There must be certain life goals you wish to achieve by a certain time or age. This will and should involve a certain amount of planning. It should start with getting your finances in place and understanding your current financial status so that you are able to chart a course of action for the future that help you achieve your life goals.

What is Financial Planning?

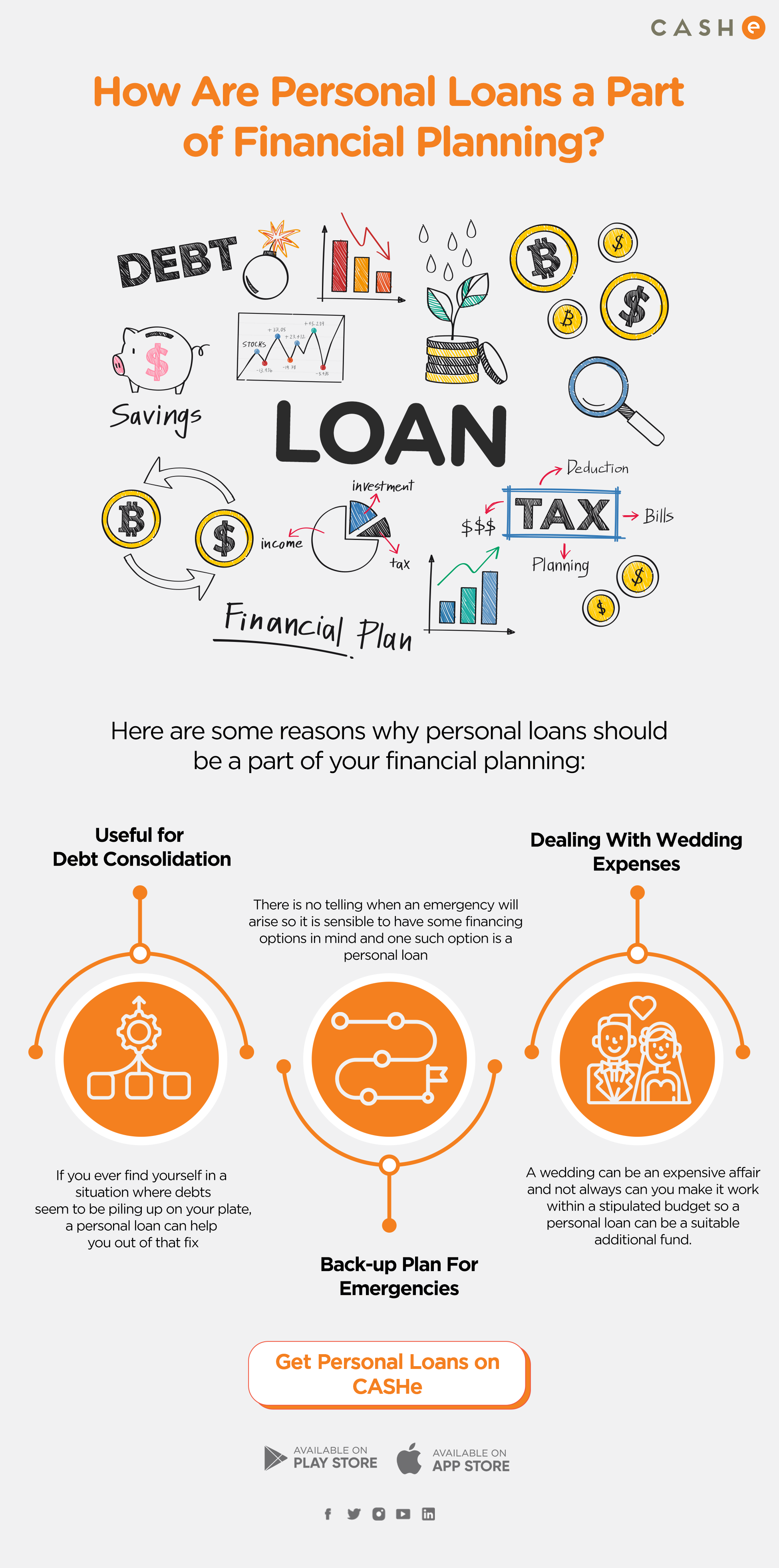

Financial planning is a comprehensive evaluation of the current financial status and planning for the future. It provides a step-by-step guide on how a person can achieve their life goals while keeping in mind their income, expenses, and investments. A person can be in better control of their finances if they have a detailed financial plan in place.

What Are Some Key Things to Consider While Financial Planning?

Some key things to consider while financial planning are:

- Consider emergency situations

- Make sure to invest in the right products

- Be mindful of your credit

- Opt for suitable cost-cutting measures

FAQs

What is the 50:30:20 budget rule?

According to this practice, you should break your monthly income into three parts – 50% of it should be utilized for needs, 30% should be utilized for wants, and the remaining 20% should be put into savings.

What is the most important part of a financial plan?

Budgeting is crucial to sound financial planning. Be realistic in your budgeting and always account for a percentage of it for savings and emergencies.

How does a personal loan help during emergencies?

If you find yourself in an emergency that requires immediate financial attention, there is a possibility you might have adequate savings to deal with it or do not want to exhaust your savings. In such situations, a personal loan can be of great use since you get the required funds immediately and can repay the borrowed amount in EMIs.

Is financial planning important?

Yes, it is very important. It can provide you with a better direction in achieving your life goals and keep you prepared to deal with various kinds of instances.