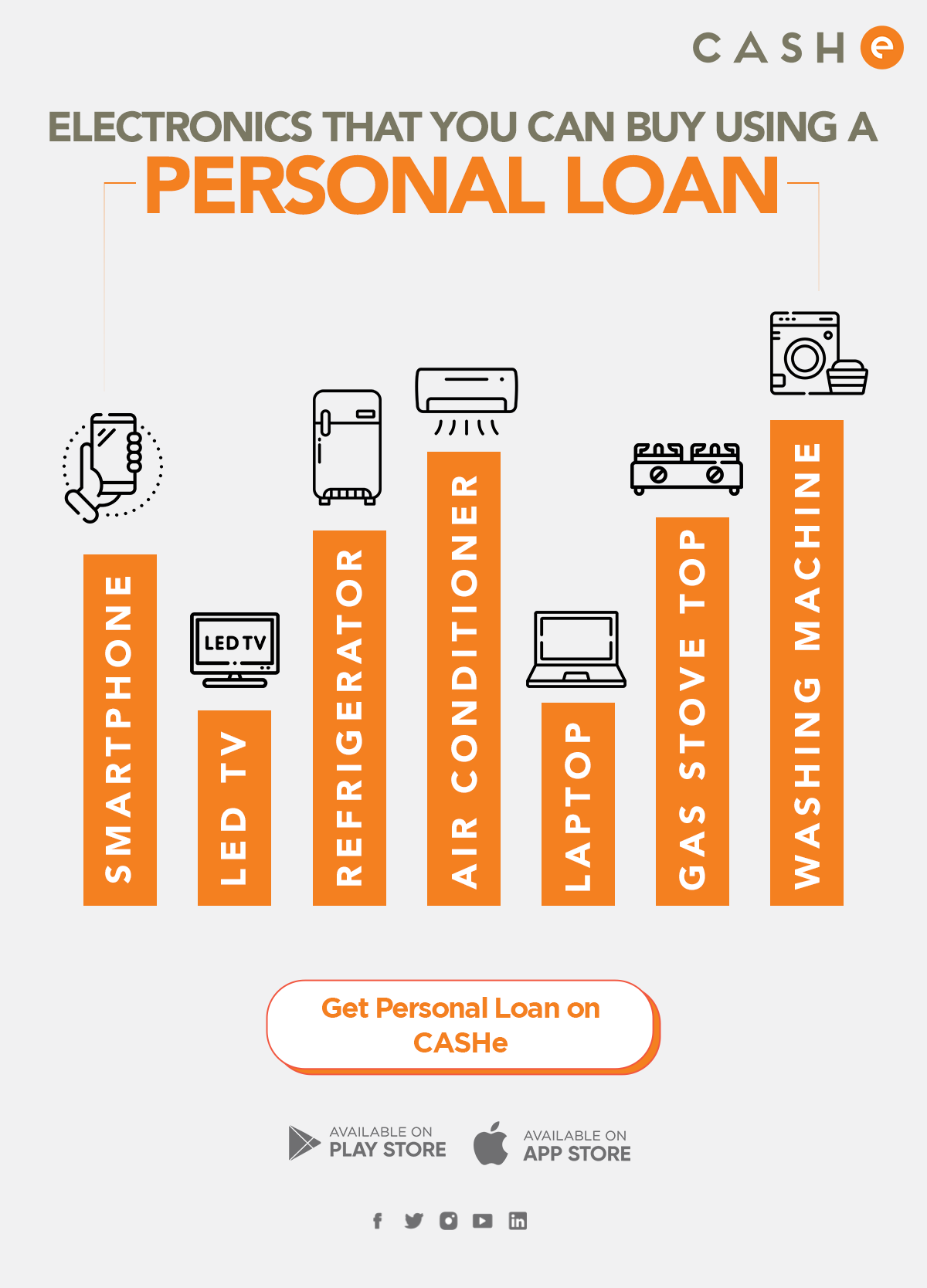

When you are planning to buy your favourite electronics like TV, fridge, phone or laptop; it can be overwhelming and confusing. Which retailer is the best? Should you get a personal loan or use your savings? These are just some of the questions that might be running through your mind. To answer all these questions, you need to know more about consumer durable loans as well as credit cards. These loans help you purchase electronics which will last longer than expected.

What is a Consumer Durable Loan?

A consumer durable loan is a loan you take out for items that are used for both personal and household purposes. The most common examples of these loans include furniture and electronics. Although they can be used to purchase any type of item, some lenders may limit their availability to certain types of consumers. If you have a low score or an outstanding balance on other cards, it could negatively impact your chances of getting approved for a consumer durable loan. You also need to consider how much money you can really afford to spend on this type of loan.

Advantages of Using a Consumer Durable Loan

- Helps borrowers get the financing they need to buy home appliance, furniture, or electronics.

- These loans come with flexible payment options that are beneficial to borrowers looking for affordable financing solutions.

- With consumer durable loans, you can pay back in regular consumer installment loans.

FAQs

What are non-durables?

Non-durables are items with a short life span, ranging from a few minutes to three years.

Can I buy multiple electronics with one consumer durable loan?

Yes, you can.

Is it okay to buy consumer durables with an EMI plan?

Yes, it is.

Can the consumer durable loan be used for other purposes too?

Yes, the loan amount can be utilised for purposes other than buying consumer durables.