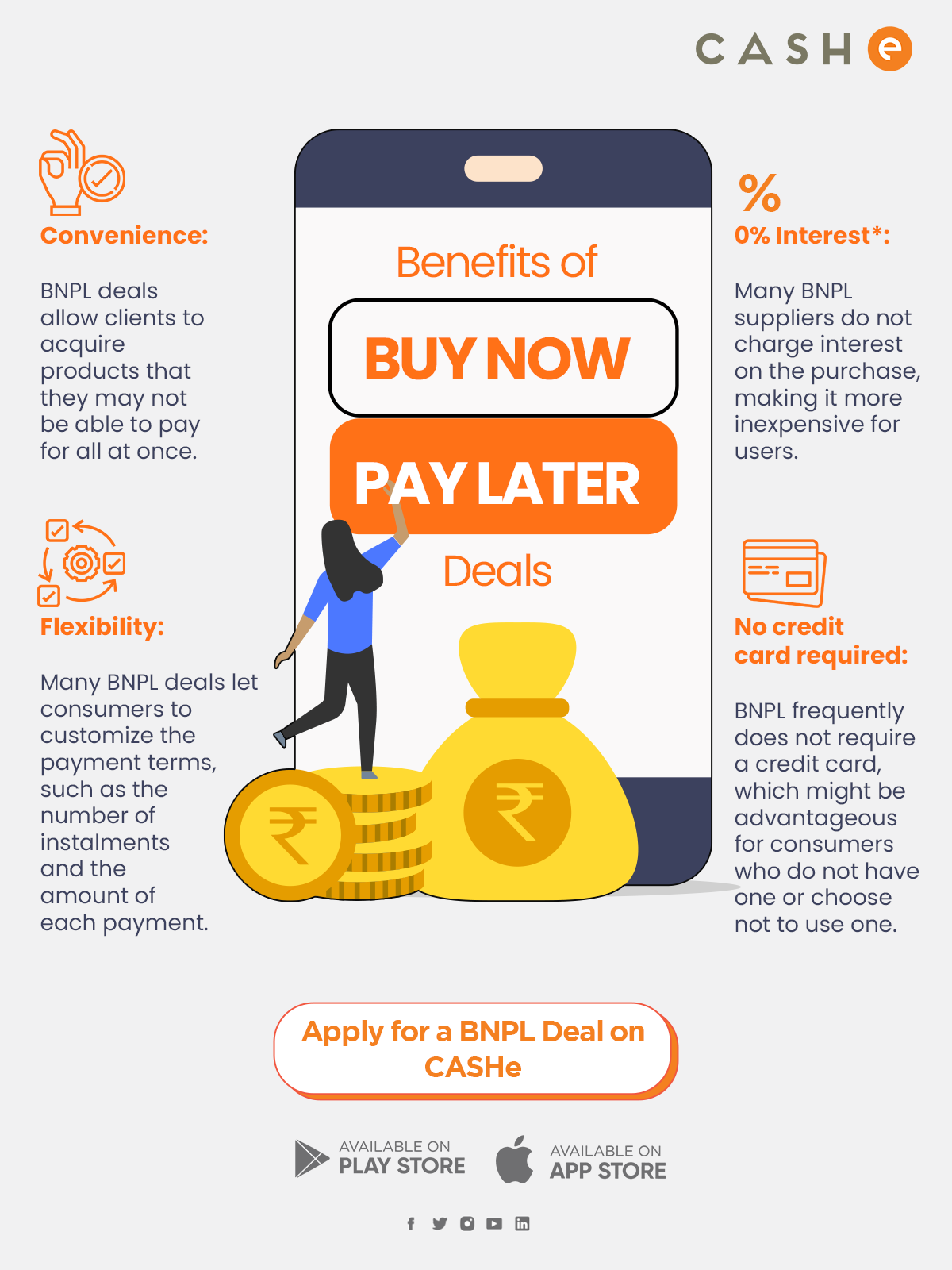

Are you looking to make a purchase but don’t have the funds available right now? Buy now pay later is here to help you understand the ins and outs of this popular shopping option. With buy now pay later, you can make your purchase today and pay for it over time, with little or no interest. This guide will explain how buy now pay later works, eligibility criteria, etc. Whether you’re looking to buy a new appliance or just want to spread out the cost of a purchase, this guide has you covered.

Eligibility Criteria For a Buy Now Pay Later Deal

Generally, the criteria may include:

- Should be at least 18 years old

- Should be an Indian citizen

- Should be an employed individual

- Should be earning a minimum monthly salary of Rs. 15,000

How to Apply For a Buy Now Pay Later Deal

Start by downloading the CASHe app from Playstore or Appstore. Once you have created an account, you can browse through the BNPL deals that CASHe offers. You can borrow up to Rs. 60,000 and choose between a 90-day and 180-day tenure. Submit all the required documents and as soon as they have been verified, you will receive the BNPL deal in the form of a 16-digit gift voucher code. This code can be utilised on the merchant’s platform at the payment gateway.

FAQs

Can I use buy now pay later to make large purchases, such as a home or car?

Buy now, pay later (BNPL) is commonly utilized for minor items like apparel or electronics. It may be feasible to use BNPL for larger purchases such as a home or automobile, but this would likely be contingent on the BNPL program’s exact terms and conditions as well as the lender’s policies.

Will using buy now pay later affect my credit score?

If you miss payments or default on a loan, using BNPL may have an impact on your credit score. However, making all of your payments on time may improve your credit score by displaying your capacity to manage credit.

Can I make partial payments with buy now pay later, or do I have to pay off the entire balance at once?

BNPL program rules and conditions differ, however, some allow for partial payments. Others may mandate that you pay up the entire sum at once or within a specific term. Before making a purchase, it’s critical to read the terms and conditions of the individual BNPL program you’re contemplating.

Can I use a buy now pay later to pay off existing debts or bills? Because BNPL is primarily used to make new purchases, it is uncommon to utilize it to pay off existing obligations or invoices. To examine your choices for repaying current debts, you should speak with a financial advisor or a credit counsellor.