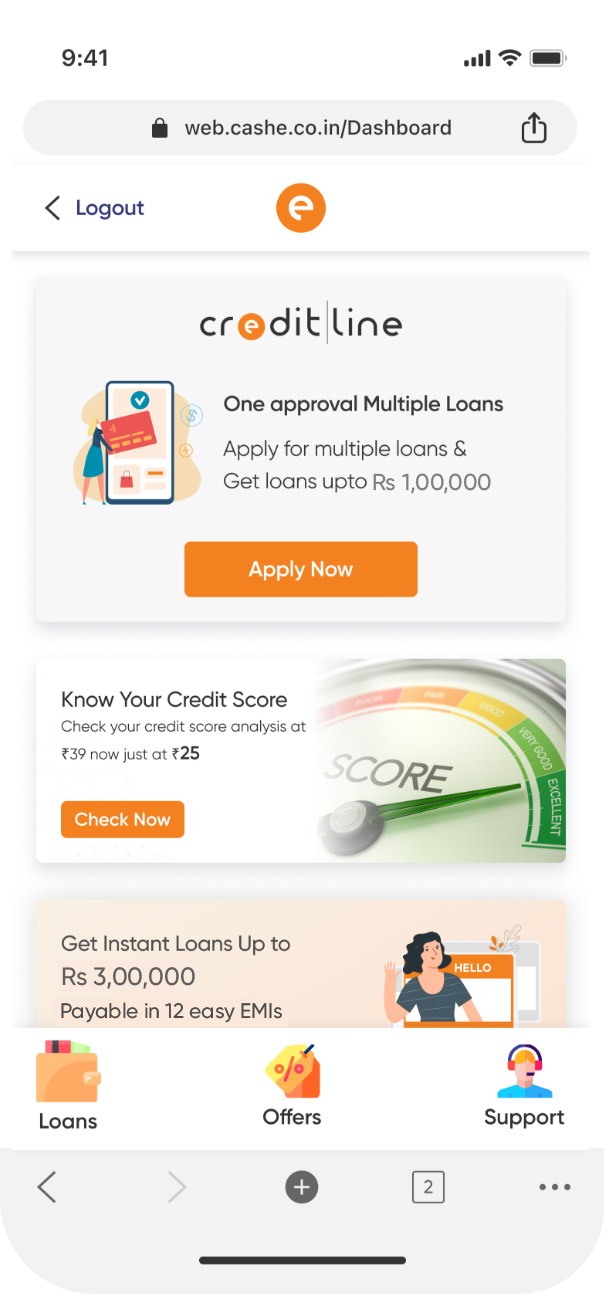

Instant Loan App

Once in a while, everybody finds themselves in a situation where they need instant money. Asking for a small amount from friends and family seems okay but asking for a huge amount might not be feasible. Banks usually have a very lengthy process which is time-consuming and getting a quick personal loan from banks is next to impossible.

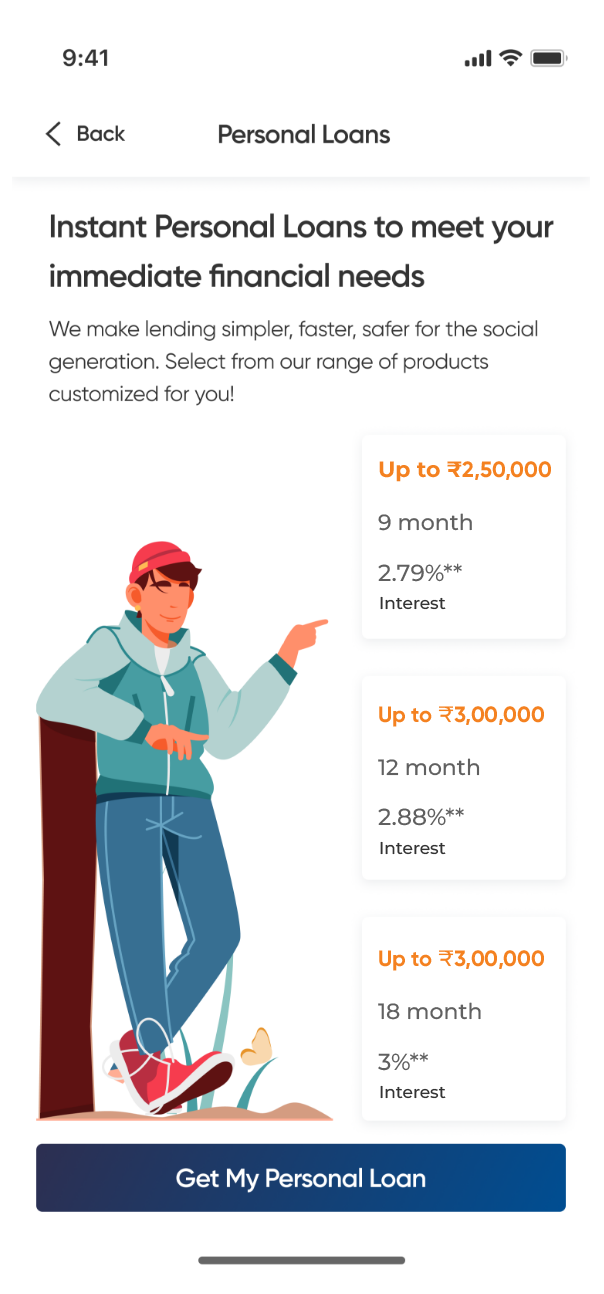

The personal loan scenario is now changing in India. There are many instant loan apps present in the market. These loan apps will give you an instant loan with much lesser paperwork. The process is quite simple and you don’t have to visit any bank or branch to apply for it.

People apply for a personal loan on the instant loan app for various reasons like medical emergencies, unpaid installments, travel expenses, home or car repair expenses, buying a new phone, or any other large asset. You are eligible to take a personal loan as per your wish.