Today, it has become so easy for people to secure loans during emergencies or when in need of any immediate financial assistance. With the introduction of personal loan apps, you can get the funds on the go – without having to visit a bank or any financial institution or spend too much time waiting for the loan application to be processed and eventually approved or rejected. Moreover, since it is an unsecured loan, you do not have to worry about pledging any collateral (asset or item of value) to secure the loan.

FAQs

What is a personal loan usually used for?

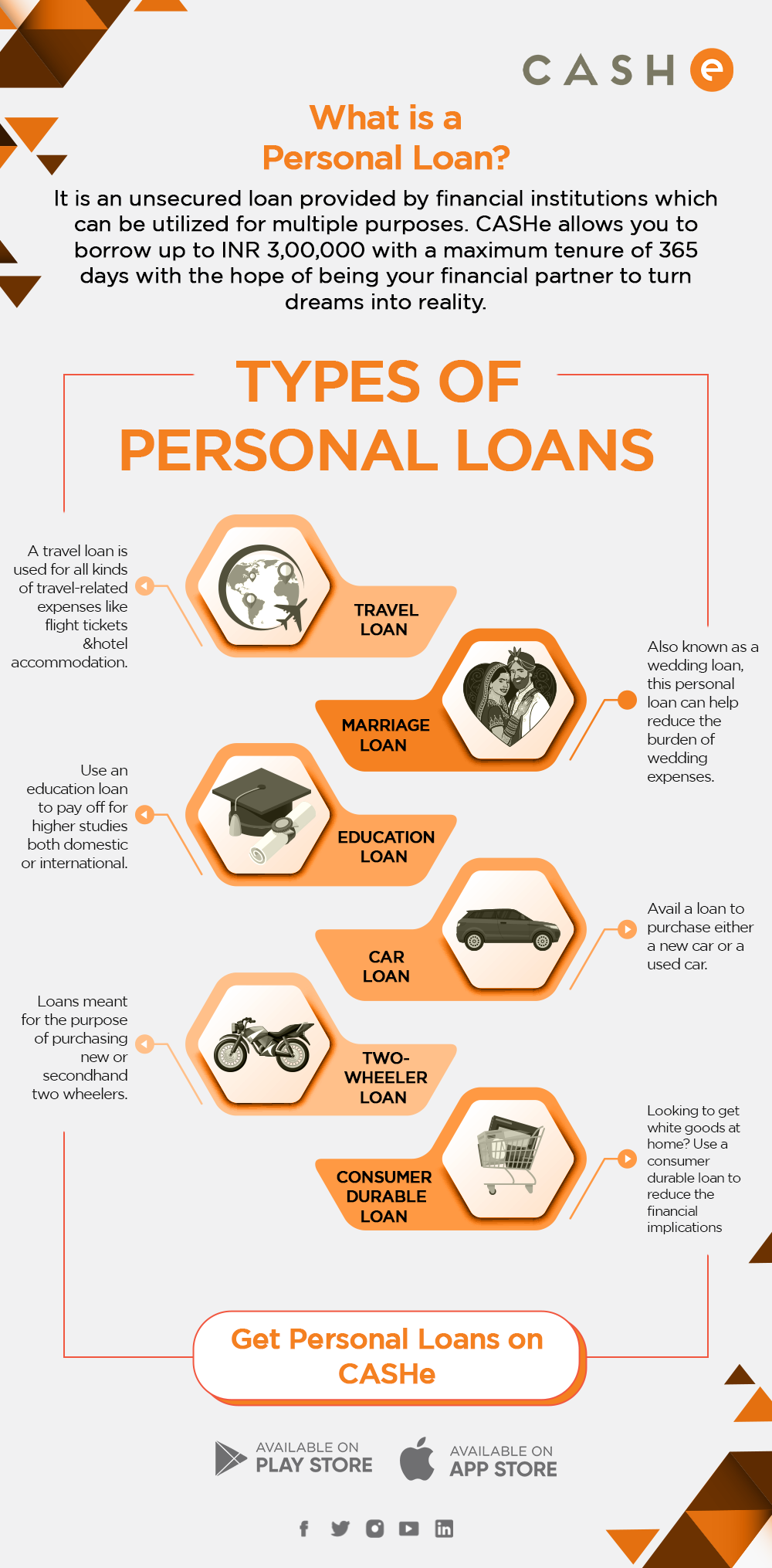

A personal loan can be used for multiple purposes such as traveling, weddings, pursuing higher education, purchasing consumer durable goods, etc.

How much personal loan can I get?

You can secure a maximum of Rs. 3,00,000 as a loan amount from CASHe.

What is the maximum repayment period?

The maximum repayment period is of 365 days (1 year).

Who is eligible for a personal loan?

An Indian citizen of at least 18 years of age is a salaried employee with a minimum monthly income of Rs. 15,000 is eligible for applying for a personal loan.

What is the interest rate on a personal loan?

The interest rate on a personal loan depends on the loan amount you have applied for and the tenure for repayment.