Quick Loan App

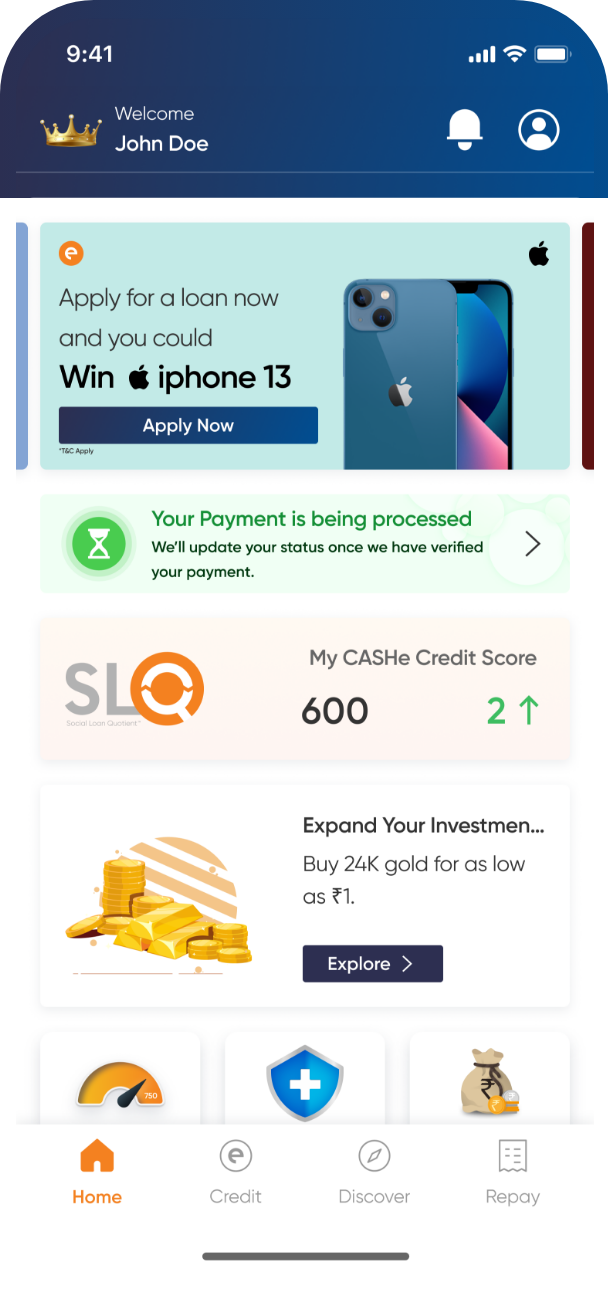

What do you do when you have a financial emergency and you need instant money? What if an app could provide you access to quick money without any trouble? That’s what a quick loan app does. The young professionals are failing to qualify for a loan with the traditional banks, this is where the quick loan app can be a savior. You could be eligible for a loan by uploading a couple of documents and the money will be in your account. Quick loans are also known as personal loans.

What is a Quick Loan?

