tax benefits

- A peaceful retirement life

Overview of Key Pension Schemes

There are different government retirement schemes for different needs. Some give fixed returns, while others give market-linked returns. Some of the most popular government retirement plans are:

- Pradhan Mantri Vaya Vandana Yojana (PMVVY)

- Senior Citizens’ Savings Scheme (SCSS)

- National Pension Scheme (NPS)

- Atal Pension Yojana (APY)

- Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

- Employees’ Pension Scheme (EPS)

- Varishtha Pension Bima Yojana (VPBY)

- National Social Assistance Programme (NSAP)

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) scheme is run by LIC and supported by the government. It provides a pension for 10 years at a fixed rate. The interest rate is decided upon when you buy the policy. Usually, it is around 7.4% per annum. Senior citizens can invest up to ₹15 lakh and choose how they want to receive pension: monthly, quarterly, half-yearly, or yearly. It is a safe government retirement scheme for those who wish to have a steady income without taking risks.

Senior Citizens’ Savings Scheme (SCSS)

One of the most trusted government pension schemes you can invest in! SCSS is available in banks and post offices, and hence, it is quite easy to open.

Here, seniors can deposit up to ₹30 lakh for a 5-year tenure, which can be extended by 3 more years. The current interest rate is around 8.2% per year, and the money is paid every three months. Deposits in the scheme are also eligible for tax deductions under Section 80C of the Income Tax Act. If you want a safe and regular income, then this is one of the best government pension plans you can consider.

National Pension System (NPS)

The National Pension Scheme is a bit different. It allows money to be invested in equity, bonds, and government securities. This means the returns you get are linked to the market, so they can be higher than fixed schemes.

People can invest in NPS up to the age of 70. At retirement, 60% of the money can be withdrawn in one go and without any tax, while the remaining 40% is used to buy a pension plan that would give a monthly income. If you are okay with some extra risk, then NPS makes for a great government retirement plan.

Also, if you have an NPS account, you can get tax benefits under Section 80CCD(1), but only up to ₹1.5 lakh as per Section 80CCE. It also gives an extra ₹50,000 deduction under Section 80CCD(1B).

Atal Pension Yojana (APY)

Atal Pension Yojana (APY) is made for workers in the unorganised sector. People up to 40 years of age can contribute small amounts during their working years, and after 60, they get a fixed pension between ₹1,000 and ₹5,000 per month. It is a simple and affordable government retirement scheme for low-income groups.

Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

Indira Gandhi National Old Age Pension Scheme (IGNOAPS) is a part of the National Social Assistance Programme (NSAP). It supports senior citizens below the poverty line who do not have any income. As per the scheme, senior citizens aged 60-79 get ₹200 per month, while those above 80 get ₹500 per month.

Employees’ Pension Scheme (EPS)

EPS is for salaried employees who are members of EPFO. Under this, a part of the employer’s PF contribution goes into this scheme. After retirement at 58, employees get a pension based on their years of service and salary. In case of the employee’s demise, the family would receive the pension. If you are still working after 58 and do not want to claim the money, you can delay it. For delaying, your pension amount increases by 4% every year.

Varishtha Pension Bima Yojana (VPBY)

Another scheme run by LIC and backed by the government! Under Varishtha Pension Bima Yojana (VPBY), senior citizens could pay a single premium and get a fixed pension for life. However, it was available only for a limited time and is no longer available for new purchases.

National Social Assistance Programme (NSAP)

The National Social Assistance Programme is a scheme for BPL (Below Poverty Line) families under which old age, widow, and disability pensions are given. Its main goal is to help poor families so that no elderly person is left without basic support.

How to Choose the Right Scheme

Here’s how you can select among the best government pension plans:

- If you want a safe fixed income, you can go with SCSS or PMVVY schemes.

- If you wish to have growth with some risk, NPS can be your option.

- If you are a salaried employee, you can go for EPS.

- If you are from low-income groups, APY or IGNOAPS is better for you.

Note: Always check for tax benefits and withdrawal rules.

Conclusion

These are the best government pension schemes in India you can consider for a secure retirement life. These schemes are especially designed to help senior citizens have a fixed income and a good growth after retirement. As each of these government retirement plans has unique benefits, choose based on your needs.

Now, if you have urgent financial needs, you can always rely on CASHe instant personal loans. CASHe offers quick loans of up to ₹3 lakh at competitive interest rates. Just apply on the CASHe app and get the loan approved within minutes.