We use different ways to send or receive money. Sometimes we send it electronically or digitally, or sometimes we rely on paper-based documents like cheques. When we look to send or receive money without using cash, two of the most popular ways are cheques and demand drafts (DDs). Both are used to pay money from one person to another. However, they work differently.

In this brief read, we will learn the difference between a cheque and a demand draft. We will also explain the different types of demand drafts, types of cheques, which one to choose and more.

What is a Cheque?

A cheque is a piece of paper that you give to someone so they can withdraw money from your bank account. The cheque is written by the account holder, and the money goes to the person whose name is written on the cheque. You can use a cheque to pay someone or deposit the money into their bank account. The major types of cheques are:

- Bearer Cheque – The person who is holding it can get the money.

- Order Cheque – Only the person named can receive the money.

- Crossed Cheque – This cheque can only be used to transfer the money into a bank account, and not in cash.

- Post-dated Cheque – It has a future date and hence, is not usable before that.

- Blank Cheque – It is a cheque with only a signature on it and no name or amount.

You would need a chequebook to write a cheque. There are also different cheque book types depending on the size, like 25, 50 or 100 cheques in one book.

Also Read : What is a Cross Cheque , What is a Cancelled ChequeWhat is a Demand Draft?

A demand draft (DD) is like a payment slip that you get from the bank. To get a DD, you first give the money to the bank, and then the bank prepares a draft that can be given to the person or company you want to pay. DDs are often used when you need a safe and trusted payment method for college fees or government forms. The major types of demand draft include:

- Sight Demand Draft – In this, the money is paid only after checking some documents.

- Time Demand Draft – Here, the money is paid after a fixed time or date.

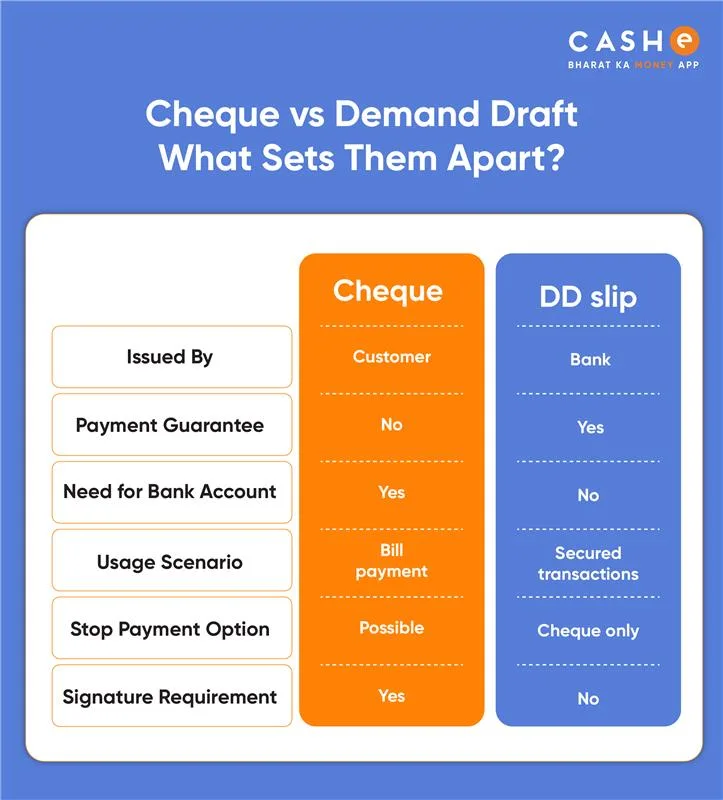

Key Differences Between Cheque and Demand Draft

The difference between a demand draft and a cheque is as follows:

| Feature | Demand Draft (DD) | Cheque |

|---|---|---|

| Who issues it? | Bank | Account holder |

| Is payment guaranteed? | Yes | No |

| Payment type | Payment is made to the bank before the DD is issued. | Payment is made from your account after the cheque is processed. |

| Validity | 3 months | 3 months |

| Safety | Higher | Lower |

| Can it bounce? | No | Yes |

| Used for | Secure and official payments | Personal and general payments |

| Extra charges | Small charges may apply | Usually no charges |

| Bank account requirement | A person without a bank account can make DD payments | Only a person with a bank account can make cheque payments. |

Which One Should You Use – Cheque or DD?

If you are confused about which payment method to use, a cheque or a demand draft, then here is what you need to understand. You can use a cheque when you are paying a friend or someone you trust. It would be quick and simple.

However, if you are making an important payment and want a safe and secure method, then a demand draft is a better option.

Advantages and Disadvantages

ChequeThe major advantages of a cheque are that it is easy to use and you do not need to visit any bank. You can just write a cheque anytime.

However, the disadvantages associated with cheque payment are:

- Your cheque would bounce if there is no money in your account.

- Someone can misuse it if lost.

- It sometimes takes time to clear.

DDs are safe and secure, and the bank guarantees the payment here as it is a prepaid method. The best part is DDs are accepted by all official places.

However, the disadvantages include:

- You have to visit the bank to get one.

- You must make the payment first.

- Some charges may apply.

Conclusion

Now you know the difference between a cheque and a demand draft. However, they serve different purposes, and both are useful in making payments. Use a cheque for simple payments and a DD for safe and official payments.

Now, if you need quick money for your urgent needs, consider the CASHe instant personal loan app. CASHe offers instant personal loans of up to ₹3 lakh with quick approvals. You can apply through the CASHe app, where the process is 100% online with zero paperwork.