Applying for a personal loan online is proving to be one of the most convenient methods of gaining financial aid during emergencies. The process has been optimized in a manner that you only have to spend a few minutes to get through the process, get the loan application approved, and for the loan amount to be disbursed to your bank account.

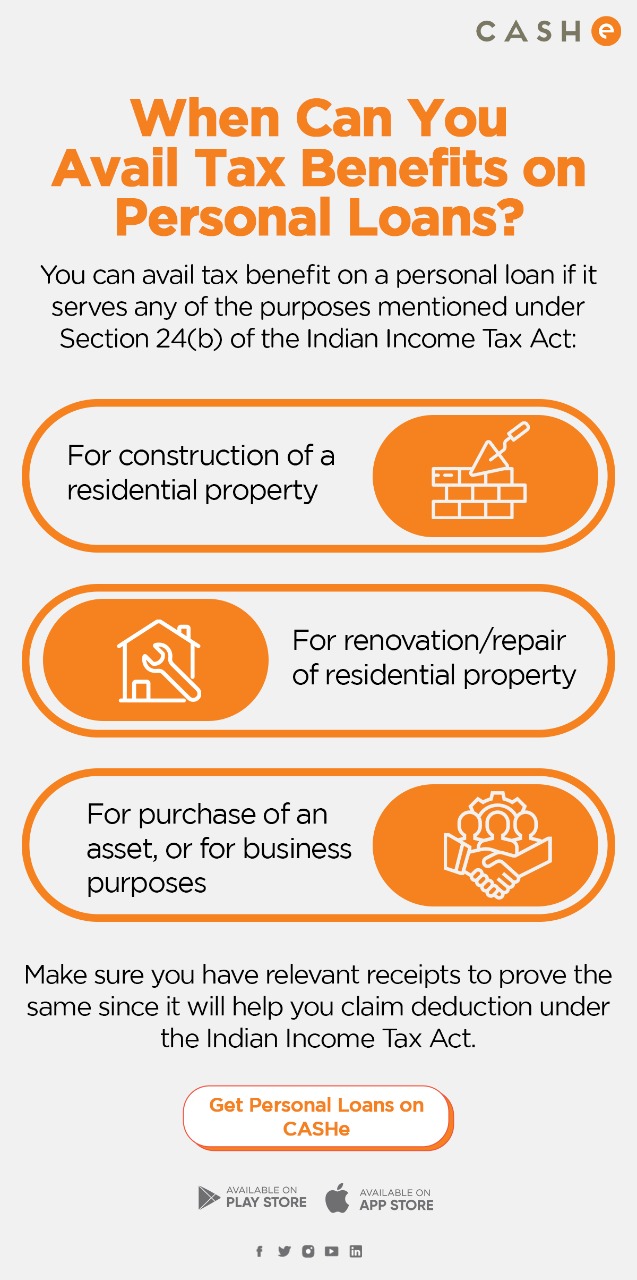

There are numerous benefits of applying for a personal loan. But are personal loans exempted from tax and are there any tax benefits you can enjoy?

FAQs

Is tax exemption applicable on all types of personal loans?

For the most part, personal loans are non-taxable. But on certain purposes, such as home renovations, construction of a property, and business purposes, you can avail of certain tax benefits.

Is there a limit on how much gets exempted from tax?

Up to ₹1.5 lakhs can be claimed as tax deductions on the interest on a personal loan.

Is a loan covered under 80C?

Under Section 80C, you can claim a deduction of up to Rs. 1.5 lakhs on the personal loan repayment of the principal amount of the loan amount is used for the construction or purchase of a new property.

Can I show my personal loan in ITR?

Since a personal loan is not considered to be a part of your income, it is non-taxable. But you can show it in your ITR if you are utilizing that loan for home renovations, construction of a property, or for business purposes.