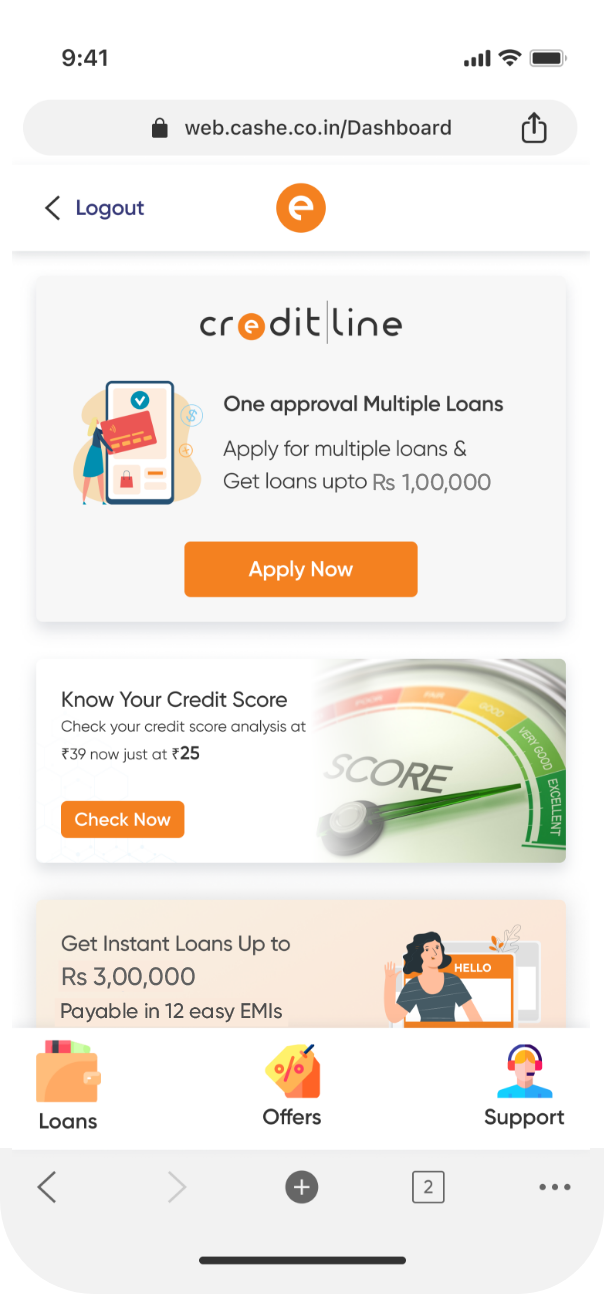

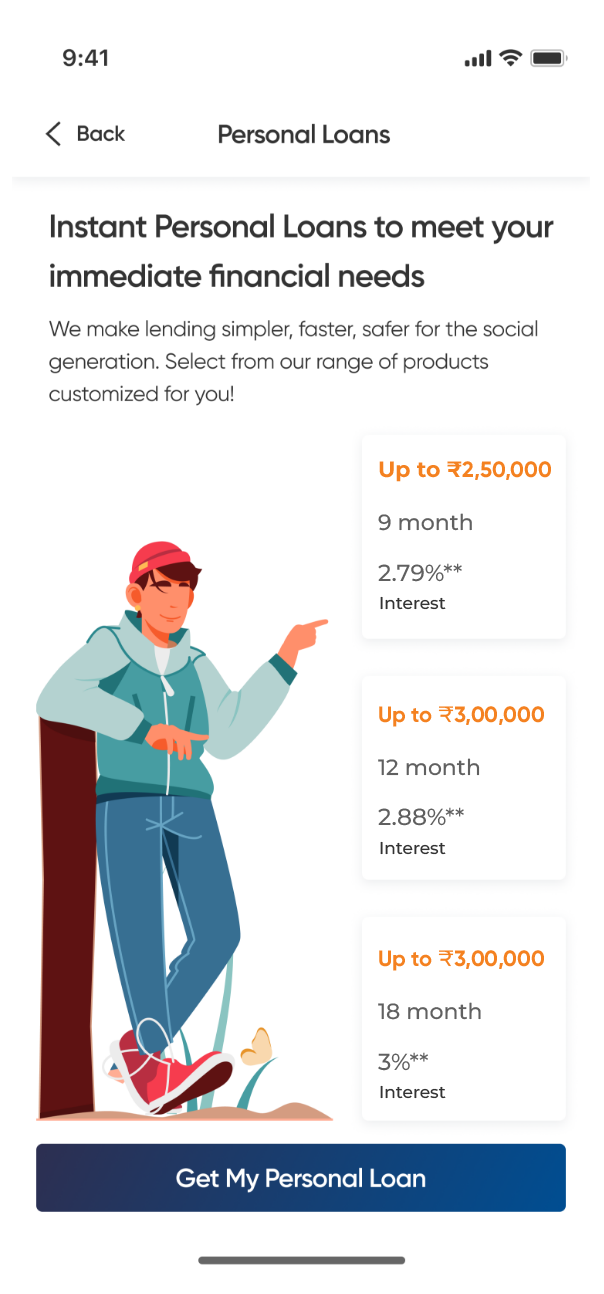

Are you in a hurry to get funds for an emergency circumstance or sudden expenses? A quick loan helps you with the immediate financial assistance you need without any wait. When you opt for a quick loan with CASHe, you borrow a short term loan which you can repay with interest over a predetermined period. Our instant quick loans offer a lifeline in emergencies or when you are short on funds for crucial payments. Whether it is paying urgent bills, seizing a limited-time opportunity, or making essential purchases, CASHe’s quick loans offer swift access to the funds you need.