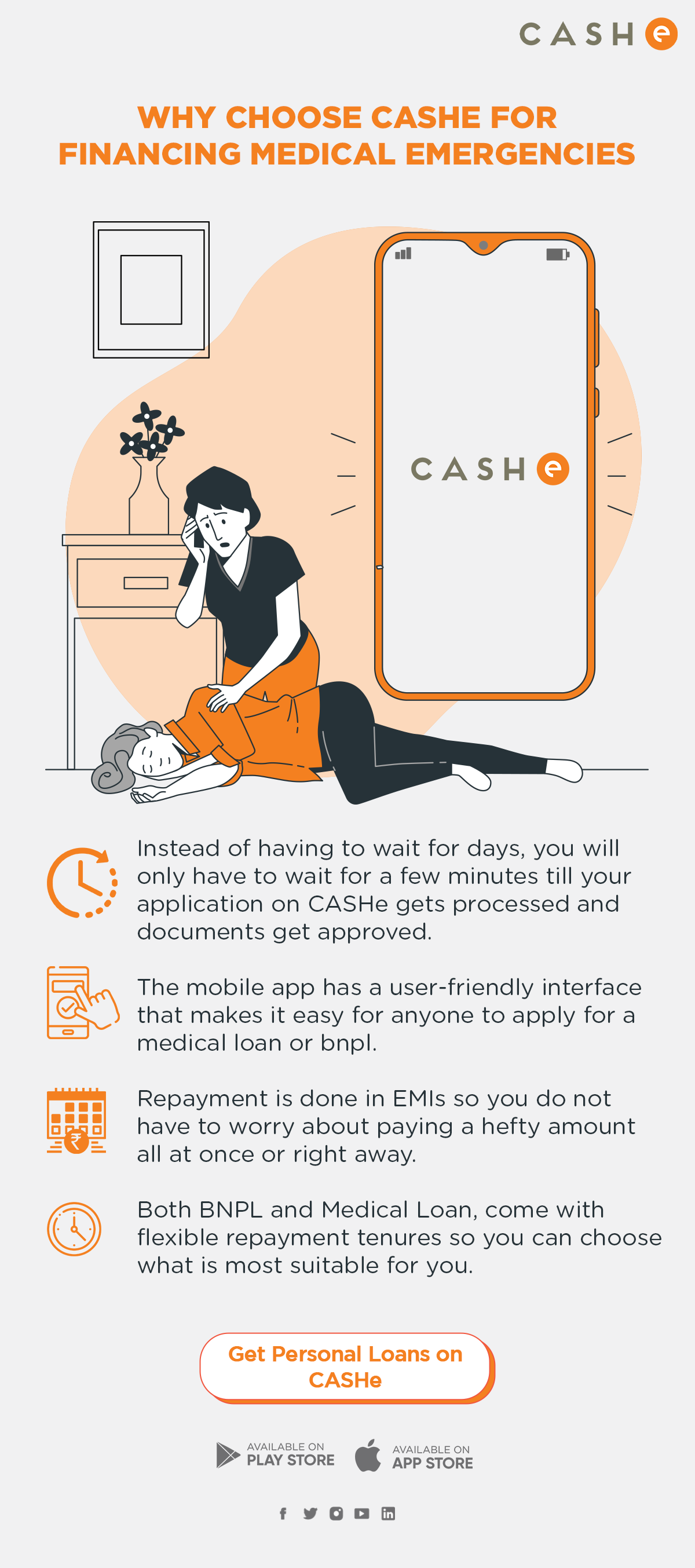

With changing times and the development in technology, so many financial tools have been made available. Each of these options comes with its own set of benefits and can be most useful during emergencies. When it comes to dealing with a medical emergency, you need to be prepared for spending a considerable amount. If you do not want to dip into your savings or do not have enough savings to deal with such expenses, you can consider two options – Medical Loan or Buy Now Pay Later.

Advantages of a Medical Loan

- You can borrow up to Rs. 4,00,000.

- You can choose from multiple repayment options, from 90 days to 540 days.

- You can expect the funds to be disbursed to your bank account within a few minutes.

Advantages of BNPL

- You can secure the Apollo Pharmacy BNPL deal at a 0%* interest rate.

- You can visit a nearby Apollo Pharmacy outlet and purchase medicines up to Rs. 10,000.

- You can use this as a gift voucher and has a validity of 1 year.

FAQs

Can I apply for a BNPL deal and a personal loan at the same time?

Yes, you can apply for both at the same time. But keep in mind that you are able to repay everything on time.

How quickly can I secure the required funds?

As long as the documents are genuine and you have a good credit score, it only takes a few minutes for the application to get processed and the funds to be disbursed to your bank account.

What are the repayment options?

You can repay the borrowed amount via net banking, NEFT, or IMPS.

Is there a minimum or maximum amount that I have to borrow?

For a medical loan, you can borrow a minimum amount of Rs. 15,000 and a maximum amount of Rs. 4,00,000. For the Apollo Pharmacy BNPL deal, you can borrow a minimum amount of Rs. 3,000 (90-day plan) or Rs. 6,000 (180-day plan) and a maximum amount of Rs. 10,000 (90-day plan and 180-day plan).